As European markets navigate the complexities of AI valuation concerns and shifting interest rate expectations, the STOXX Europe 600 Index has recently faced downward pressure, reflecting broader market sentiment. Despite these challenges, opportunities remain for discerning investors to identify promising small-cap stocks that demonstrate resilience and potential for growth amidst economic expansion indicators like steady eurozone business activity. In this environment, a good stock is often characterized by its ability to maintain strong fundamentals and adapt to changing market dynamics while offering unique value propositions that align with evolving industry trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 5.37% | 4.80% | 13.56% | ★★★★★★ |

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Bittium Oyj (HLSE:BITTI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bittium Oyj is a company that offers communications and connectivity solutions, healthcare technology products and services, as well as biosignal measuring and monitoring in Finland, Germany, and the United States with a market capitalization of €684.75 million.

Operations: Bittium generates revenue primarily from its Defense & Security segment (€55.50 million) and Medical segment (€29.00 million), with additional contributions from Engineering Services (€14.72 million). The company incurs costs related to Group Functions amounting to €11.08 million.

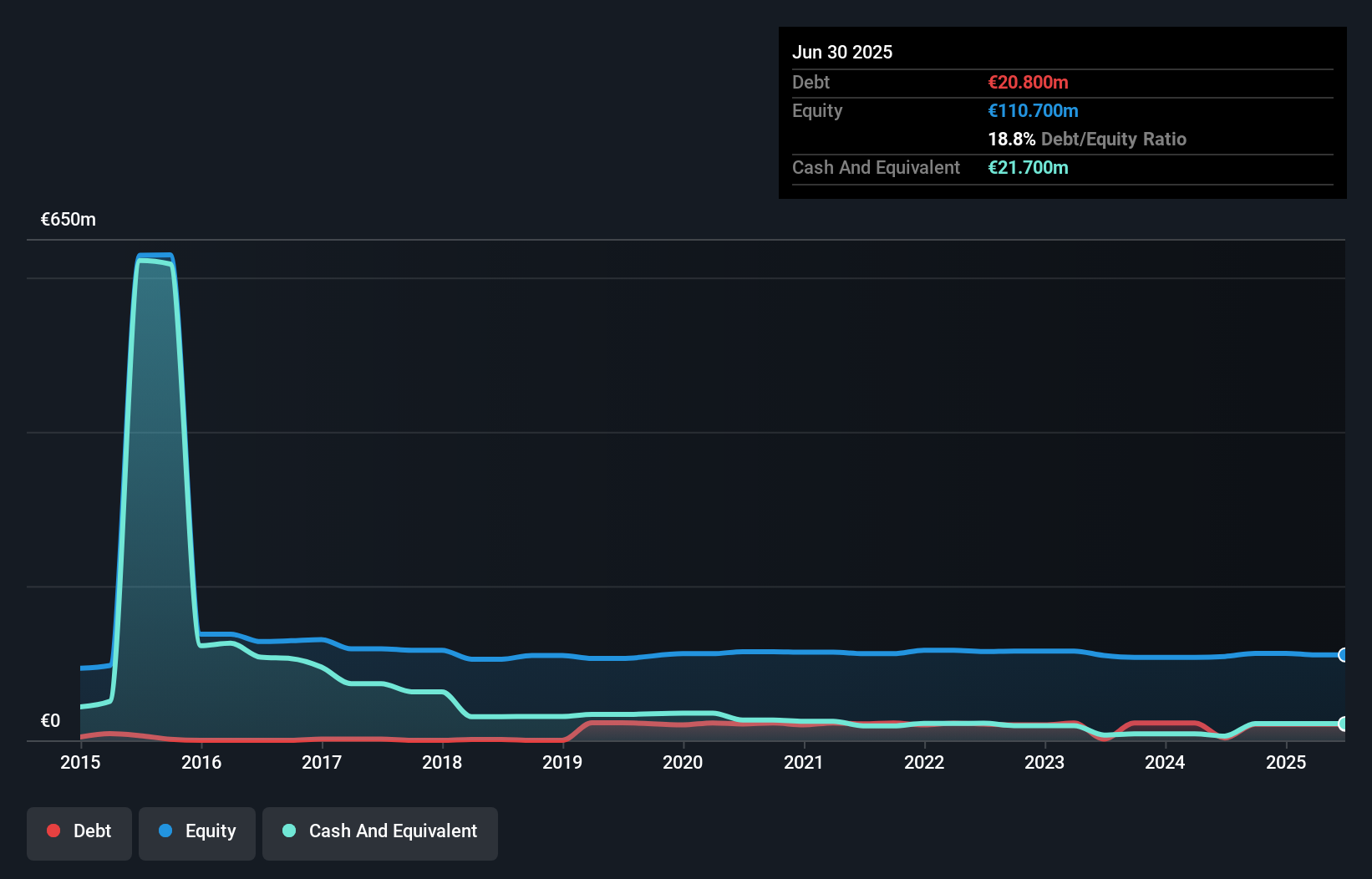

Bittium Oyj, a nimble player in the tech space, is making waves with its strategic focus on secure communication and healthcare technology. The company's earnings skyrocketed by 1278.9% over the past year, outpacing industry norms significantly. With a debt-to-equity ratio slightly increasing from 18.5 to 18.8 over five years, Bittium still boasts more cash than total debt and maintains strong interest coverage at 22.6 times EBIT. Recent product launches like the Tough Mobile 3 smartphone and Embedded AI solutions underscore its commitment to innovation in high-security markets, positioning it well for future growth despite potential challenges from competition and contract dependencies.

ASBISc Enterprises (WSE:ASB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ASBISc Enterprises Plc, along with its subsidiaries, is a global trader and distributor of computer hardware and software across regions including the Former Soviet Union, Central Eastern Europe, Western Europe, the Middle East, and Africa; it has a market capitalization of PLN1.60 billion.

Operations: ASBISc Enterprises generates revenue primarily through its IT product distribution segment, which accounted for $3.54 billion. The company's market capitalization stands at PLN1.60 billion.

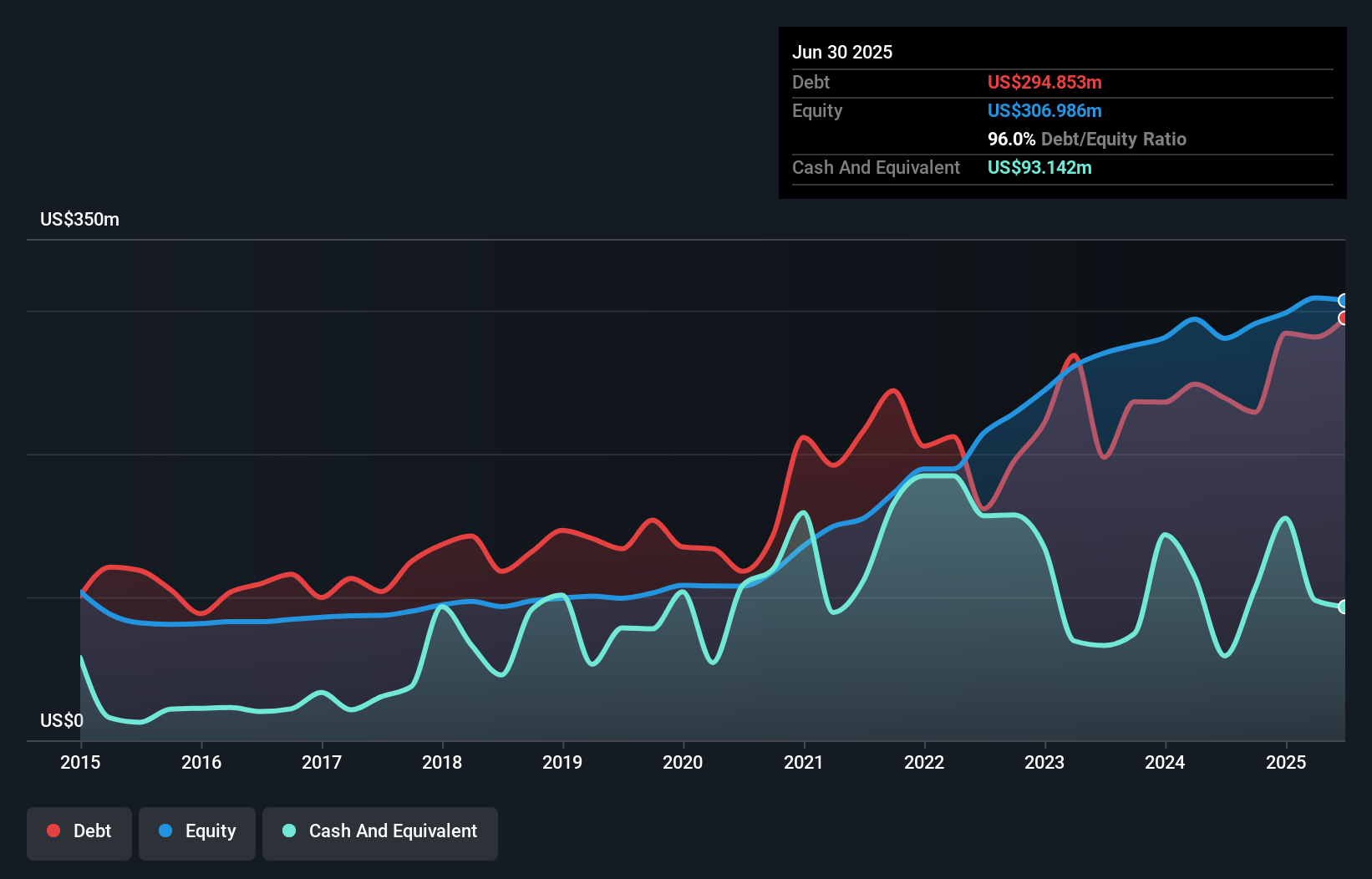

ASBISc Enterprises, a notable player in the electronics sector, has been making waves with its impressive earnings growth of 75.9% over the past year, outpacing the industry average. Despite a high net debt to equity ratio of 67.7%, which is considered elevated, ASB's interest payments are well covered by EBIT at 4.3 times coverage. The company's recent financials reveal robust sales figures for Q3 2025 at US$929 million compared to US$722 million last year and net income rising to US$11.85 million from US$9.67 million previously, showcasing its potential as an intriguing investment opportunity in Europe’s market landscape.

- Take a closer look at ASBISc Enterprises' potential here in our health report.

Evaluate ASBISc Enterprises' historical performance by accessing our past performance report.

IVU Traffic Technologies (XTRA:IVU)

Simply Wall St Value Rating: ★★★★★★

Overview: IVU Traffic Technologies AG, along with its subsidiaries, specializes in creating and managing integrated IT solutions for global bus and train systems, with a market cap of €362.69 million.

Operations: IVU Traffic Technologies generates revenue primarily from its Public Transport segment, which includes logistics, amounting to €150.21 million. The company's market cap stands at €362.69 million.

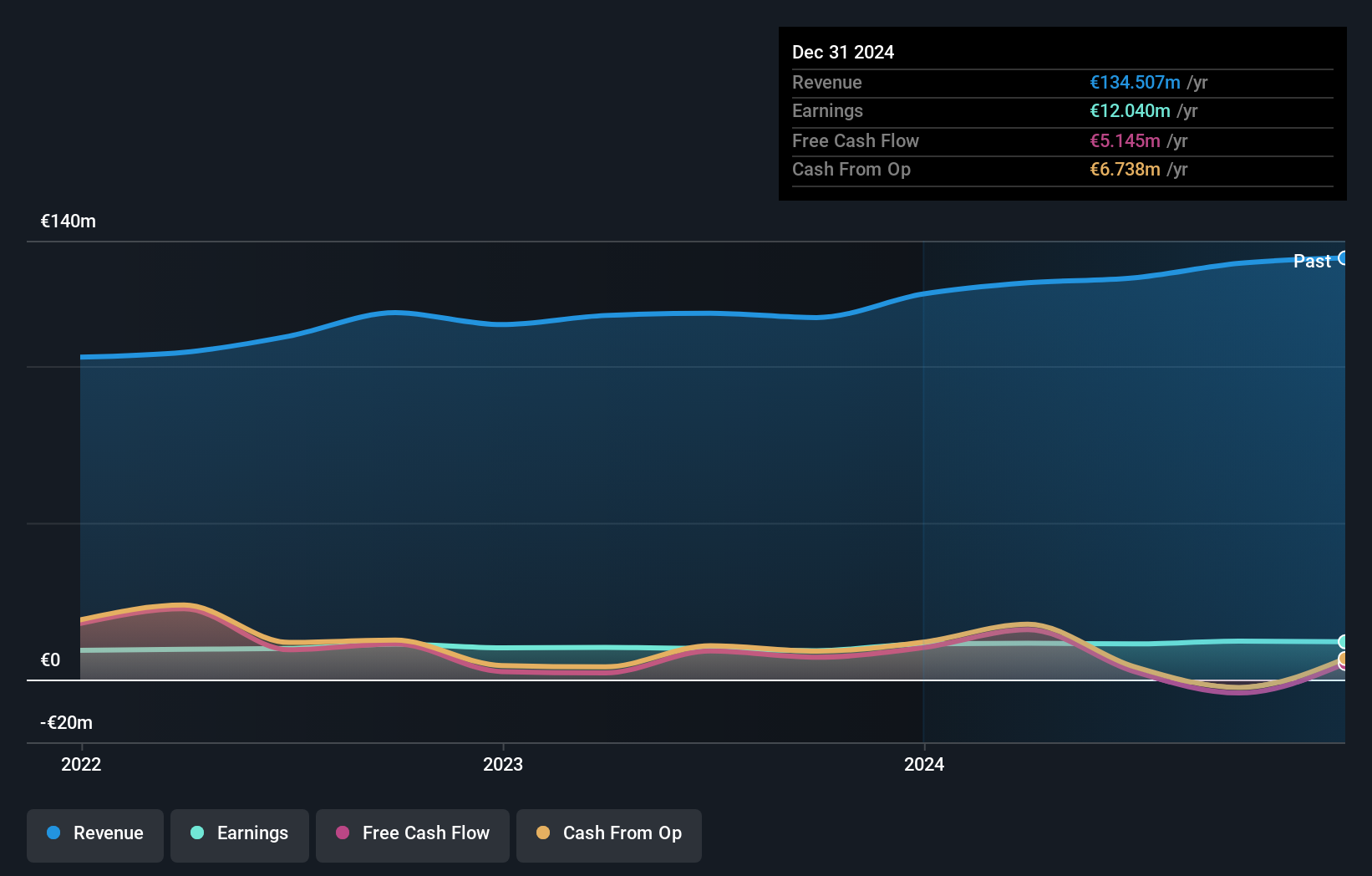

IVU Traffic Technologies is making waves with its robust financial health and strategic moves. This debt-free company has seen earnings grow 5.3% annually over the past five years, though recent growth of 9.7% trails the software industry's 13.6%. With a forecasted annual earnings growth of 9.36%, IVU's high-quality earnings are noteworthy. Recent quarterly results show sales at €37.75 million, up from €31.28 million last year, while net income rose to €3.76 million from €2.68 million previously, reflecting strong operational performance despite no share repurchases this year under its buyback program.

- Dive into the specifics of IVU Traffic Technologies here with our thorough health report.

Gain insights into IVU Traffic Technologies' past trends and performance with our Past report.

Next Steps

- Explore the 315 names from our European Undiscovered Gems With Strong Fundamentals screener here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bittium Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BITTI

Bittium Oyj

Provides solutions for communications and connectivity, healthcare technology products and services, and biosignal measuring and monitoring in Finland, Germany, and the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success