cyan AG (ETR:CYR), might not be a large cap stock, but it led the XTRA gainers with a relatively large price hike in the past couple of weeks. Less-covered, small caps tend to present more of an opportunity for mispricing due to the lack of information available to the public, which can be a good thing. So, could the stock still be trading at a low price relative to its actual value? Let’s take a look at cyan’s outlook and value based on the most recent financial data to see if the opportunity still exists.

View our latest analysis for cyan

What's The Opportunity In cyan?

Great news for investors – cyan is still trading at a fairly cheap price. My valuation model shows that the intrinsic value for the stock is €2.40, but it is currently trading at €1.82 on the share market, meaning that there is still an opportunity to buy now. What’s more interesting is that, cyan’s share price is quite volatile, which gives us more chances to buy since the share price could sink lower (or rise higher) in the future. This is based on its high beta, which is a good indicator for how much the stock moves relative to the rest of the market.

What does the future of cyan look like?

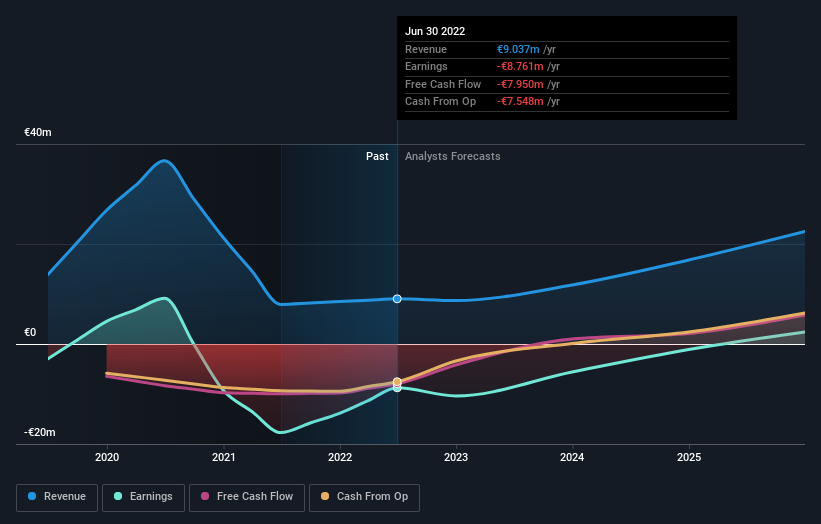

Future outlook is an important aspect when you’re looking at buying a stock, especially if you are an investor looking for growth in your portfolio. Although value investors would argue that it’s the intrinsic value relative to the price that matter the most, a more compelling investment thesis would be high growth potential at a cheap price. cyan's earnings over the next few years are expected to increase by 62%, indicating a highly optimistic future ahead. This should lead to more robust cash flows, feeding into a higher share value.

What This Means For You

Are you a shareholder? Since CYR is currently undervalued, it may be a great time to accumulate more of your holdings in the stock. With a positive outlook on the horizon, it seems like this growth has not yet been fully factored into the share price. However, there are also other factors such as financial health to consider, which could explain the current undervaluation.

Are you a potential investor? If you’ve been keeping an eye on CYR for a while, now might be the time to enter the stock. Its buoyant future outlook isn’t fully reflected in the current share price yet, which means it’s not too late to buy CYR. But before you make any investment decisions, consider other factors such as the track record of its management team, in order to make a well-informed investment decision.

Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. Case in point: We've spotted 4 warning signs for cyan you should be aware of.

If you are no longer interested in cyan, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if cyan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CYR

cyan

Through its subsidiaries, provides cybersecurity solutions and telecommunication services in Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion