Amidst a backdrop of fluctuating market sentiment and economic uncertainty, the European stock markets have shown resilience with mixed returns across major indices. As investors navigate these complex conditions, identifying stocks that demonstrate strong fundamentals and potential for growth can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | -2.23% | 6.18% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| Intellego Technologies | 11.59% | 68.05% | 72.76% | ★★★★★★ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| Prim | 10.72% | 10.36% | 0.14% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers a variety of banking and financial services to individuals, farmers, professionals, businesses, and public authorities in France, with a market cap of approximately €1.22 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative generates revenue primarily from its retail banking segment, which contributes approximately €626 million. The company's market cap stands at around €1.22 billion.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, a cooperative bank with total assets of €42.2 billion and equity of €5 billion, is making waves by growing earnings at 6.2% over the past year, outpacing the industry average of 5.3%. Despite a 2.2% revenue dip, it trades at a substantial discount—47% below estimated fair value—suggesting potential upside for investors seeking undervalued opportunities. The bank's funding is primarily low-risk customer deposits (91%), and its allowance for bad loans stands robustly at 115%, with non-performing loans kept to an appropriate level of 1.2%, highlighting sound risk management practices.

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €445.92 million.

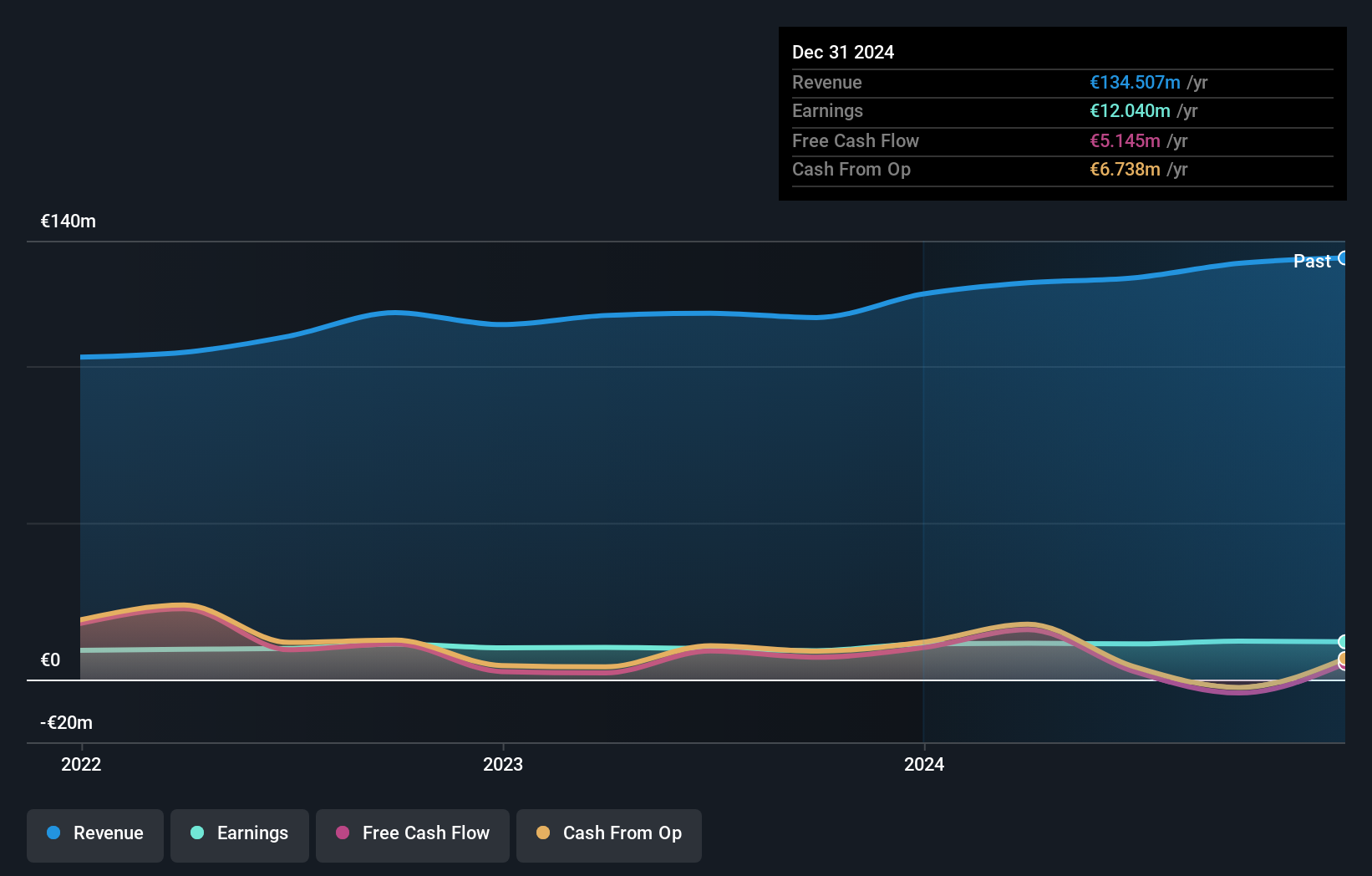

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €487.56 million. The company has a market capitalization of €445.92 million, indicating its financial standing in the industry.

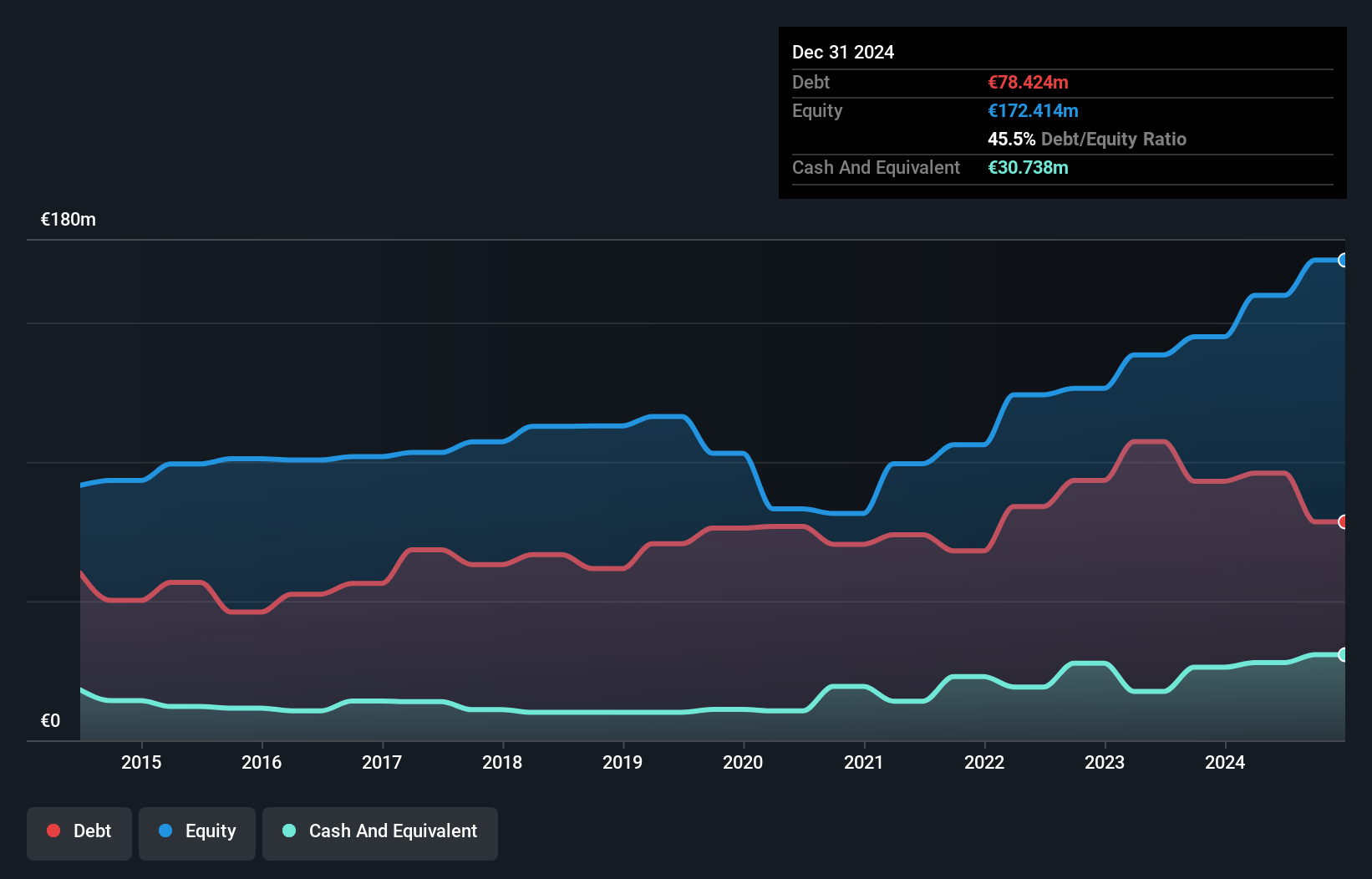

EPC Groupe, a nimble player in the chemicals industry, shows promise with its earnings growth of 17% last year, outpacing the sector's -4%. Trading at 34.1% below estimated fair value suggests potential upside for investors. However, its net debt to equity ratio stands at a high 42.6%, indicating leverage concerns despite reducing from 60.7% over five years. The company is free cash flow positive and profitable, which mitigates near-term liquidity worries but interest payments are only covered 2.9 times by EBIT, highlighting financial strain in covering debt obligations fully through operations alone.

- Delve into the full analysis health report here for a deeper understanding of EPC Groupe.

Understand EPC Groupe's track record by examining our Past report.

IVU Traffic Technologies (XTRA:IVU)

Simply Wall St Value Rating: ★★★★★★

Overview: IVU Traffic Technologies AG, along with its subsidiaries, specializes in the development, installation, maintenance, and operation of integrated IT solutions for buses and trains globally, with a market capitalization of €291.69 million.

Operations: IVU Traffic Technologies generates revenue primarily from its Public Transport segment, which includes logistics, amounting to €132.86 million.

IVU Traffic Technologies, a nimble player in the software sector, showcases impressive growth with earnings surging 32.7% last year, outpacing the industry’s 20.2% rise. The company stands out for its debt-free status over five years and high-quality non-cash earnings, though it isn’t free cash flow positive yet. Recent developments include securing a significant contract with BLS AG for their IVU.rail product and Mission Trail Capital Management acquiring an 8% stake from Daimler Buses GmbH. These moves suggest promising expansion opportunities as they continue to enhance their market position in providing innovative transport solutions across Europe and beyond.

- Get an in-depth perspective on IVU Traffic Technologies' performance by reading our health report here.

Learn about IVU Traffic Technologies' historical performance.

Seize The Opportunity

- Access the full spectrum of 368 European Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives