- Germany

- /

- Life Sciences

- /

- XTRA:GXI

July 2024 Insights Into German Exchange Stocks Estimated as Undervalued

Reviewed by Simply Wall St

Amid a backdrop of moderate gains across major European indices, with Germany's DAX index recently climbing by 1.32%, investors are keenly observing market movements for potential opportunities. In this context, identifying undervalued stocks within the German market could offer attractive entry points against the current economic landscape marked by cautious optimism and evolving monetary policies.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Stabilus (XTRA:STM) | €45.80 | €81.24 | 43.6% |

| technotrans (XTRA:TTR1) | €18.90 | €29.84 | 36.7% |

| Novem Group (XTRA:NVM) | €5.20 | €10.19 | 49% |

| PSI Software (XTRA:PSAN) | €22.50 | €43.46 | 48.2% |

| Stratec (XTRA:SBS) | €45.40 | €82.22 | 44.8% |

| SBF (DB:CY1K) | €3.10 | €5.83 | 46.8% |

| CHAPTERS Group (XTRA:CHG) | €23.80 | €46.60 | 48.9% |

| MTU Aero Engines (XTRA:MTX) | €253.70 | €421.41 | 39.8% |

| Your Family Entertainment (DB:RTV) | €2.46 | €4.51 | 45.5% |

| Redcare Pharmacy (XTRA:RDC) | €136.70 | €215.36 | 36.5% |

Here's a peek at a few of the choices from the screener

Gerresheimer (XTRA:GXI)

Overview: Gerresheimer AG operates globally, specializing in the production and sale of medical packaging and drug delivery devices, with a market capitalization of approximately €3.49 billion.

Operations: The company's revenue is primarily derived from its Plastics & Devices and Primary Packaging Glass segments, generating €1.09 billion and €0.91 billion respectively.

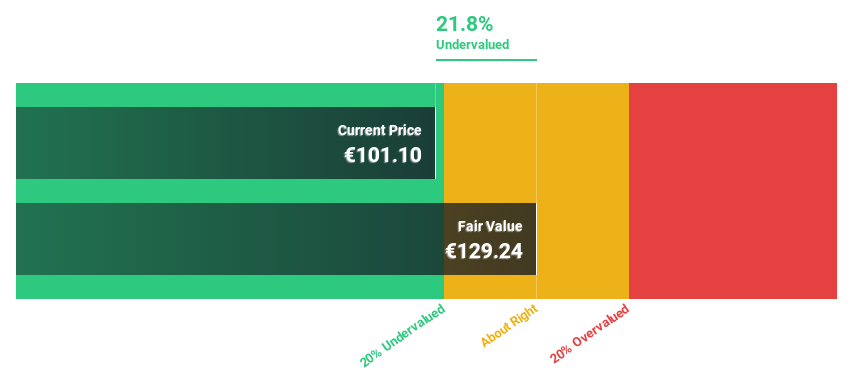

Estimated Discount To Fair Value: 23.1%

Gerresheimer AG, priced at €101, is trading below its estimated fair value of €131.34, reflecting a 23.1% undervaluation. Analyst consensus suggests a potential price increase of 33.5%. Despite high debt levels and a forecasted low Return on Equity of 13.8% in three years, the company's earnings are expected to grow significantly at 20.41% annually over the next three years, outpacing the German market's growth rate (18.8%). Recent guidance predicts revenue growth between 5% and 15% through 2025.

- Our earnings growth report unveils the potential for significant increases in Gerresheimer's future results.

- Take a closer look at Gerresheimer's balance sheet health here in our report.

M1 Kliniken (XTRA:M12)

Overview: M1 Kliniken AG operates a chain offering aesthetic medicine and plastic surgery services across Germany, Austria, the Netherlands, Switzerland, the UK, Croatia, Hungary, Bulgaria, Romania, and Australia with a market capitalization of approximately €312.27 million.

Operations: The company generates its revenue from two primary segments: Trade, which brought in €245.49 million, and Beauty, contributing €70.83 million.

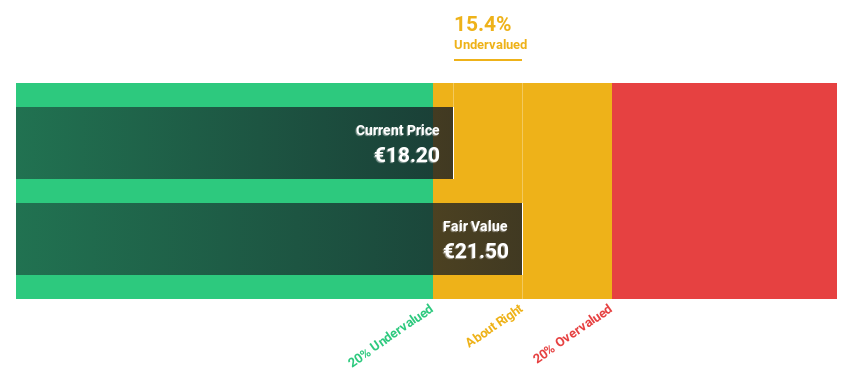

Estimated Discount To Fair Value: 20.7%

M1 Kliniken AG, with a current price of €17.05, is valued below its fair value of €21.5, indicating a significant undervaluation. The company's earnings have surged by 138% over the past year and are projected to grow at 24.4% annually, outstripping the German market's forecasted growth. Despite this robust earnings trajectory and a revenue growth forecast faster than the market average, its share price remains highly volatile and its dividends are poorly covered by earnings and cash flows.

- Our comprehensive growth report raises the possibility that M1 Kliniken is poised for substantial financial growth.

- Get an in-depth perspective on M1 Kliniken's balance sheet by reading our health report here.

SAP (XTRA:SAP)

Overview: SAP SE, along with its subsidiaries, offers applications, technology, and services globally and has a market capitalization of approximately €217.68 billion.

Operations: The company generates €31.81 billion from its Applications, Technology & Services segment.

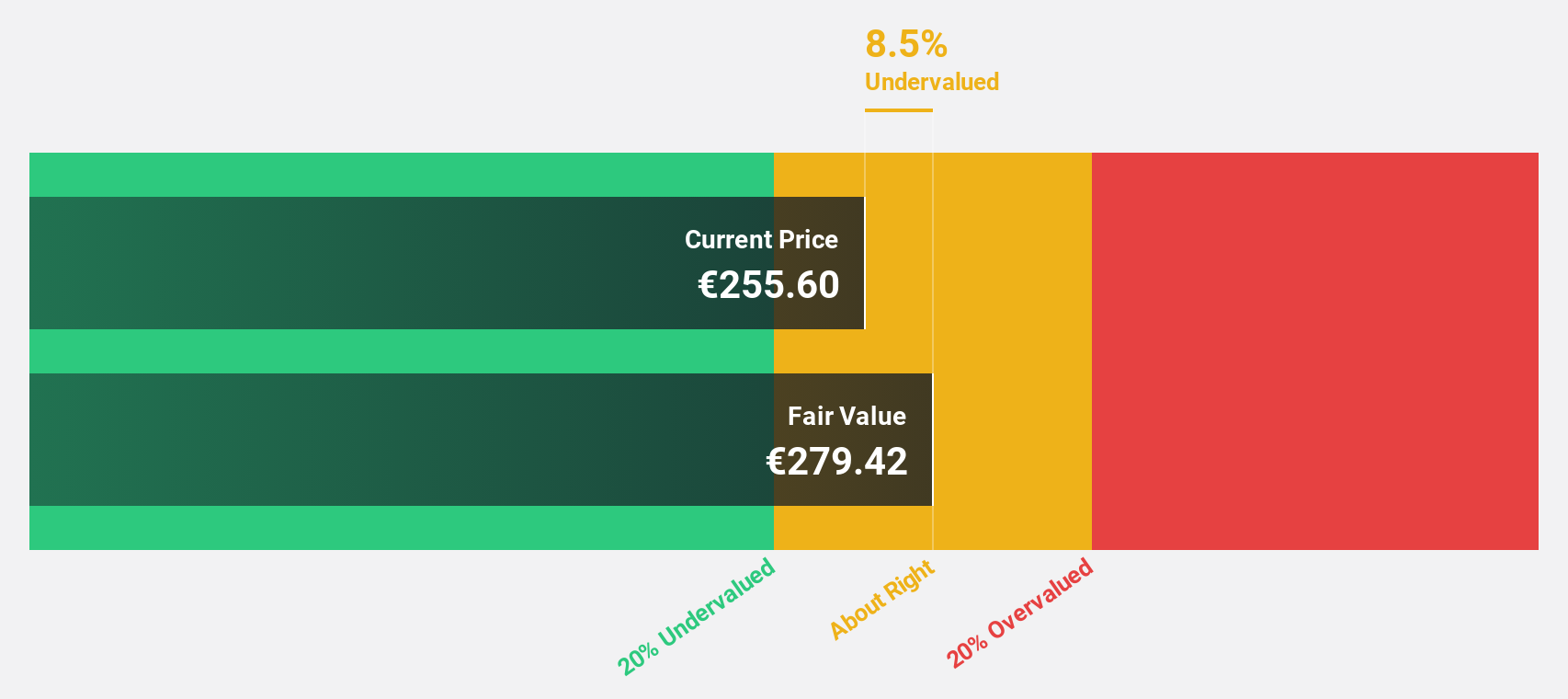

Estimated Discount To Fair Value: 33.7%

SAP, priced at €187.84, trades significantly below its estimated fair value of €283.43, reflecting a substantial undervaluation based on discounted cash flows. The company's revenue and earnings growth are projected to outpace the German market, with revenues increasing by 9.6% annually and earnings by 34% annually. Recent strategic alliances and technological integrations, such as the expanded partnership with Datricks and LTIMindtree, enhance SAP's offerings in risk mitigation and complex manufacturing solutions, potentially bolstering its financial position further despite a forecasted low return on equity of 16.1% in three years.

- Upon reviewing our latest growth report, SAP's projected financial performance appears quite optimistic.

- Dive into the specifics of SAP here with our thorough financial health report.

Turning Ideas Into Actions

- Click here to access our complete index of 29 Undervalued German Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:GXI

Gerresheimer

Manufactures and sells medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives