The European stock markets have shown resilience, with key indices like the STOXX Europe 600 Index and major national indexes such as France’s CAC 40 and Germany’s DAX posting gains amid hopes for more trade deals. In this context, penny stocks—traditionally smaller or less-established companies—continue to capture investor interest as they can offer unique growth opportunities. While the term "penny stocks" might seem outdated, these investments remain relevant for those seeking potential value in under-the-radar firms with strong financial health and promising prospects.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.43 | €45.56M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.48 | RON17.08M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.80 | €59.06M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.91 | €18.36M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.38 | PLN11.8M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.42 | SEK2.32B | ✅ 4 ⚠️ 1 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.26 | €10.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.18 | €300.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.984 | €33.18M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Metsä Board Oyj (HLSE:METSB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Metsä Board Oyj operates in the folding boxboard, fresh fibre linerboard, and market pulp sectors both in Finland and internationally, with a market cap of €1.22 billion.

Operations: The company's revenue from its folding boxboard, fresh fibre linerboard, and market pulp operations amounts to €1.94 billion.

Market Cap: €1.22B

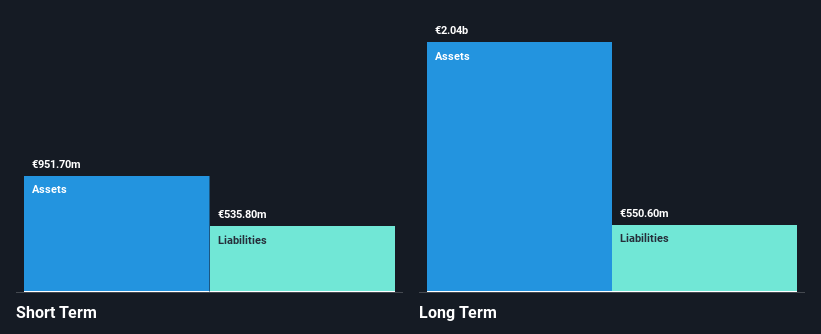

Metsä Board Oyj, with a market cap of €1.22 billion and revenue of €1.94 billion, faces challenges due to weak demand for market pulp and U.S. import tariffs impacting paperboard sales. The company has taken steps to improve profitability by closing its Tako mill and transferring production to the Kyro mill, while also investing €60 million in the Simpele mill for enhanced print quality and sustainability efforts. Despite negative earnings growth over the past year, Metsä Board's short-term assets comfortably cover both short- and long-term liabilities, offering some financial stability amidst operational adjustments.

- Unlock comprehensive insights into our analysis of Metsä Board Oyj stock in this financial health report.

- Understand Metsä Board Oyj's earnings outlook by examining our growth report.

Getin Holding (WSE:GTN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Getin Holding S.A. is a financial holding company involved in investment activities both in Poland and internationally, with a market cap of PLN106.46 million.

Operations: The company generates revenue from banking services in Ukraine, amounting to PLN12.21 million.

Market Cap: PLN106.46M

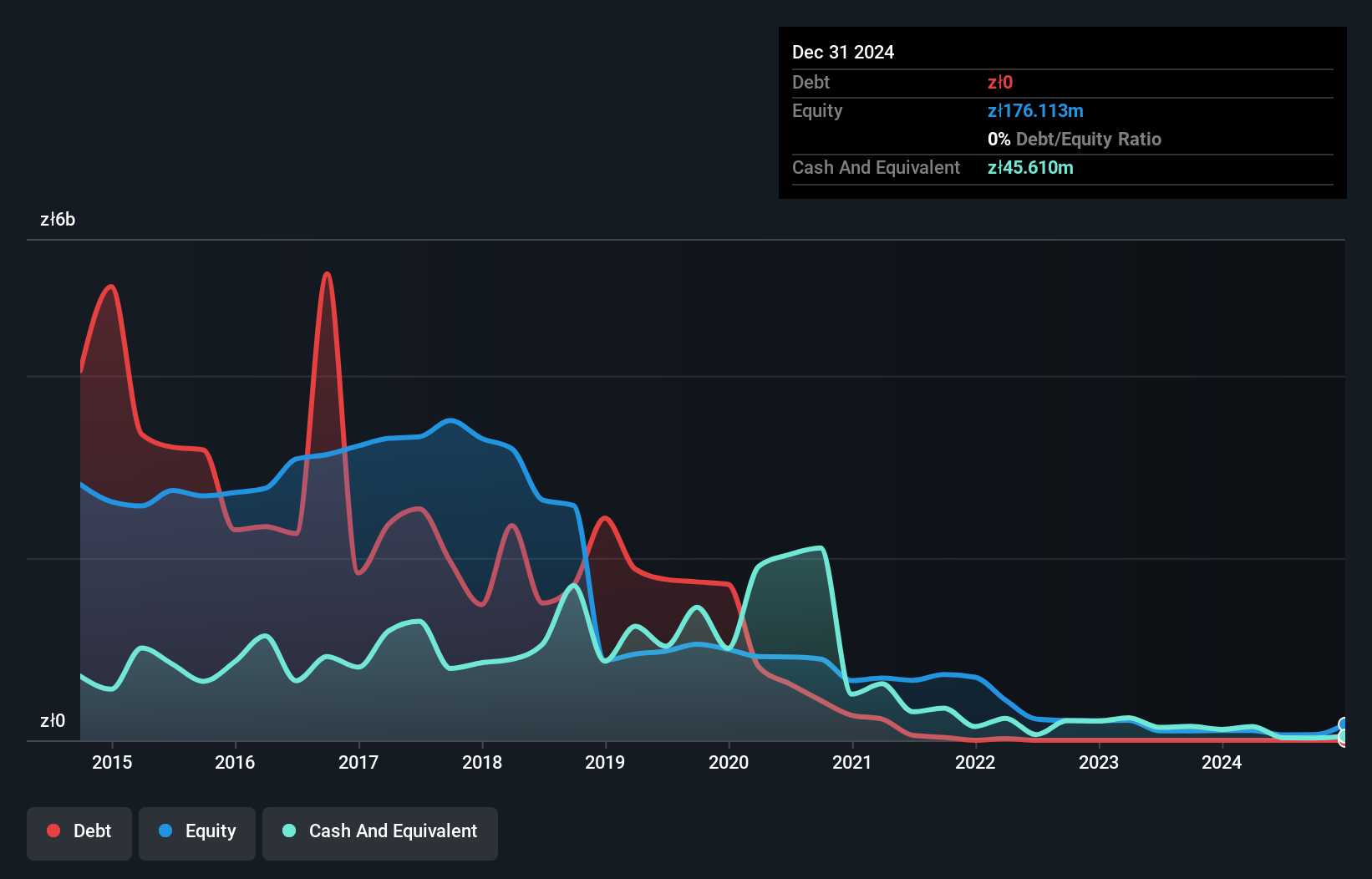

Getin Holding S.A., with a market cap of PLN106.46 million, has recently turned profitable, reporting net income of PLN129.08 million for the year ended December 31, 2024. The company's earnings quality is considered high despite low return on equity and an assets to equity ratio of 4.3x, indicating limited financial leverage. While its dividend yield appears unsustainable at present levels, Getin Holding's liabilities are primarily funded through low-risk customer deposits (77%). However, its share price remains highly volatile and the company lacks significant revenue streams outside banking services in Ukraine (PLN12 million).

- Get an in-depth perspective on Getin Holding's performance by reading our balance sheet health report here.

- Evaluate Getin Holding's historical performance by accessing our past performance report.

q.beyond (XTRA:QBY)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: q.beyond AG operates in the cloud, applications, artificial intelligence (AI), and security sectors both in Germany and internationally, with a market cap of €119.35 million.

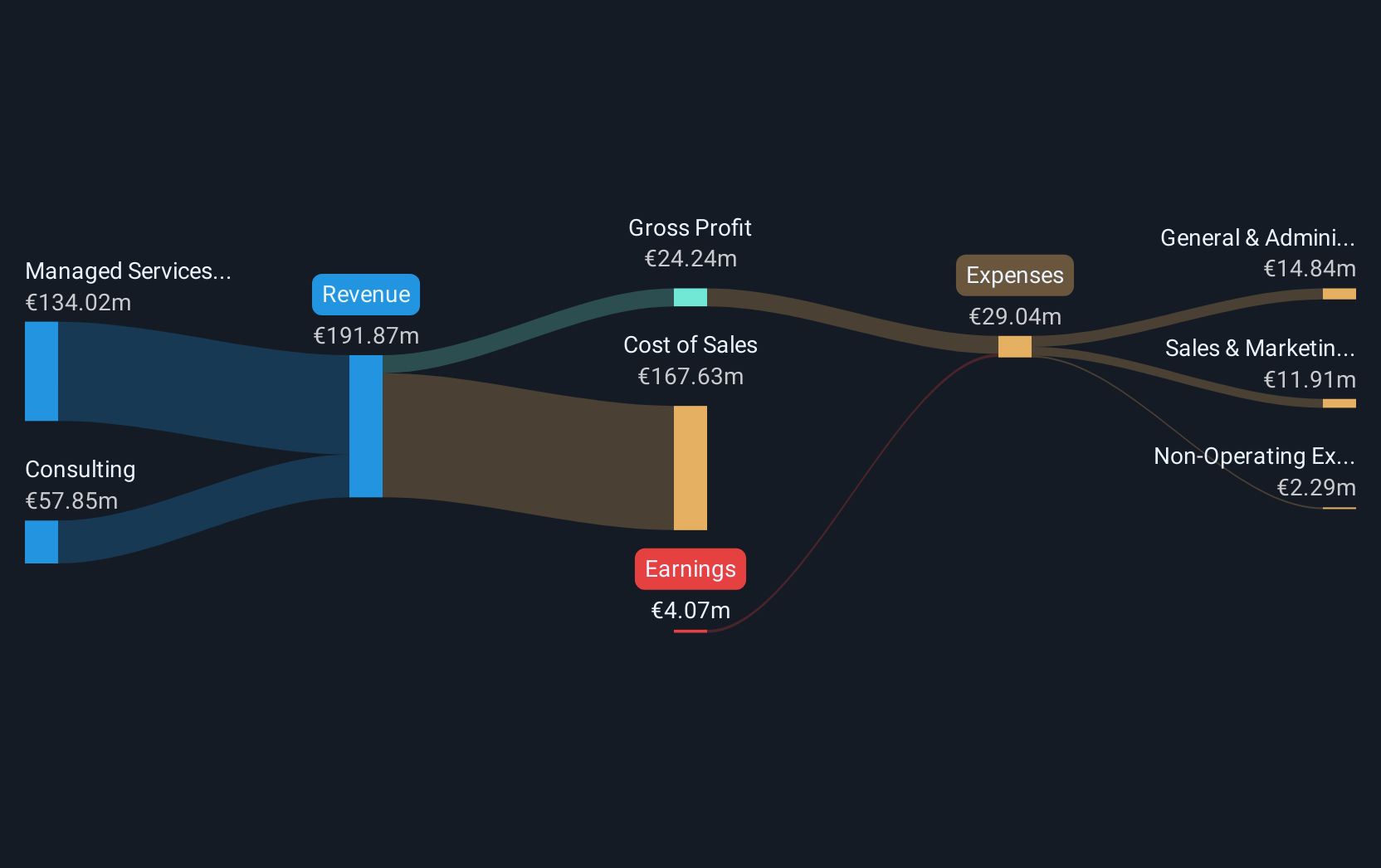

Operations: The company's revenue is derived from two main segments: Consulting, which generated €57.85 million, and Managed Services, contributing €134.02 million.

Market Cap: €119.35M

q.beyond AG, with a market cap of €119.35 million, is expanding its cybersecurity capabilities by opening a second Cyber Defence Center in Latvia. Despite being unprofitable and facing increased losses over the past five years, q.beyond remains debt-free and has sufficient cash runway for over three years due to positive free cash flow. The company's short-term assets exceed both its short-term and long-term liabilities, indicating solid financial health despite current profitability challenges. With revenue from consulting (€57.85 million) and managed services (€134.02 million), it continues to support digitalisation projects across various sectors internationally.

- Click here to discover the nuances of q.beyond with our detailed analytical financial health report.

- Review our growth performance report to gain insights into q.beyond's future.

Make It Happen

- Access the full spectrum of 326 European Penny Stocks by clicking on this link.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:METSB

Metsä Board Oyj

Engages in the folding boxboard, fresh fibre linerboard, and market pulp businesses in Finland and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives