- Germany

- /

- Electronic Equipment and Components

- /

- XTRA:BKHT

Exploring Brockhaus Technologies And Two Other High Growth German Tech Stocks

Reviewed by Simply Wall St

As the European market shows signs of resilience with Germany’s DAX climbing 3.38%, investors are increasingly focusing on high-growth opportunities within the tech sector. In this article, we will explore Brockhaus Technologies and two other promising German tech stocks that exemplify strong growth potential in an evolving economic landscape where innovation and market adaptability are key drivers of success.

Top 10 High Growth Tech Companies In Germany

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ströer SE KGaA | 7.39% | 29.86% | ★★★★★☆ |

| Stemmer Imaging | 13.34% | 23.20% | ★★★★★☆ |

| Exasol | 14.66% | 117.10% | ★★★★★☆ |

| NAGA Group | 25.85% | 78.32% | ★★★★★☆ |

| ParTec | 41.16% | 63.31% | ★★★★★★ |

| medondo holding | 34.52% | 71.99% | ★★★★★☆ |

| Northern Data | 32.53% | 68.17% | ★★★★★☆ |

| cyan | 27.51% | 67.79% | ★★★★★☆ |

| Rubean | 43.51% | 73.87% | ★★★★★☆ |

| asknet Solutions | 20.06% | 74.86% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €297.76 million, focusing on investments in high-growth technology companies.

Operations: Brockhaus Technologies AG generates revenue primarily from its Financial Technologies and Security Technologies segments, contributing €174.59 million and €37.03 million respectively. The company focuses on high-growth technology investments, leveraging its expertise to drive value in these segments.

Brockhaus Technologies is poised for growth, with revenue expected to rise 16.8% annually, outpacing the German market's 5.7%. Despite a net loss of €6.65 million in H1 2024, sales surged to €109.43 million from €84.59 million year-on-year, highlighting robust demand in its tech segments. R&D expenditure remains critical; investing significantly in innovation could drive future profitability and competitiveness within the industry.

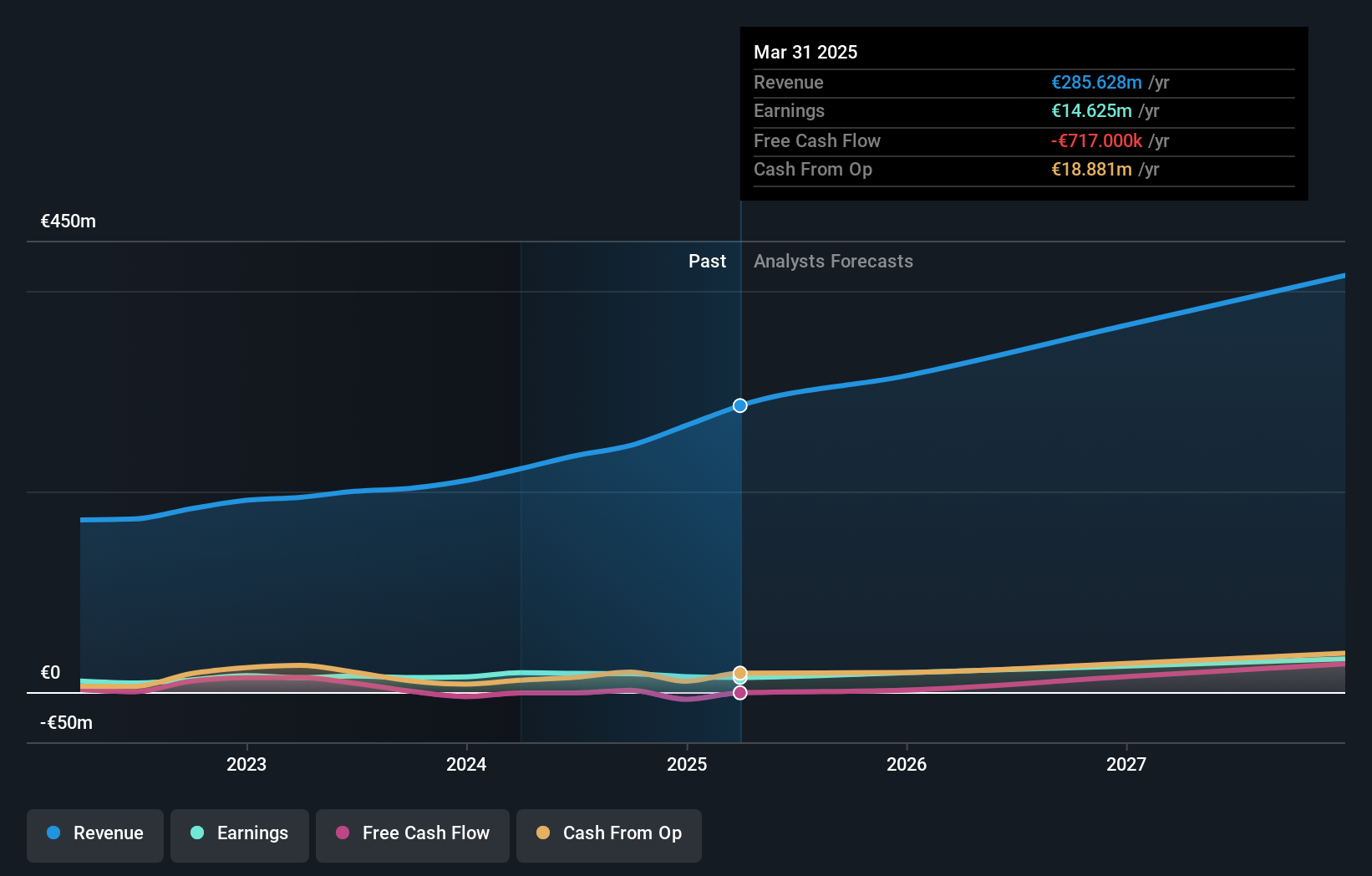

init innovation in traffic systems (XTRA:IXX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: init innovation in traffic systems SE, along with its subsidiaries, provides intelligent transportation systems solutions for public transportation worldwide and has a market cap of €368.38 million.

Operations: init innovation in traffic systems SE generates revenue primarily from its Wireless Communications Equipment segment, which contributed €235.67 million. The company focuses on providing intelligent transportation systems solutions for public transportation globally.

Init innovation in traffic systems SE has demonstrated robust growth, with sales increasing to €64.04 million in Q2 2024 from €51.1 million a year ago, and six-month sales reaching €114.49 million compared to €89.63 million previously. Despite a slight dip in net income for the quarter, the company's earnings are forecasted to grow at an impressive 21.6% annually over the next three years, outpacing the German market's 19.8%. Significant investment in R&D, which accounted for 12.5% of revenue last year, underscores its commitment to innovation and future competitiveness within the tech industry.

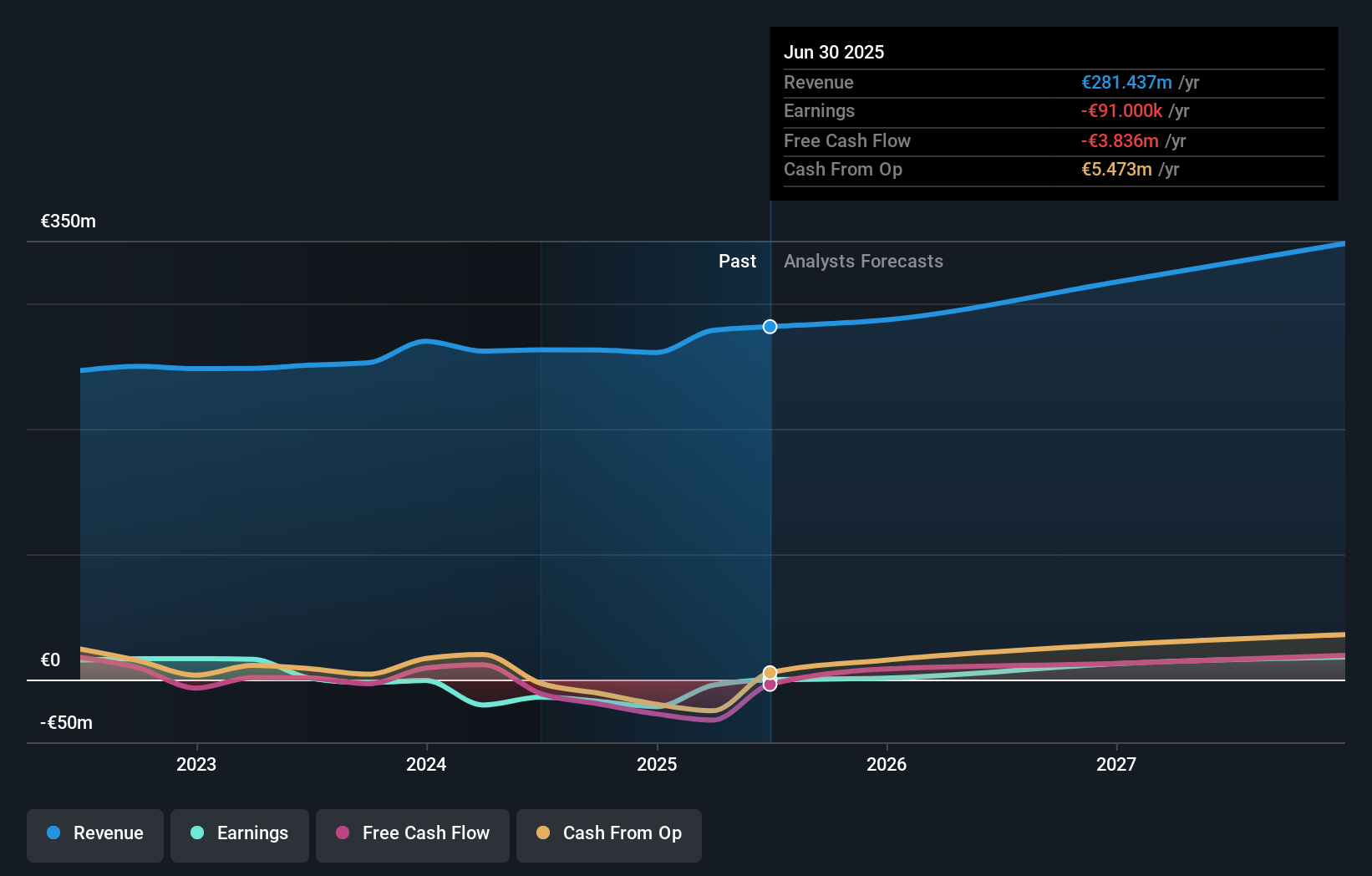

PSI Software (XTRA:PSAN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PSI Software SE develops and integrates software solutions for optimizing the flow of energy and materials for utilities and industry worldwide, with a market cap of €315.96 million.

Operations: PSI Software SE generates revenue primarily from its Energy Management and Production Management segments, with the latter contributing €148.79 million and the former €141.78 million. The company focuses on software solutions that optimize energy and material flows for utilities and industries globally.

PSI Software SE, with a forecasted annual revenue growth of 7.3%, is expected to outpace the German market's 5.7% growth rate. Despite being currently unprofitable, earnings are projected to surge by 61.24% annually over the next three years, indicating a robust recovery trajectory. The company has invested significantly in R&D, spending €12 million last year, which underscores its commitment to innovation and technological advancements in software solutions for industrial processes and energy management sectors.

- Click here to discover the nuances of PSI Software with our detailed analytical health report.

Explore historical data to track PSI Software's performance over time in our Past section.

Key Takeaways

- Explore the 43 names from our German High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brockhaus Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BKHT

Excellent balance sheet and good value.