Is SAP Share Price Dip a Buying Opportunity After Recent AI Investments in 2025?

Reviewed by Bailey Pemberton

- Wondering if SAP is still a smart buy after all the market noise? You are not alone. Many investors are asking if the company’s recent moves have left it undervalued or overpriced.

- SAP’s share price has had a choppy ride lately, slipping 2.1% over the last week and nearly 10% in the last month. However, its longer-term track record remains impressive with over 100% gains in the past three years.

- This recent dip comes as the tech sector adjusts to shifting investor sentiment. SAP has also made headlines for continued investment in AI and strategic acquisitions, with market watchers considering what these developments mean for long-term value.

- According to our checks, SAP scores 3 out of 6 on undervaluation. See the full breakdown here. Next, we will explain exactly how this valuation score is calculated and reveal a smarter, more holistic way to judge SAP’s worth that goes far beyond traditional numbers.

Approach 1: SAP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common valuation tool that estimates a company's intrinsic value by projecting future cash flows and discounting them back to today's value. This approach aims to reflect the present worth of all cash SAP is expected to generate in the years ahead.

For SAP, the current Free Cash Flow (FCF) reported for the last twelve months is €6.44 Billion. Looking ahead, analysts project this figure will rise steadily, with estimates reaching €11.46 Billion in 2027. Beyond this, Simply Wall St extends the projections up to 2035, ultimately forecasting FCF to approach €17.29 Billion, although accuracy decreases the further out the projection goes.

Based on this two-stage DCF calculation, SAP's intrinsic fair value is estimated at €258.35 per share. Compared to recent market prices, this calculation implies SAP is trading at an 18.3% discount to its true worth, which suggests the shares may be undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SAP is undervalued by 18.3%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: SAP Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is widely relied upon when valuing profitable companies like SAP because it reflects how much investors are willing to pay for each euro of the company’s earnings. High-quality, established businesses with stable profits can be more accurately compared on P/E. This makes it a useful tool for understanding SAP’s market value in context.

However, what counts as a “normal” or “fair” P/E ratio depends on growth expectations and the risks involved. Companies with faster anticipated earnings growth or lower perceived risk often justify a higher P/E, while those facing challenges or volatility typically demand a lower multiple.

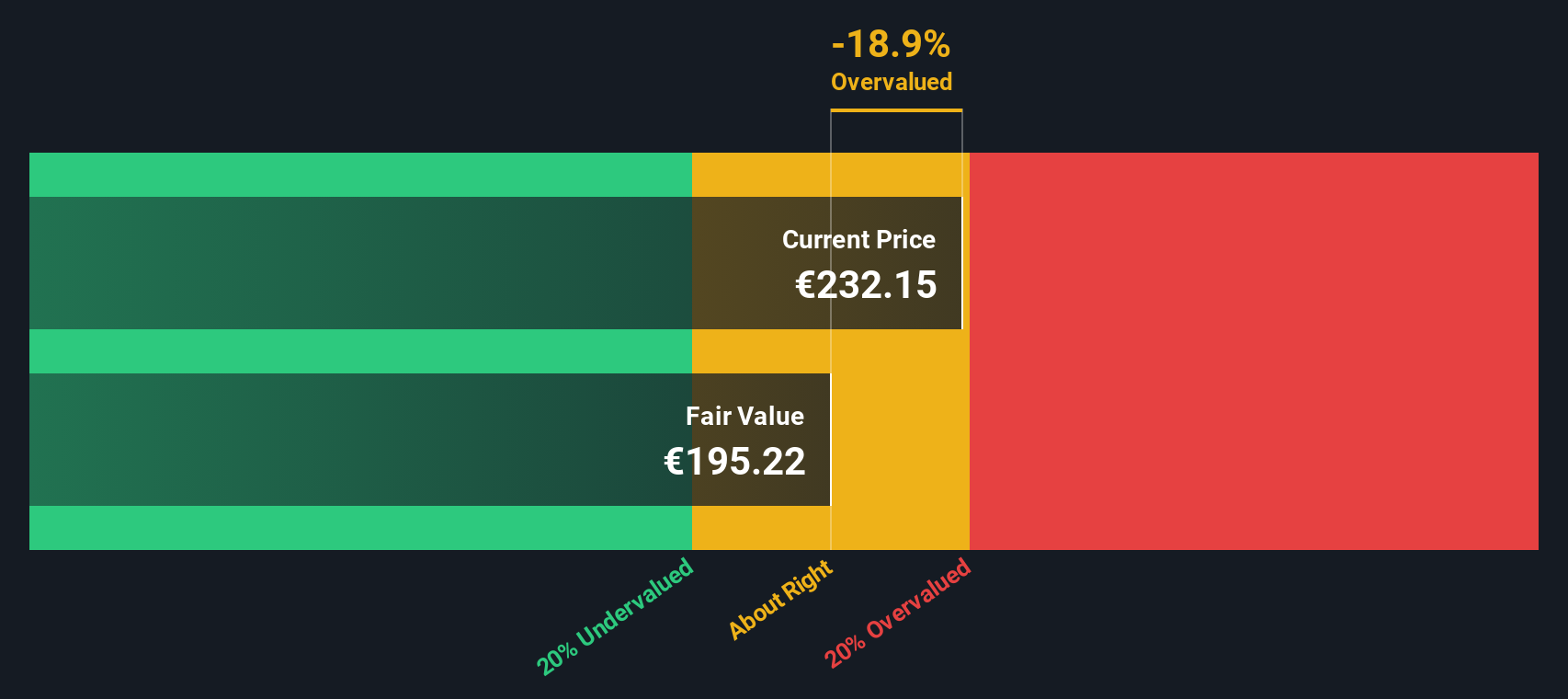

SAP is currently trading at a P/E of 34.7x. This is higher than the Software industry average of 28.1x and also exceeds the peer average of 31.0x. To account for more than just surface-level comparisons, Simply Wall St’s Fair Ratio provides a richer assessment. SAP’s Fair Ratio is 39.8x, which factors in the company’s specific growth outlook, profit margins, market cap, and risk profile.

The Fair Ratio goes beyond simple peer or industry averages by integrating the expected earnings trajectory, business quality metrics, and risk considerations tailored to SAP’s scale and sector. This makes it a more robust benchmark when judging whether shares are sensibly priced.

With SAP’s current P/E of 34.7x slightly below its Fair Ratio of 39.8x, the stock appears undervalued based on this holistic methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SAP Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal perspective or "story" about a company, connecting your view of SAP’s future, such as its expected revenue, profit margins, and fair value, to an investment thesis that goes beyond basic numbers. Narratives help bridge the gap between financial forecasts and the real business trends driving SAP forward, giving your investment decision a transparent, defendable foundation.

With Simply Wall St’s Community page, crafting your Narrative is easy; millions of investors already use this tool to define what they believe SAP’s fair value should be based on their own assumptions, then compare it to the current share price to spot opportunities to buy or sell. Unlike static models, Narratives are updated dynamically as new information such as earnings, news, or big deal announcements comes in, so your outlook evolves with the market.

For example, some SAP Narratives assume rapid cloud adoption and strong AI-driven growth, resulting in a high fair value of €345 per share. Others take a more cautious view and project fair value as low as €192. This proves there is no single “right” answer, and empowers you to make smarter, more personalized decisions.

Do you think there's more to the story for SAP? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SAP

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives