Cliq Digital AG's (ETR:CLIQ) Price Is Right But Growth Is Lacking After Shares Rocket 32%

Cliq Digital AG (ETR:CLIQ) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 68% share price drop in the last twelve months.

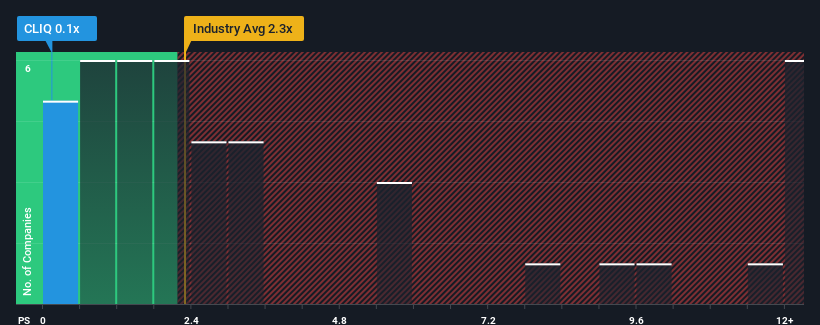

Although its price has surged higher, Cliq Digital may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.1x, considering almost half of all companies in the Software industry in Germany have P/S ratios greater than 2.3x and even P/S higher than 8x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Cliq Digital

What Does Cliq Digital's Recent Performance Look Like?

While the industry has experienced revenue growth lately, Cliq Digital's revenue has gone into reverse gear, which is not great. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Cliq Digital's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Cliq Digital?

Cliq Digital's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 26%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 62% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 3.0% per year as estimated by the three analysts watching the company. With the industry predicted to deliver 14% growth per annum, that's a disappointing outcome.

With this in consideration, we find it intriguing that Cliq Digital's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Even after such a strong price move, Cliq Digital's P/S still trails the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

It's clear to see that Cliq Digital maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

You should always think about risks. Case in point, we've spotted 2 warning signs for Cliq Digital you should be aware of, and 1 of them makes us a bit uncomfortable.

If these risks are making you reconsider your opinion on Cliq Digital, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:CLIQ

Cliq Digital

An online performance marketing company, sells digital products and bundled-content subscriptions to consumers in North America, Europe, Latin America, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives