After Leaping 28% INTERSHOP Communications Aktiengesellschaft (ETR:ISHA) Shares Are Not Flying Under The Radar

INTERSHOP Communications Aktiengesellschaft (ETR:ISHA) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Unfortunately, despite the strong performance over the last month, the full year gain of 3.5% isn't as attractive.

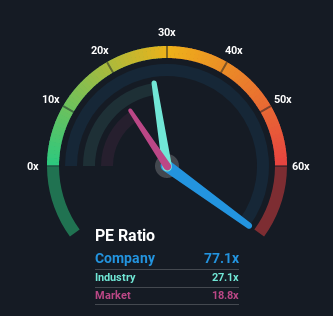

After such a large jump in price, INTERSHOP Communications' price-to-earnings (or "P/E") ratio of 77.1x might make it look like a strong sell right now compared to the market in Germany, where around half of the companies have P/E ratios below 18x and even P/E's below 10x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's inferior to most other companies of late, INTERSHOP Communications has been relatively sluggish. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for INTERSHOP Communications

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like INTERSHOP Communications' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Accordingly, shareholders probably wouldn't have been satisfied with the complete absence of medium-term growth.

Looking ahead now, EPS is anticipated to climb by 56% per annum during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 15% each year, which is noticeably less attractive.

In light of this, it's understandable that INTERSHOP Communications' P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From INTERSHOP Communications' P/E?

INTERSHOP Communications' P/E is flying high just like its stock has during the last month. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that INTERSHOP Communications maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for INTERSHOP Communications you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ISHA

INTERSHOP Communications

Offers ecommerce solutions in Germany and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives