3 German Exchange Stocks That Might Be Trading At Up To 30.8% Discount

Reviewed by Simply Wall St

The German stock market has shown resilience, with the DAX index rising by 1.70% amid growing optimism that the European Central Bank may cut interest rates next month. Despite a weak economic outlook from the Bundesbank, investor sentiment remains cautiously positive. In this context, identifying undervalued stocks can be crucial for investors looking to capitalize on potential market inefficiencies. Here are three German exchange stocks that might be trading at up to a 30.8% discount, offering potential opportunities in these uncertain times.

Top 10 Undervalued Stocks Based On Cash Flows In Germany

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Bertrandt (XTRA:BDT) | €23.50 | €42.45 | 44.6% |

| technotrans (XTRA:TTR1) | €16.95 | €31.04 | 45.4% |

| MBB (XTRA:MBB) | €102.60 | €194.64 | 47.3% |

| M1 Kliniken (XTRA:M12) | €13.95 | €23.69 | 41.1% |

| Verbio (XTRA:VBK) | €17.38 | €29.93 | 41.9% |

| RENK Group (DB:R3NK) | €26.935 | €51.99 | 48.2% |

| Schweizer Electronic (XTRA:SCE) | €4.50 | €7.66 | 41.2% |

| MTU Aero Engines (XTRA:MTX) | €271.10 | €492.71 | 45% |

| Dr. Hönle (XTRA:HNL) | €15.95 | €28.49 | 44% |

| elumeo (XTRA:ELB) | €2.22 | €3.91 | 43.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

adidas (XTRA:ADS)

Overview: adidas AG, with a market cap of €41.35 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue segments include €3.26 billion from Greater China, €2.39 billion from Latin America, and €5.07 billion from North America.

Estimated Discount To Fair Value: 16.6%

adidas is trading at €231.6, below its fair value estimate of €277.82, indicating it may be undervalued based on cash flows. Recent earnings reports show strong performance with Q2 sales rising to €5.82 billion and net income increasing to €190 million from €84 million a year ago. Earnings are forecast to grow 40.7% annually, outpacing the German market's 19.8%. The company raised its full-year guidance, expecting operating profit around €1 billion despite unfavorable currency effects impacting profitability.

- Our growth report here indicates adidas may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of adidas.

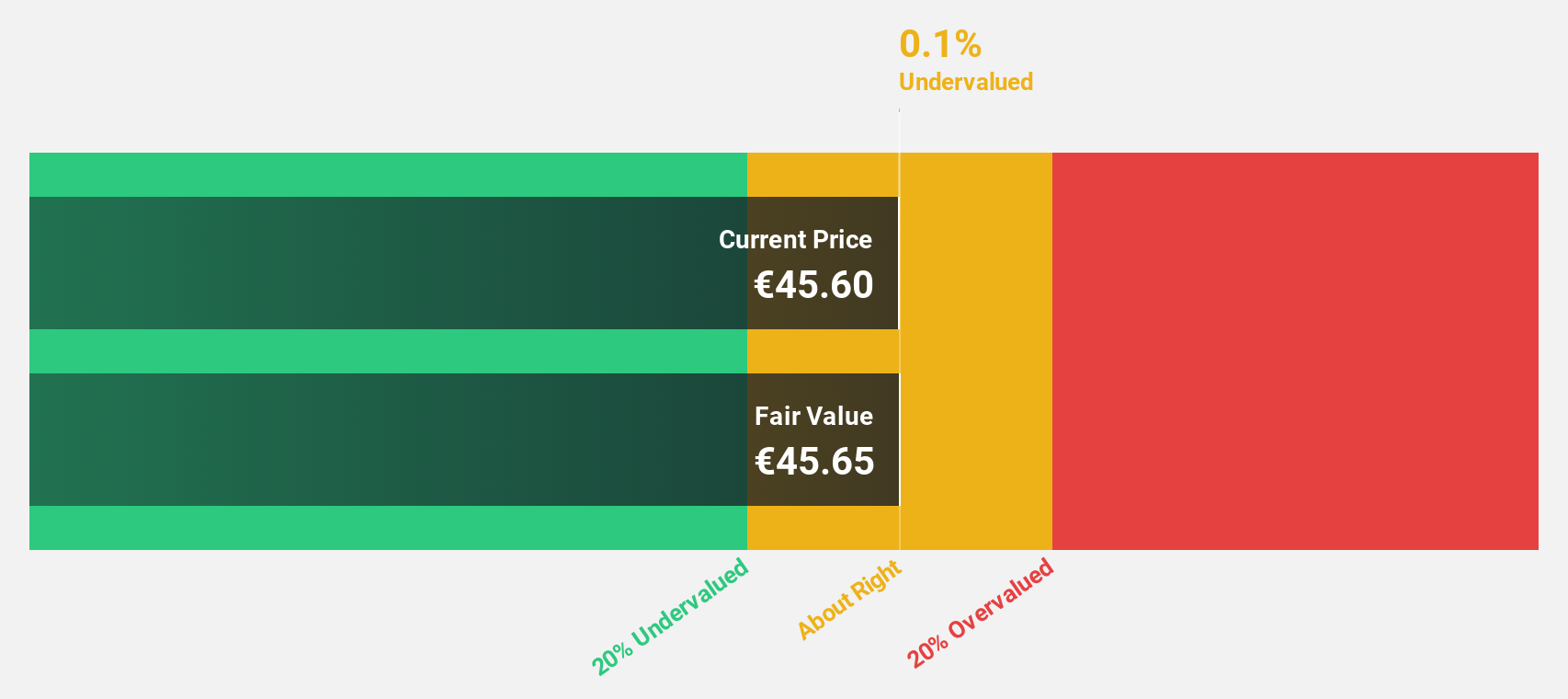

init innovation in traffic systems (XTRA:IXX)

Overview: Init innovation in traffic systems SE, with a market cap of €368.38 million, provides intelligent transportation systems solutions for public transportation globally through its subsidiaries.

Operations: Revenue from wireless communications equipment amounts to €235.67 million.

Estimated Discount To Fair Value: 29.7%

init innovation in traffic systems SE, trading at €37.3, is significantly undervalued compared to its fair value estimate of €53.07. Recent earnings show Q2 sales increased to €64.04 million from €51.1 million a year ago, though net income slightly declined to €2.42 million from €3.03 million. Despite this, six-month net income surged to €4.82 million from €1.34 million previously reported, with earnings forecasted to grow 21.62% annually—outpacing the German market's 19.8%.

- Our expertly prepared growth report on init innovation in traffic systems implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of init innovation in traffic systems with our detailed financial health report.

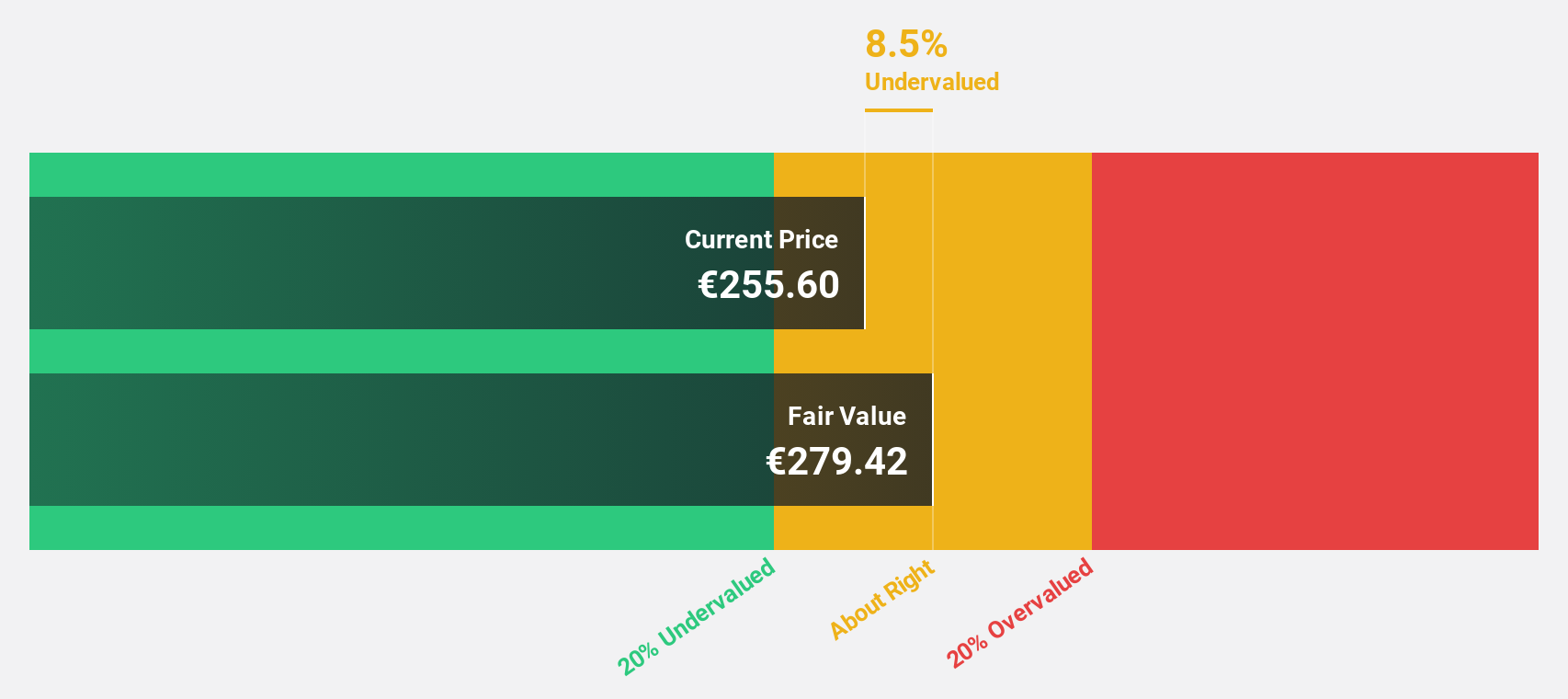

SAP (XTRA:SAP)

Overview: SAP SE, together with its subsidiaries, provides applications, technology, and services worldwide and has a market cap of approximately €232.11 billion.

Operations: The company's revenue segments include Applications, Technology & Services, which generated €32.54 billion.

Estimated Discount To Fair Value: 30.8%

SAP (€199.02) is trading at 30.8% below its fair value estimate of €287.54, indicating significant undervaluation based on discounted cash flows. Earnings are forecasted to grow significantly at 37.88% annually over the next three years, outpacing both revenue growth (10%) and the German market average (19.8%). Recent client announcements, such as partnerships with Xerox and Kyndryl for cloud ERP solutions, support SAP's strategic shift towards scalable cloud services and long-term revenue growth potential.

- The analysis detailed in our SAP growth report hints at robust future financial performance.

- Take a closer look at SAP's balance sheet health here in our report.

Seize The Opportunity

- Navigate through the entire inventory of 25 Undervalued German Stocks Based On Cash Flows here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ADS

adidas

Designs, develops, produces, and markets athletic and sports lifestyle products in Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific, and Latin America.

High growth potential with excellent balance sheet.