As of June 2025, the European market has seen a decline in key indices such as the STOXX Europe 600, driven by concerns over geopolitical tensions and economic uncertainty. Despite these challenges, opportunities remain for investors seeking potential growth in small-cap stocks that demonstrate resilience and adaptability. Identifying promising stocks often involves looking for companies with strong fundamentals and innovative strategies that can thrive amidst broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Linc | NA | 101.28% | 29.81% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| Castellana Properties Socimi | 53.49% | 7.49% | 44.78% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★☆

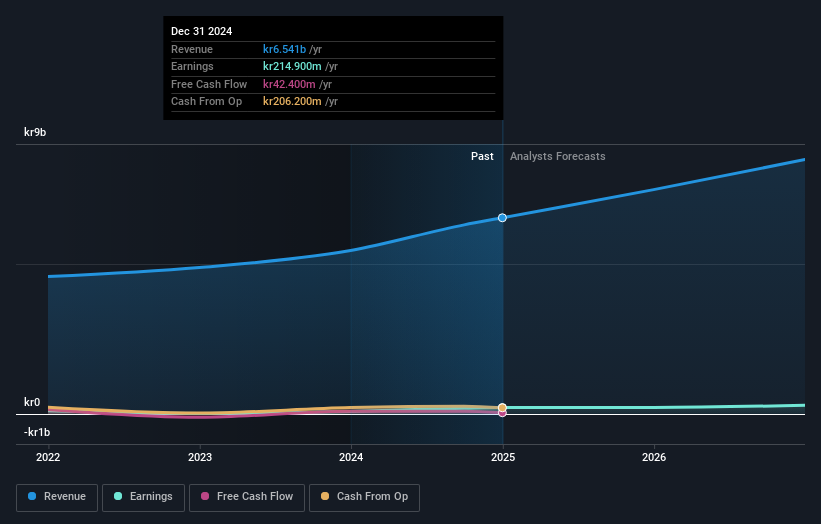

Overview: Apotea AB (publ) operates an online pharmacy in Sweden and has a market capitalization of approximately SEK9.11 billion.

Operations: The company's primary revenue stream is from online retailers, generating SEK6.78 billion.

Apotea, a nimble player in the consumer retailing sector, has shown impressive earnings growth of 94.9% over the past year, significantly outpacing the industry's 2.6%. Despite not being free cash flow positive recently, its net debt to equity ratio stands at a satisfactory 8.7%, indicating prudent financial management. The company's earnings quality is bolstered by high non-cash earnings and robust interest coverage at 146 times EBIT. Recent developments include Apotea's addition to the S&P Global BMI Index and notable executive board changes, suggesting potential shifts in strategic direction as it continues its upward trajectory in sales and revenue growth.

- Navigate through the intricacies of Apotea with our comprehensive health report here.

Explore historical data to track Apotea's performance over time in our Past section.

Kernel Holding (WSE:KER)

Simply Wall St Value Rating: ★★★★★★

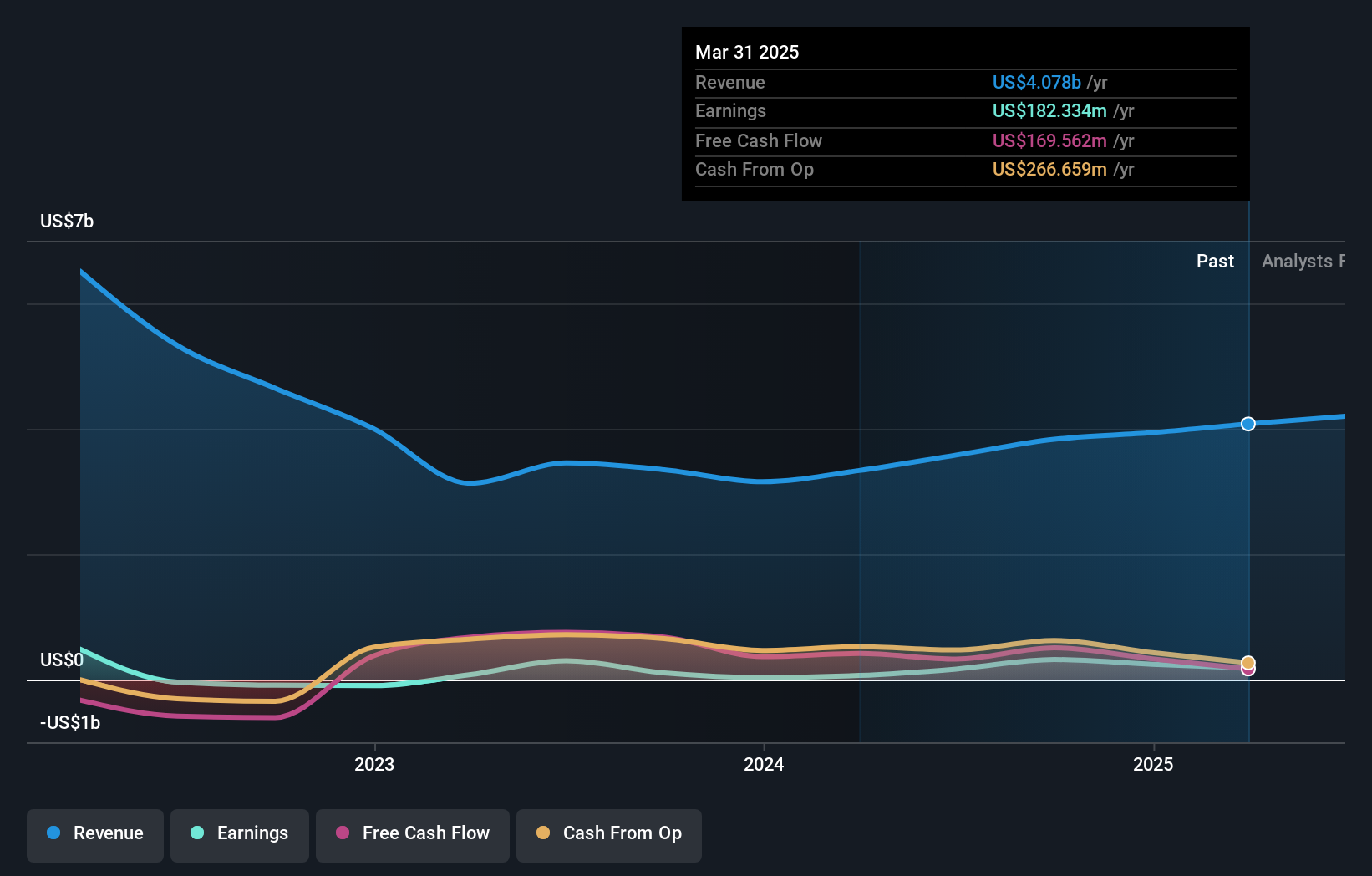

Overview: Kernel Holding S.A. operates a diversified agricultural business with activities in multiple countries including India, Hong Kong, China, and Ukraine, and has a market capitalization of PLN4.92 billion.

Operations: Kernel Holding S.A. generates revenue primarily from its Infrastructure and Trading segment ($2.24 billion) and Oilseed Processing ($2.01 billion), with Farming contributing $515.24 million, while adjustments account for a reduction of $774.83 million in the total revenue calculation.

Kernel Holding, a dynamic player in the European market, has seen its debt to equity ratio improve significantly from 85.8% to 26.7% over the past five years, indicating healthier financial leverage. Despite a volatile share price recently, the company posted an impressive earnings growth of 177.8% last year, outpacing the food industry's -9.2%. However, its recent financial results were marred by a $130 million one-off loss impacting earnings for March 2025. With interest payments well-covered at 10.4 times EBIT and a price-to-earnings ratio of 7.3x below Poland's market average of 13x, Kernel seems undervalued yet promising amidst ongoing legal challenges and strategic shifts like potential delisting from Warsaw Stock Exchange.

All for One Group (XTRA:A1OS)

Simply Wall St Value Rating: ★★★★★☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and other international markets with a market cap of €274.48 million.

Operations: The company generates revenue primarily from its CORE segment, contributing €455.37 million, and the LOB segment, which adds €75.12 million.

All for One Group, a small player in the IT sector, has been making waves with its strategic pivot towards cloud subscriptions and S/4HANA transformation. This move is expected to bolster recurring revenue streams and improve net margins from 3.1% to 5.5%. Despite challenges like economic uncertainties impacting digitalization investments, the company shows promise with earnings projected to grow by 22% annually. Recent earnings reports revealed sales of €123 million for Q2 2025, slightly up from last year, though net income dipped to €0.83 million from €3.14 million previously, indicating some transitional hurdles in their ambitious growth strategy.

Summing It All Up

- Delve into our full catalog of 337 European Undiscovered Gems With Strong Fundamentals here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:A1OS

All for One Group

Provides business software solutions for SAP, Microsoft, and IBM primarily in Germany, Switzerland, Austria, Poland, Luxembourg, and internationally.

Undervalued with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion