As European markets react to the recent U.S. tariff announcements, with the STOXX Europe 600 Index experiencing its steepest decline in five years, investors are closely monitoring how these global trade tensions might impact high growth tech stocks in the region. In such volatile times, a good stock often demonstrates resilience through strong fundamentals and innovative capabilities that can navigate economic uncertainties while capitalizing on emerging technological trends.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Archos | 20.52% | 36.58% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| Yubico | 20.33% | 25.80% | ★★★★★★ |

| Elicera Therapeutics | 63.53% | 97.24% | ★★★★★★ |

| Devyser Diagnostics | 26.28% | 96.52% | ★★★★★★ |

| Skolon | 29.73% | 91.18% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| XTPL | 97.45% | 117.95% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Sword Group (ENXTPA:SWP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sword Group S.E. is a global provider of IT and software solutions, with a market capitalization of €281.19 million.

Operations: Sword Group S.E. operates in the IT and software solutions sector, focusing on delivering specialized services globally.

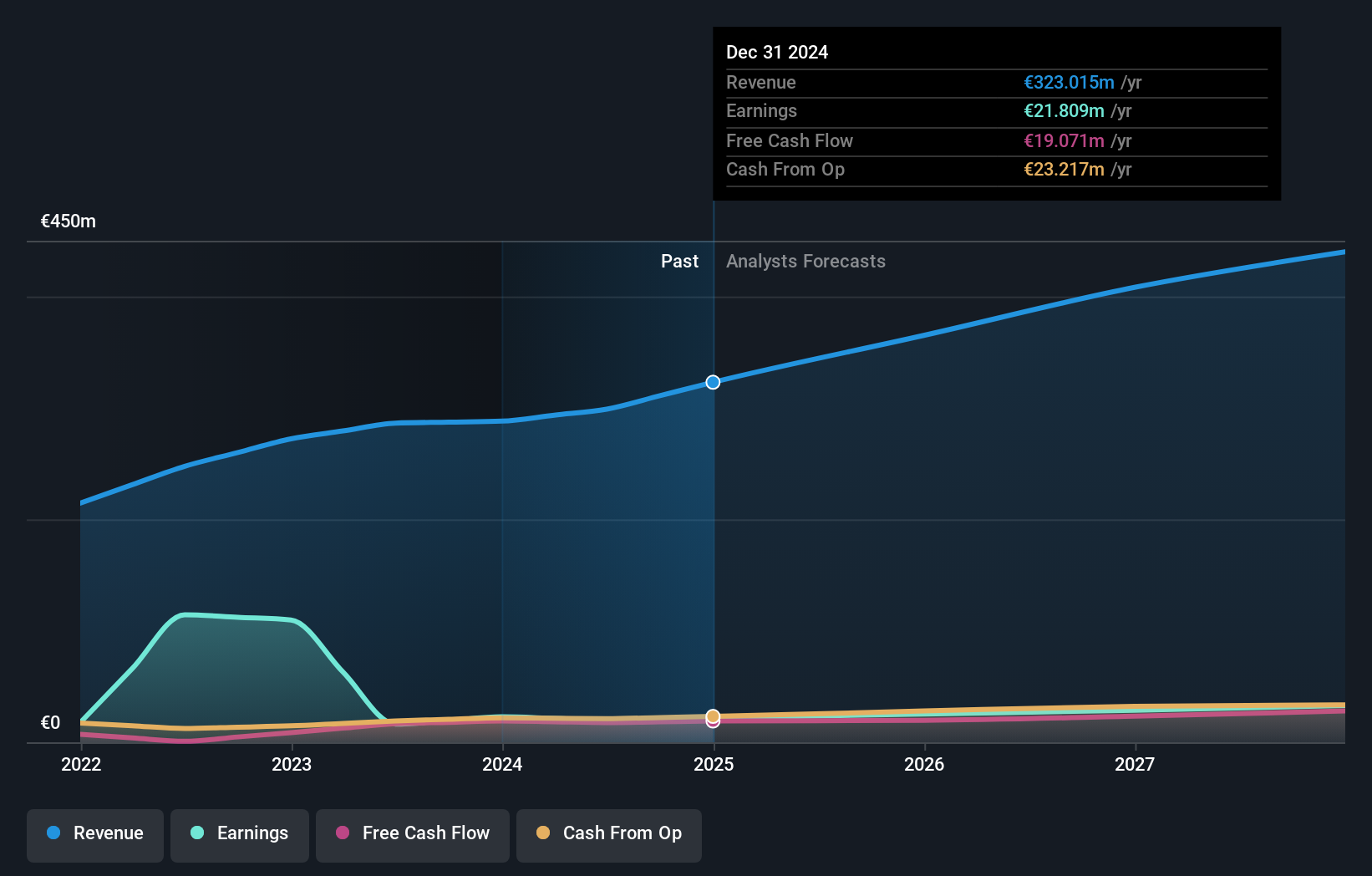

Sword Group S.E. recently reported a modest increase in annual sales to €323.02 million, up from €288.13 million, though net income slightly decreased to €21.81 million from €22.82 million previously. Despite this dip, the company is ramping up its dividend to €2 per share and expanding its strategic partnerships, notably securing a significant 5-year contract with the WHO, enhancing its presence in international markets. This move aligns with Sword's focus on specialized services for global organizations and underscores its commitment to leveraging innovative solutions for long-term growth in the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Sword Group.

Gain insights into Sword Group's historical performance by reviewing our past performance report.

adesso (XTRA:ADN1)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: adesso SE, along with its subsidiaries, offers IT services across Germany, Austria, Switzerland, and internationally with a market cap of €558.18 million.

Operations: The company generates revenue primarily from IT services (€1.48 billion) and IT solutions (€136.01 million). The business operates internationally, focusing on providing specialized technology solutions across various regions.

Adesso SE has demonstrated a robust growth trajectory, with its annual sales soaring to €1.3 billion, a significant leap from the previous year's €1.14 billion. This growth is complemented by an impressive increase in net income, which more than doubled to €8.12 million from €3.21 million, reflecting a potent combination of operational efficiency and market expansion strategies. The company's commitment to innovation and technology enhancement is evident in its strategic share repurchases amounting to €10 million, underscoring confidence in its future prospects and financial health. Moreover, Adesso’s forward-looking guidance anticipates sales reaching up to €1.45 billion in 2025, positioning it as a dynamic force within Europe's high-growth tech landscape.

- Click here to discover the nuances of adesso with our detailed analytical health report.

Understand adesso's track record by examining our Past report.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA operates in the advertising sector, offering out-of-home and digital out-of-home media services across Germany and internationally, with a market capitalization of approximately €2.68 billion.

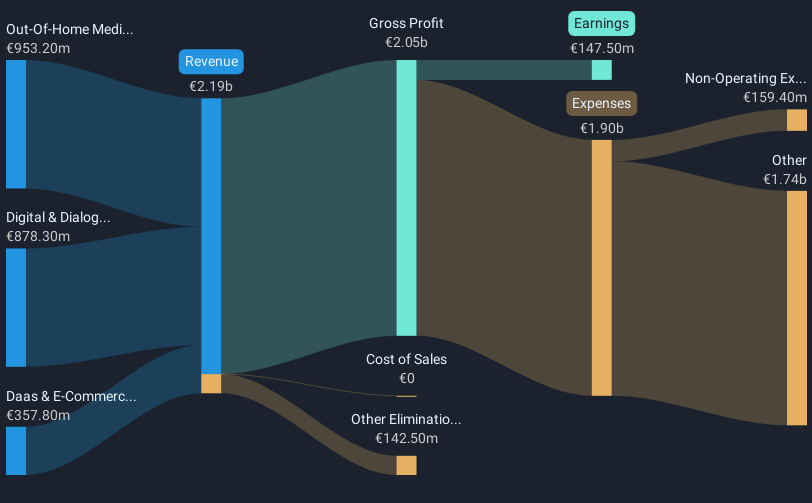

Operations: Ströer SE & Co. KGaA generates revenue primarily from its Out-Of-Home Media segment, which contributes €953.21 million, and Digital & Dialog Media segment, with €878.25 million. The Daas & E-Commerce segment adds €357.79 million to the revenue stream, reflecting a diversified business model within the advertising sector across Germany and internationally.

Ströer SE & Co. KGaA has demonstrated resilience and growth in the competitive European tech sector, with a notable 6.9% increase in annual sales to EUR 2.05 billion in 2024 from EUR 1.91 billion the previous year, underpinned by robust net income growth of 31.3% to EUR 147.5 million. This financial uptrend is mirrored by its strategic R&D investments, aligning with industry shifts towards digital and out-of-home advertising solutions that cater to dynamic market demands. Amidst exploring significant divestitures potentially exceeding its current market cap, Ströer remains agile, leveraging its operational strengths while eyeing expansive future prospects that could reshape its market standing and shareholder value.

- Get an in-depth perspective on Ströer SE KGaA's performance by reading our health report here.

Examine Ströer SE KGaA's past performance report to understand how it has performed in the past.

Where To Now?

- Click here to access our complete index of 236 European High Growth Tech and AI Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion