KPS' (ETR:KSC) Shareholders Will Receive A Bigger Dividend Than Last Year

KPS AG (ETR:KSC) will increase its dividend on the 23rd of May to €0.19. This will take the annual payment from 4.6% to 4.6% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for KPS

KPS' Payment Has Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Prior to this announcement, KPS' dividend made up quite a large proportion of earnings but only 46% of free cash flows. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

Over the next year, EPS is forecast to expand by 18.8%. Assuming the dividend continues along the course it has been charting recently, our estimates show the payout ratio being 66% which brings it into quite a comfortable range.

Dividend Volatility

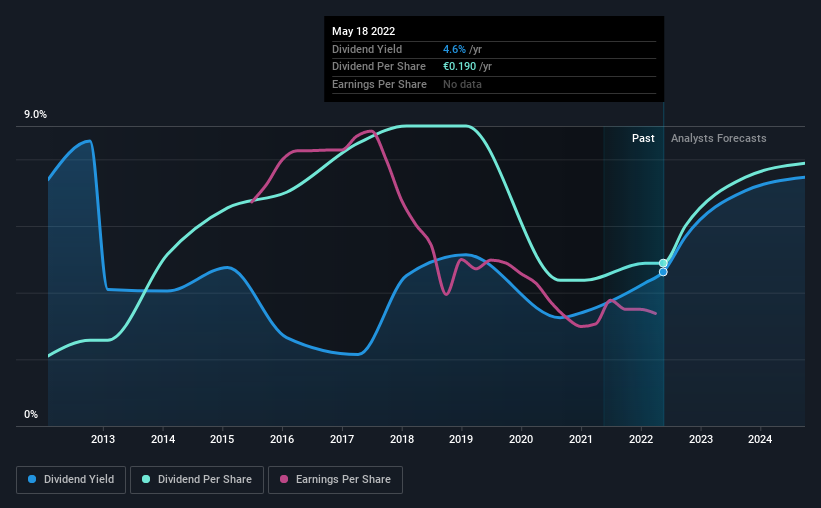

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2012, the dividend has gone from €0.082 to €0.19. This means that it has been growing its distributions at 8.8% per annum over that time. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

The Dividend Has Limited Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. KPS' EPS has fallen by approximately 17% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

Our Thoughts On KPS' Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think KPS is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 1 warning sign for KPS that you should be aware of before investing. Is KPS not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:KSC

KPS

Provides business transformation consulting and process optimization services in retail and consumer goods sectors in Germany, Scandinavia, the United Kingdom, Switzerland, Benelux, Spain, and internationally.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion