Investors Give Cliq Digital AG (ETR:CLIQ) Shares A 42% Hiding

To the annoyance of some shareholders, Cliq Digital AG (ETR:CLIQ) shares are down a considerable 42% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 65% share price decline.

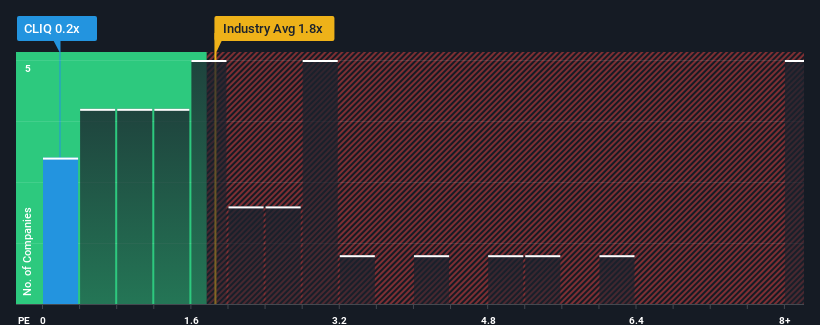

Following the heavy fall in price, Cliq Digital's price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Software industry in Germany, where around half of the companies have P/S ratios above 1.8x and even P/S above 5x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Cliq Digital

What Does Cliq Digital's P/S Mean For Shareholders?

Recent times have been advantageous for Cliq Digital as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Cliq Digital will help you uncover what's on the horizon.How Is Cliq Digital's Revenue Growth Trending?

In order to justify its P/S ratio, Cliq Digital would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 18% last year. Pleasingly, revenue has also lifted 205% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the four analysts watching the company. That's shaping up to be similar to the 11% each year growth forecast for the broader industry.

In light of this, it's peculiar that Cliq Digital's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Cliq Digital's P/S?

The southerly movements of Cliq Digital's shares means its P/S is now sitting at a pretty low level. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Cliq Digital currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Cliq Digital is showing 2 warning signs in our investment analysis, and 1 of those shouldn't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CLIQ

Cliq Digital

An online performance marketing company, sells digital products and bundled-content subscriptions to consumers in North America, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives