Mensch und Maschine Software's (ETR:MUM) Shareholders Will Receive A Bigger Dividend Than Last Year

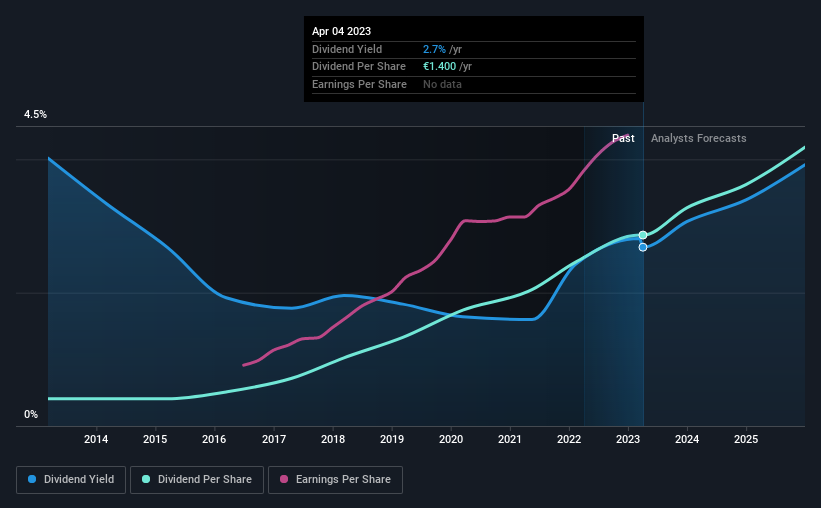

The board of Mensch und Maschine Software SE (ETR:MUM) has announced that it will be paying its dividend of €1.40 on the 16th of May, an increased payment from last year's comparable dividend. This will take the annual payment to 2.7% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Mensch und Maschine Software

Mensch und Maschine Software's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Prior to this announcement, Mensch und Maschine Software's dividend made up quite a large proportion of earnings but only 70% of free cash flows. In general, cash flows are more important than earnings, so we are comfortable that the dividend will be sustainable going forward, especially with so much cash left over for reinvestment.

EPS is set to grow by 43.1% over the next year. Assuming the dividend continues along recent trends, our estimates say the payout ratio could reach 77% - on the higher side, but we wouldn't necessarily say this is unsustainable.

Mensch und Maschine Software Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the annual payment back then was €0.20, compared to the most recent full-year payment of €1.40. This implies that the company grew its distributions at a yearly rate of about 21% over that duration. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Mensch und Maschine Software Might Find It Hard To Grow Its Dividend

The company's investors will be pleased to have been receiving dividend income for some time. Mensch und Maschine Software has impressed us by growing EPS at 24% per year over the past five years. Earnings per share is growing nicely, but the company is paying out most of its earnings as dividends. This might be sustainable, but we wonder why Mensch und Maschine Software is not retaining those earnings to reinvest in growth.

In Summary

Overall, this is a reasonable dividend, and it being raised is an added bonus. The dividend is easily covered by cash flows and has a good track record, but we think the payout ratio might be a bit high. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Mensch und Maschine Software that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MUM

Mensch und Maschine Software

Provides computer aided design, manufacturing, and engineering, product data management, and building information modeling/management solutions in Germany, Austria, Switzerland, the United Kingdom, Italy, France, Hungary, and internationally.

Undervalued with proven track record.

Market Insights

Community Narratives