Kontron (XTRA:SANT) Valuation in Focus After Major IoT Energy Partnership and Latest Earnings Update

Reviewed by Simply Wall St

Kontron (XTRA:SANT) caught investor attention this week by unveiling a major partnership to provide IoT-based control systems for global energy operations. The deal positions Kontron to tap into a market expected to surpass USD 100 million.

See our latest analysis for Kontron.

Kontron’s latest IoT partnership comes shortly after their third-quarter earnings report, where nine-month net income improved even as quarterly sales and profits dipped slightly compared to last year. The stock presents a compelling narrative: despite a recent pullback, with a 30-day share price return of -8.63%, momentum this year has been strong, and the 12-month total shareholder return stands at an impressive 39%. This is supported by a solid three-year figure of 74%.

If this kind of growth story has you curious about what else is out there, now’s a perfect time to broaden your search and discover fast growing stocks with high insider ownership

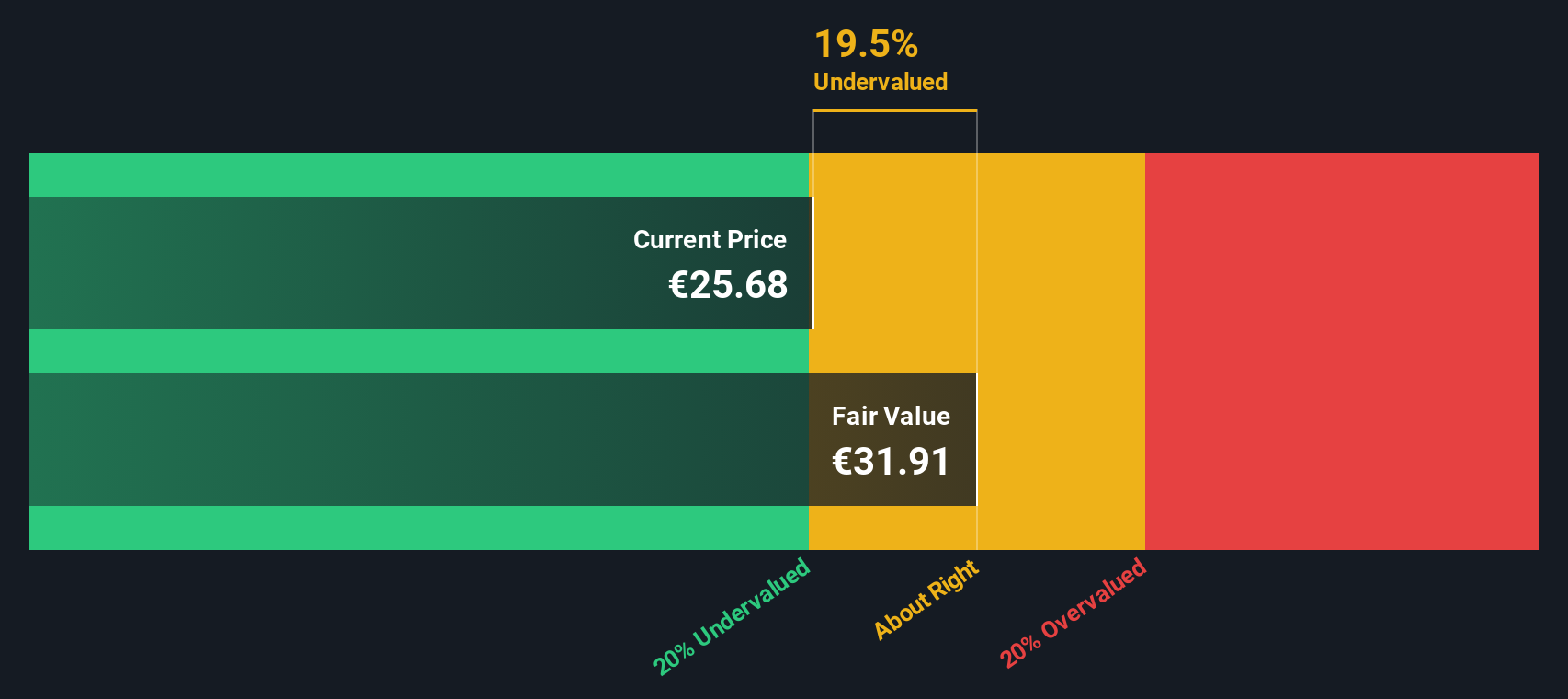

With Kontron shares currently trading at a notable discount to analyst price targets, investors may be wondering if the market has overlooked the company’s growth trajectory or already accounted for future gains. Is there a buying opportunity here?

Price-to-Earnings of 10.5x: Is it justified?

Kontron's shares currently trade at a price-to-earnings (P/E) ratio of 10.5x, which is notably lower than both peers and the industry. This suggests an undervaluation relative to market benchmarks.

The price-to-earnings ratio measures how much investors are willing to pay for each euro of earnings. For technology firms like Kontron, a lower P/E could indicate the market is factoring in slower future growth or is underestimating the company’s earnings power.

In Kontron’s case, the P/E of 10.5x is less than both the European IT industry average of 18.8x and the average among direct peers of 34.8x. Compared to an estimated fair price-to-earnings ratio of 20.1x, the market may have significant room to re-rate the shares upward if performance expectations remain intact.

Explore the SWS fair ratio for Kontron

Result: Price-to-Earnings of 10.5x (UNDERVALUED)

However, if revenue or net income growth stalls, or if broader IT spending weakens, Kontron’s current valuation discount could persist for longer than expected.

Find out about the key risks to this Kontron narrative.

Another View: What Does the SWS DCF Model Indicate?

While the price-to-earnings ratio points to undervaluation, our SWS DCF model estimates Kontron’s fair value at €29.94 per share. This figure is about 22% higher than the current trading price of €23.3. This second method suggests further upside and raises the question: is the market really mispricing Kontron?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kontron for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 862 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kontron Narrative

If you’d rather take a hands-on approach or see the story differently, you can easily build your own analysis and perspective in just a few minutes. Do it your way

A great starting point for your Kontron research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Moves?

Don’t let today’s opportunities pass you by. The market is packed with stocks offering game-changing growth, value, or income, if you know where to look.

- Tap into blockchain innovation and shake up your portfolio by scanning these 82 cryptocurrency and blockchain stocks for companies driving advances in decentralized finance and digital assets.

- Boost your yield with steady performers. Explore these 14 dividend stocks with yields > 3% to spot stocks delivering reliable income and outperforming in choppy markets.

- Ride the momentum of AI trends and get ahead of the curve with these 26 AI penny stocks, featuring businesses harnessing artificial intelligence for real transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kontron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SANT

Kontron

Provides Internet of Things software and solutions in Europe and internationally.

Very undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives