Little Excitement Around Cliq Digital AG's (ETR:CLIQ) Revenues As Shares Take 30% Pounding

Cliq Digital AG (ETR:CLIQ) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 74% share price decline.

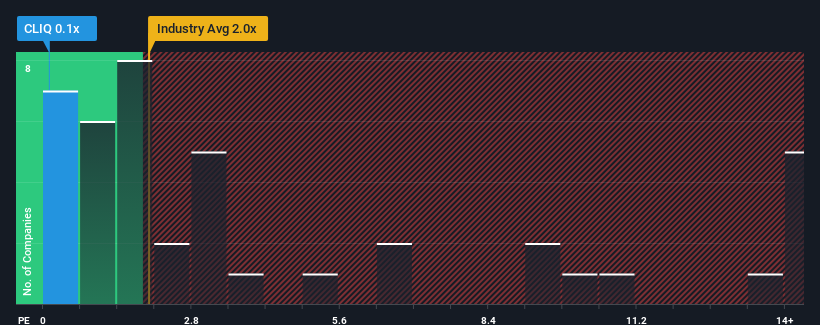

Since its price has dipped substantially, Cliq Digital's price-to-sales (or "P/S") ratio of 0.1x might make it look like a buy right now compared to the Software industry in Germany, where around half of the companies have P/S ratios above 2x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Cliq Digital

What Does Cliq Digital's P/S Mean For Shareholders?

Recent times haven't been great for Cliq Digital as its revenue has been rising slower than most other companies. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cliq Digital.How Is Cliq Digital's Revenue Growth Trending?

Cliq Digital's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 3.3% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 179% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 8.9% each year as estimated by the three analysts watching the company. That's shaping up to be materially lower than the 12% each year growth forecast for the broader industry.

With this information, we can see why Cliq Digital is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Cliq Digital's recently weak share price has pulled its P/S back below other Software companies. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Cliq Digital's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Cliq Digital is showing 2 warning signs in our investment analysis, and 1 of those makes us a bit uncomfortable.

If you're unsure about the strength of Cliq Digital's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CLIQ

Cliq Digital

An online performance marketing company, sells digital products and bundled-content subscriptions to consumers in North America, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives