The European market has shown resilience as the pan-European STOXX Europe 600 Index rose by 3.44%, buoyed by easing tariff concerns and positive economic growth in the eurozone, which doubled its rate to 0.4% in the first quarter. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation capabilities and adaptability to shifting market conditions, ensuring they can capitalize on emerging opportunities within Europe's evolving tech landscape.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Digital Value | 29.11% | 29.54% | ★★★★★★ |

| KebNi | 20.83% | 67.27% | ★★★★★★ |

| Pharma Mar | 25.21% | 43.09% | ★★★★★★ |

| Yubico | 20.08% | 25.52% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Ascelia Pharma | 43.57% | 70.39% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

cBrain (CPSE:CBRAIN)

Simply Wall St Growth Rating: ★★★★★☆

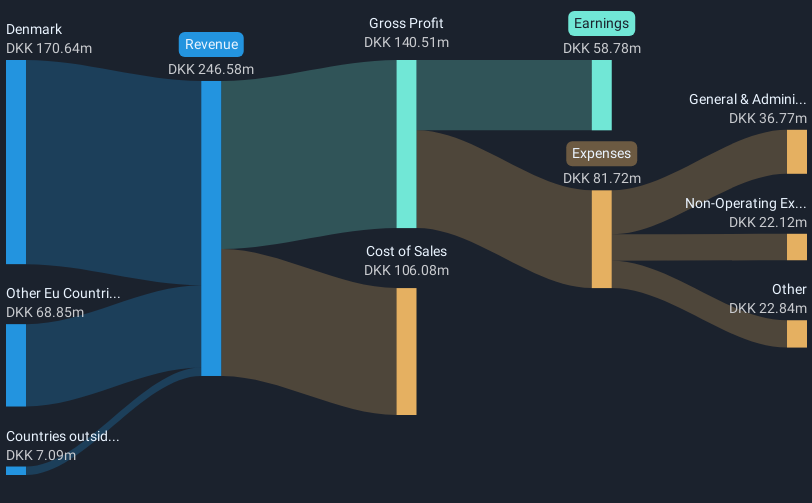

Overview: cBrain A/S is a software company that offers software solutions to government, private, education, and non-profit sectors across Denmark, the rest of the European Union, and internationally with a market cap of DKK3.48 billion.

Operations: cBrain A/S generates revenue primarily through its Software & Programming segment, which contributed DKK267.78 million. The company's software solutions cater to diverse sectors, including government and education, both in Denmark and internationally.

cBrain, a notable entity in the European tech landscape, recently affirmed its robust growth trajectory with an anticipated revenue surge of 19.2% annually and earnings before tax expected to rise by 18-23% for 2025. This outlook is bolstered by a consistent dividend policy, marked by a recent increase to DKK 0.64 per share, underscoring confidence in sustained profitability. Despite not outpacing the software industry's growth last year, cBrain's commitment to innovation is evident from its R&D investments which align with its strategic focus on expanding its digital government solutions portfolio. With these developments, cBrain is poised to enhance its market position while navigating the volatile share price dynamics observed over the past months.

- Click here and access our complete health analysis report to understand the dynamics of cBrain.

Gain insights into cBrain's past trends and performance with our Past report.

AT & S Austria Technologie & Systemtechnik (WBAG:ATS)

Simply Wall St Growth Rating: ★★★★☆☆

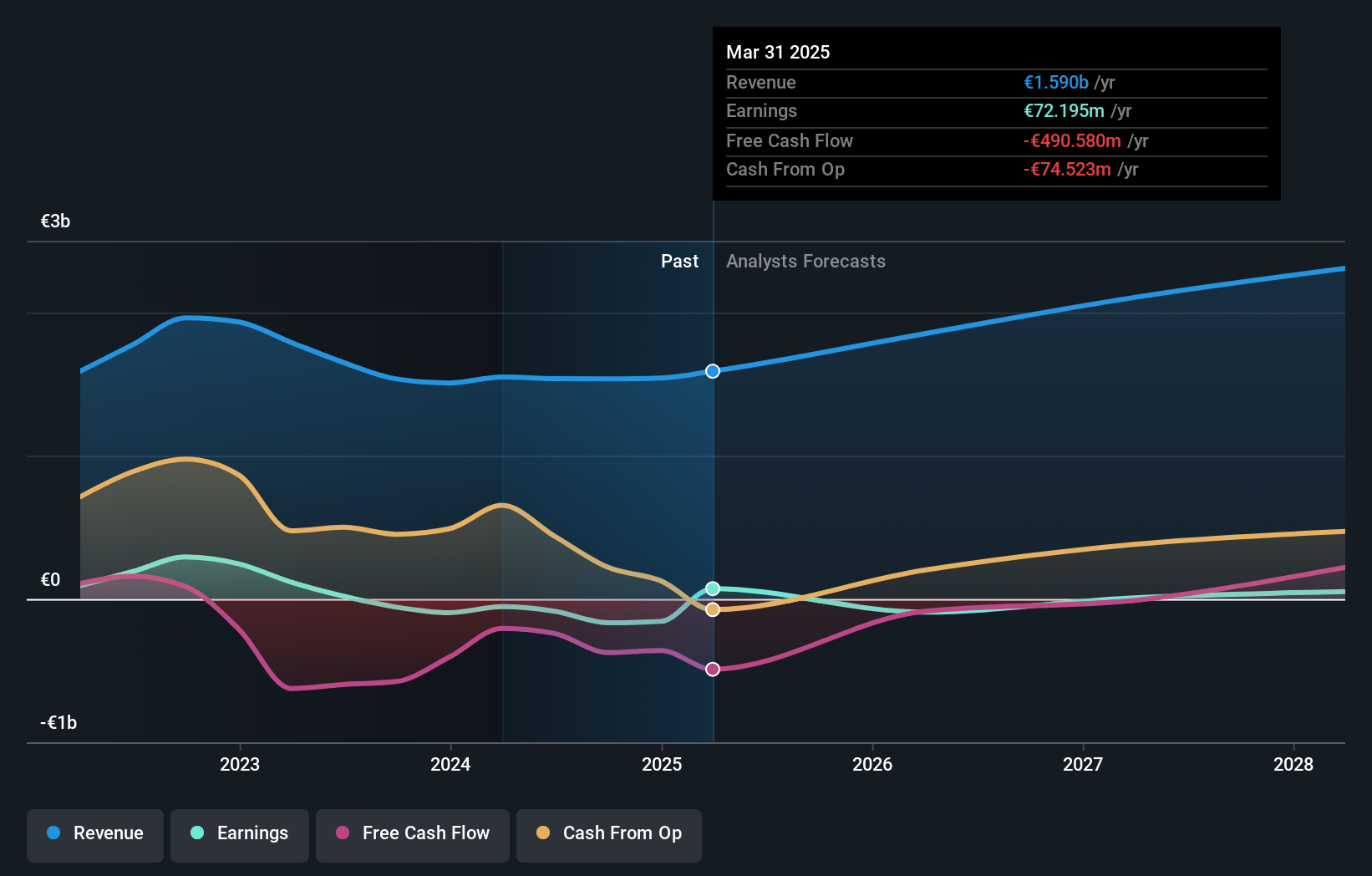

Overview: AT & S Austria Technologie & Systemtechnik Aktiengesellschaft, along with its subsidiaries, specializes in manufacturing and distributing printed circuit boards across various regions including Austria, Germany, Europe, China, Asia, and the Americas; it has a market cap of approximately €605.28 million.

Operations: AT & S Austria Technologie & Systemtechnik generates revenue primarily from two segments: Microelectronics, contributing €672.95 million, and Electronics Solutions, adding €953.08 million.

AT & S Austria Technologie & Systemtechnik, despite its current unprofitability, is on a path to profitability with earnings expected to grow by 94.16% annually over the next three years. This growth trajectory is supported by robust revenue projections of 14.1% per year, outpacing the Austrian market's average of 0.6%. The appointment of Dr. Michael Mertin as CEO heralds a strategic pivot, potentially enhancing innovation and operational efficiency given his extensive background in technology and leadership at JENOPTIK AG.

PSI Software (XTRA:PSAN)

Simply Wall St Growth Rating: ★★★★★☆

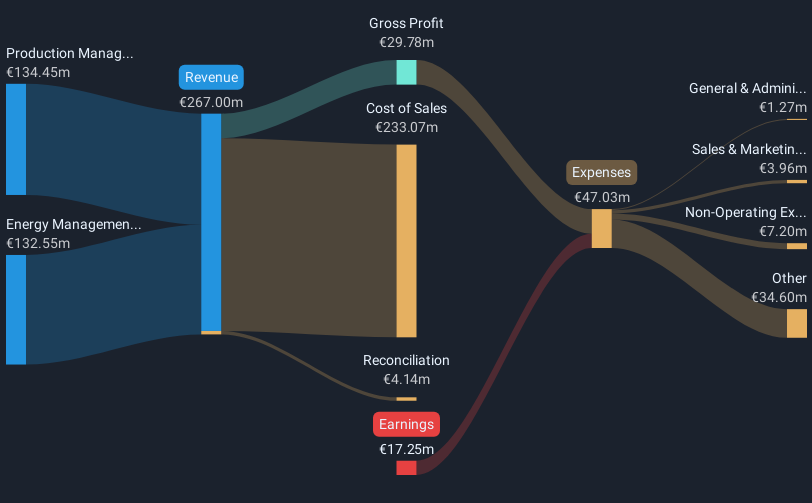

Overview: PSI Software SE specializes in developing and integrating software solutions to optimize energy and material flows for utilities and industries globally, with a market cap of €469.29 million.

Operations: The company generates revenue primarily through its Process Industries & Metals segment (€72.15 million) and Logistics segment (€33.77 million), focusing on software solutions for optimizing energy and material flows.

PSI Software's recent pivot towards a cloud-based SaaS model, in partnership with Google Cloud, marks a significant strategic shift aimed at enhancing operational efficiencies and accelerating market reach. This transformation is underscored by a robust forecast of 9% annual revenue growth, outpacing the German market's 5.9%. Moreover, the company has rebounded impressively from previous losses, as evidenced by its first quarter results showing sales jumping to EUR 67.9 million from EUR 50.27 million year-over-year and turning a net loss into a profit of EUR 0.271 million. These developments suggest PSI is not only recovering but also adapting swiftly to meet future digital infrastructure demands.

- Click to explore a detailed breakdown of our findings in PSI Software's health report.

Evaluate PSI Software's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 223 European High Growth Tech and AI Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if cBrain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CBRAIN

cBrain

A software company, provides software solutions for government, private, education, and non-profit sectors in Denmark, rest of the European Union, and internationally.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion