Nemetschek (XTRA:NEM) Earnings Growth Tops 5-Year Trend, Challenging Valuation Concerns

Reviewed by Simply Wall St

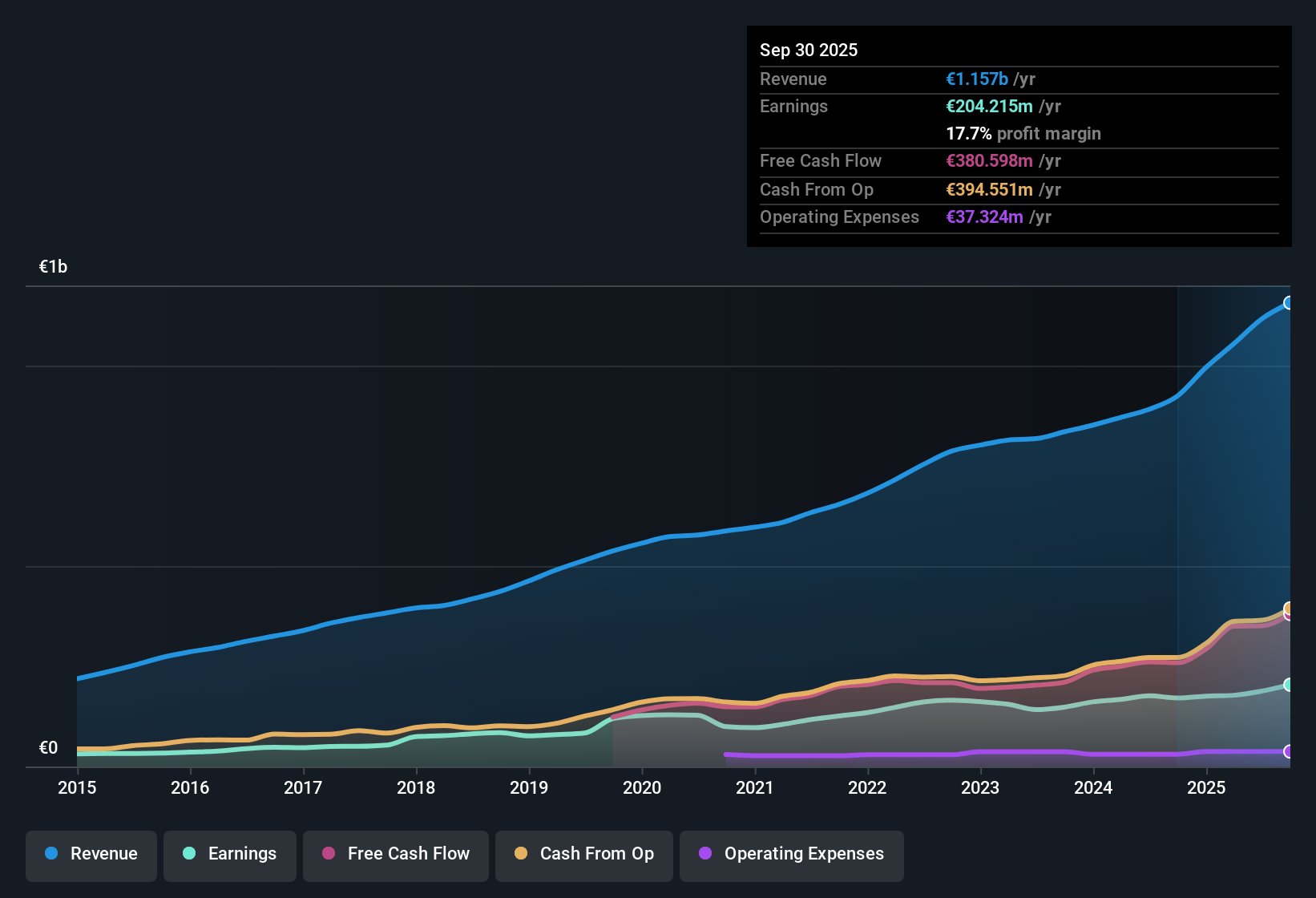

Nemetschek (XTRA:NEM) delivered earnings growth of 19.5% over the last year, handily outpacing its 5-year average of 11.5% per year. Net profit margin stands at 17.6%, a touch below last year’s 18.5%, with earnings expected to continue rising faster than the German market at 18.4% per year ahead. With solid growth forecasts and no flagged risks, investors will be weighing the strong growth outlook, high-quality earnings, and fair value discount against a premium Price-To-Earnings Ratio that is well above industry averages.

See our full analysis for Nemetschek.Next, we will see how Nemetschek’s headline numbers compare with the market’s widely held narratives. Stay tuned as we check which stories hold up and where surprises may emerge.

See what the community is saying about Nemetschek

SaaS Shift Drives Recurring Revenue Surge

- Subscription and SaaS revenue now make up a record high portion of sales, growing at roughly 75%. This sharp increase points to enhanced revenue visibility and improved customer retention compared to prior reliance on more volatile perpetual licenses.

- Consensus narrative notes that the swift move to SaaS and subscriptions is expected to lift recurring revenue and expand margins, as Nemetschek’s AI-powered offerings and global partnerships (like Google Cloud) raise product differentiation and increase potential pricing power.

- With recurring revenue at record highs and continued investment in advanced AI features, consensus expects higher average revenue per user and a stronger long-term growth profile.

- However, reliance on contract structures means short-term volatility could remain, especially as the proportion of multi-year deals is expected to diminish, which may affect future revenue predictability.

- To see how Nemetschek’s growth momentum is shaping the industry narrative, check the full Consensus Narrative for deeper insights. 📊 Read the full Nemetschek Consensus Narrative.

Profit Margin Stability as Expansion Continues

- Net profit margin stands solid at 17.6%, just below last year’s 18.5%, and analysts project a further rise to 21.7% within three years. This suggests that margin growth is part of the long-term earnings picture, even amid ongoing investments in AI and M&A.

- Consensus narrative underscores that margin expansion is closely linked to successful SaaS transition and execution on international growth, but also cautions about risks from integrating acquisitions (like GoCanvas) and from required ongoing investment in new technology and legacy transitions.

- Margin improvement is seen as achievable if the SaaS mix and operational leverage keep accelerating, but integration costs or tougher legacy transitions could temporarily compress profitability.

- Geographic and regulatory complexities, especially with significant new markets in Asia-Pacific, may introduce margin volatility in future years.

Premium Valuation Versus Fair Value Gap

- Although Nemetschek’s share price (€99.55) currently trades at a discount to its DCF fair value of €113.11, its Price-To-Earnings Ratio of 56.3× sharply exceeds peer (28.7×) and European industry (27×) averages. This signals a valuation debate between robust fundamentals and premium pricing concerns.

- Consensus narrative highlights that the stock’s premium multiples will invite scrutiny as investors balance above-market growth and quality earnings against sector benchmarks. The “discount to fair value” may act as a draw for growth-focused investors.

- Investors targeting high-growth software names may view Nemetschek’s combination of strong forecasts and perceived discount as a rare setup, yet the elevated PE versus sector norms is hard to dismiss in risk/reward calculations.

- With no flagged risks and healthy expansion trends, bullish investors will look for execution to justify the valuation, while skeptics focus on whether such a premium can persist without a slip in growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nemetschek on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the numbers? Bring your perspective to life by sharing your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Nemetschek.

See What Else Is Out There

Nemetschek’s impressive growth is balanced by concerns about its premium valuation, with its Price-To-Earnings Ratio significantly higher than industry and peer averages.

If you’re seeking growth without overpaying, check out these 840 undervalued stocks based on cash flows to focus on stocks with more attractive valuations and better upside potential now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nemetschek might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:NEM

Nemetschek

Provides software solutions for architecture, engineering, construction, operation, and media industries in Germany, the rest of Europe, the Americas, the Asia Pacific, and internationally.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives