Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Aroundtown SA (ETR:AT1) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Aroundtown

How Much Debt Does Aroundtown Carry?

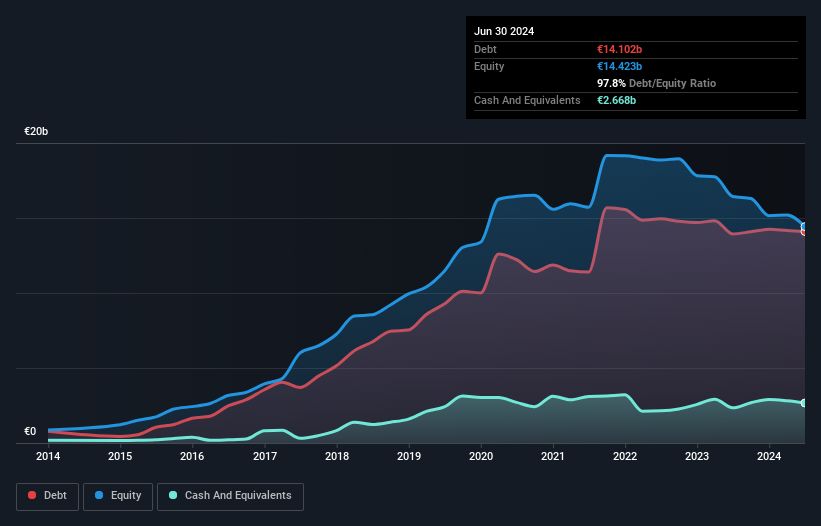

The chart below, which you can click on for greater detail, shows that Aroundtown had €14.1b in debt in June 2024; about the same as the year before. However, it does have €2.67b in cash offsetting this, leading to net debt of about €11.4b.

A Look At Aroundtown's Liabilities

According to the last reported balance sheet, Aroundtown had liabilities of €2.39b due within 12 months, and liabilities of €15.7b due beyond 12 months. Offsetting this, it had €2.67b in cash and €1.09b in receivables that were due within 12 months. So it has liabilities totalling €14.3b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the €3.29b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Aroundtown would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a net debt to EBITDA ratio of 13.6, it's fair to say Aroundtown does have a significant amount of debt. But the good news is that it boasts fairly comforting interest cover of 3.4 times, suggesting it can responsibly service its obligations. The good news is that Aroundtown improved its EBIT by 3.9% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Aroundtown can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Aroundtown recorded free cash flow worth a fulsome 87% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

On the face of it, Aroundtown's net debt to EBITDA left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Looking at the bigger picture, it seems clear to us that Aroundtown's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 2 warning signs we've spotted with Aroundtown (including 1 which is significant) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AT1

Aroundtown

Operates as a real estate company in Germany, the Netherlands, the United Kingdom, Belgium, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives