Amidst heightened global trade tensions and economic uncertainty, European markets have experienced significant volatility, with the STOXX Europe 600 Index seeing its largest drop in five years due to higher-than-expected U.S. tariffs. As investors navigate these challenging conditions, identifying high growth tech stocks requires a focus on companies that demonstrate resilience through innovation and adaptability in an ever-evolving market landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Bonesupport Holding | 30.48% | 50.17% | ★★★★★★ |

| Yubico | 20.88% | 26.53% | ★★★★★★ |

| Truecaller | 20.10% | 24.70% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.52% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.68% | 36.76% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's explore several standout options from the results in the screener.

Qt Group Oyj (HLSE:QTCOM)

Simply Wall St Growth Rating: ★★★★☆☆

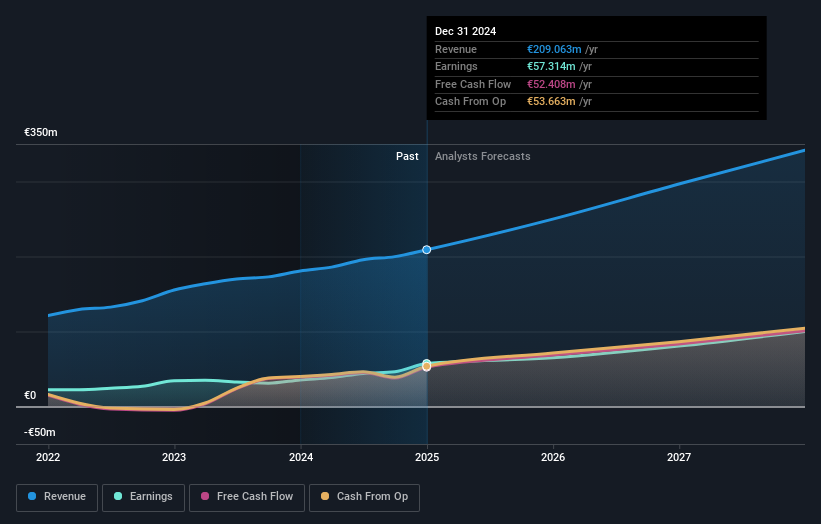

Overview: Qt Group Oyj provides cross-platform solutions for the software development lifecycle across various regions including Finland, Europe, Asia Pacific, and North America with a market capitalization of €1.79 billion.

Operations: Qt Group Oyj generates revenue primarily from its Software Development Tools segment, which contributed €209.06 million. The company operates across multiple regions, including Finland, Europe, Asia Pacific, and North America.

Qt Group Oyj, a frontrunner in the European tech scene, demonstrated robust financial performance with a significant uptick in sales to EUR 209.06 million and net income soaring to EUR 57.31 million for FY 2024. This reflects annualized revenue and earnings growth of 15.4% and 18.9%, respectively, outpacing broader market trends significantly. The company's commitment to innovation is evident from its R&D focus, crucial for sustaining long-term growth in the competitive software industry where it recently launched the Qt AI Assistant—enhancing cross-platform UI development efficiency by integrating advanced AI capabilities directly into its framework. Looking ahead, Qt Group projects a promising increase in net sales by up to 25% for FY 2025 alongside an operating profit margin between 30-40%, positioning itself as a dynamic player within high-tech sectors driven by continuous technological advancements and strategic product enhancements.

- Delve into the full analysis health report here for a deeper understanding of Qt Group Oyj.

Gain insights into Qt Group Oyj's past trends and performance with our Past report.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

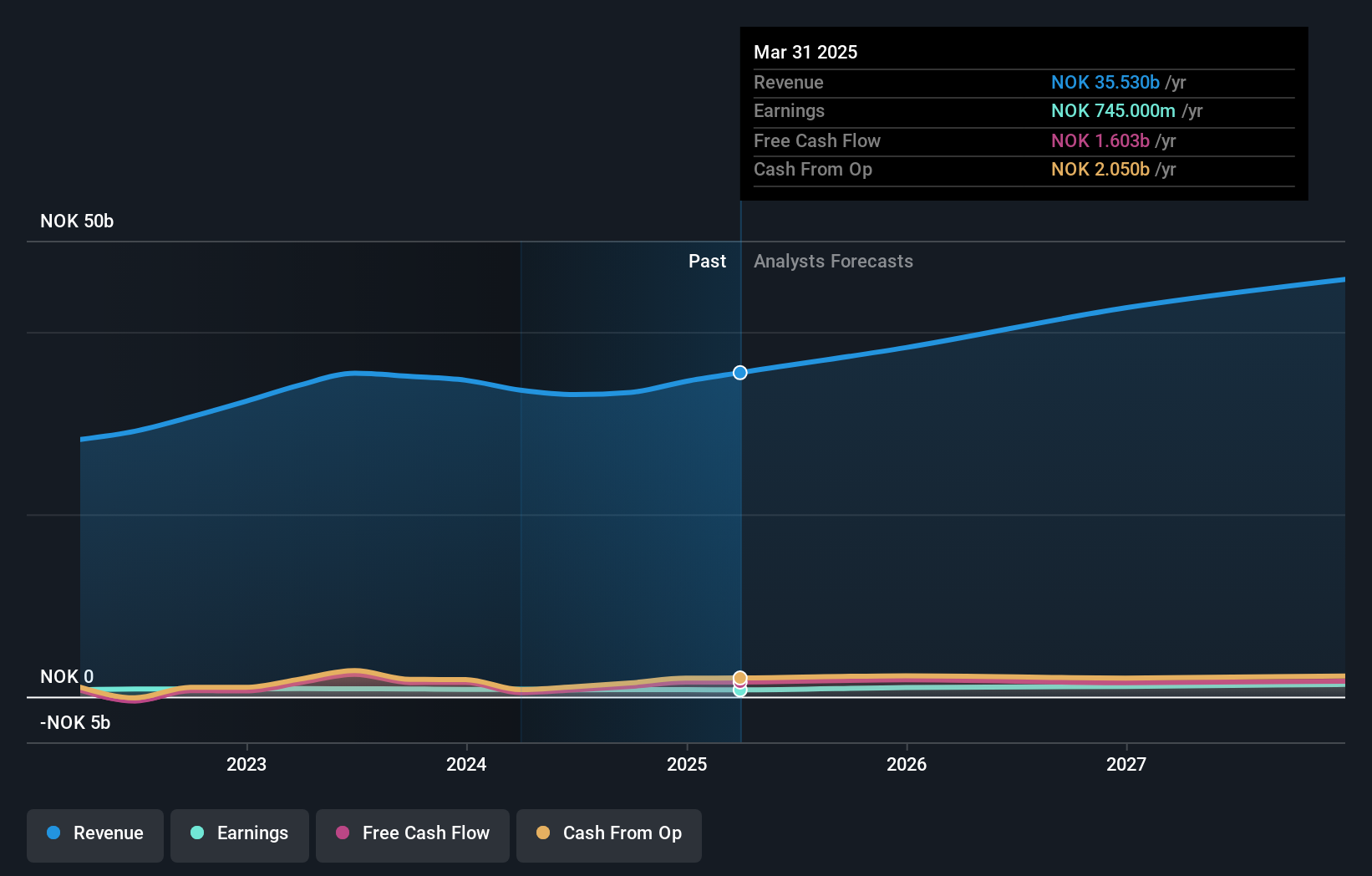

Overview: Atea ASA specializes in providing IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market capitalization of NOK14.05 billion.

Operations: Atea ASA generates revenue from IT infrastructure and solutions, with significant contributions from Sweden (NOK12.76 billion) and Norway (NOK8.80 billion). The company's operations in Denmark, Finland, and the Baltics also contribute to its overall revenue. Group costs amount to NOK10.34 billion, impacting profitability across segments.

Atea ASA, navigating the competitive European tech landscape, reported a slight dip in sales to NOK 34.58 billion for FY 2024 from NOK 34.70 billion the previous year, while net income also decreased slightly to NOK 775 million. Despite these challenges, the company's earnings are expected to surge by an impressive annual rate of 20.6%, outperforming the Norwegian market's average growth rate of 7.7%. This robust projection is supported by Atea's strategic focus on R&D and its ability to maintain high-quality earnings amidst fluctuating market conditions. With a forecasted Return on Equity of an impressive 26% in three years' time, Atea is poised for significant financial achievements despite current hurdles in revenue growth.

PSI Software (XTRA:PSAN)

Simply Wall St Growth Rating: ★★★★★☆

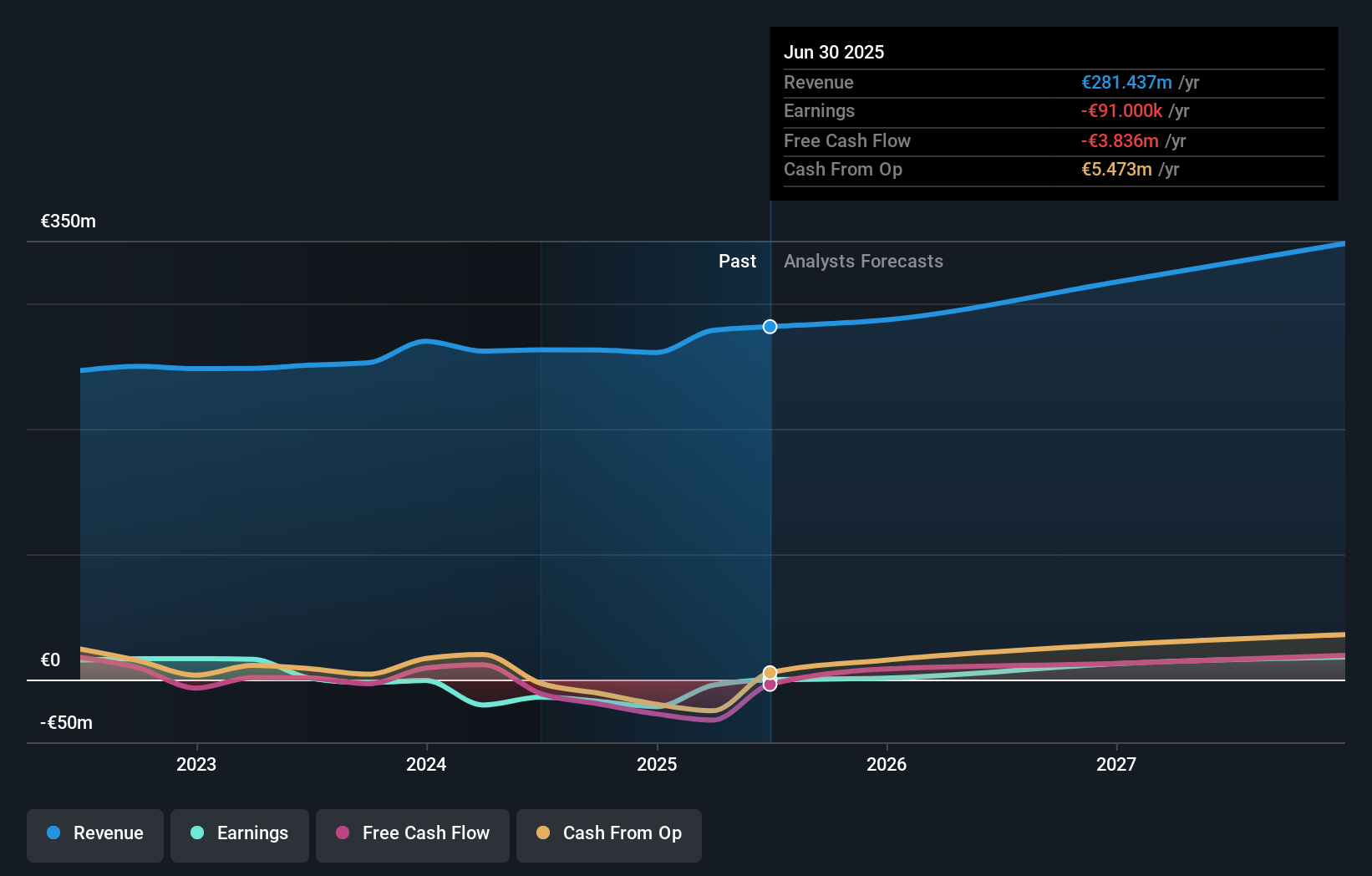

Overview: PSI Software SE specializes in developing and integrating software solutions to optimize energy and material flows for utilities and industries globally, with a market cap of €362.42 million.

Operations: PSI Software SE focuses on creating software solutions that enhance the efficiency of energy and material flows across utility and industrial sectors worldwide. The company operates with a market capitalization of €362.42 million, reflecting its significant presence in the industry.

PSI Software's recent strategic moves, including a partnership with Google Cloud and an alliance with E.ON for network control systems, underscore its commitment to transforming into a cloud-first entity. This shift is pivotal as it leverages industrial AI to enhance SaaS offerings, crucial for staying competitive in the tech-driven market. Despite a challenging fiscal year 2024 with sales dropping to EUR 260.84 million from EUR 269.89 million and shifting from a net income of EUR 0.324 million to a net loss of EUR 20.96 million, PSI is poised for recovery. The company's focus on innovative software solutions and strategic partnerships is expected to revitalize its operations and position it well for future profitability, supported by an anticipated earnings growth of 71.27% per year.

- Unlock comprehensive insights into our analysis of PSI Software stock in this health report.

Examine PSI Software's past performance report to understand how it has performed in the past.

Make It Happen

- Click here to access our complete index of 235 European High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PSAN

Reasonable growth potential with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion