As the pan-European STOXX Europe 600 Index remains relatively stable amidst ongoing assessments of interest rate policies and trade tensions, major indices like Italy's FTSE MIB and Germany's DAX have shown modest gains, reflecting a cautiously optimistic market sentiment. In this environment, identifying potential growth opportunities requires a keen eye for stocks that not only demonstrate resilience but also possess the ability to capitalize on emerging economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Dekpol | 64.28% | 10.52% | 14.34% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Spadel (ENXTBR:SPA)

Simply Wall St Value Rating: ★★★★★★

Overview: Spadel SA is a Belgian company that specializes in producing and marketing natural mineral water, with a market capitalization of €946.28 million.

Operations: Spadel generates its revenue primarily from the non-alcoholic beverages segment, amounting to €399.96 million.

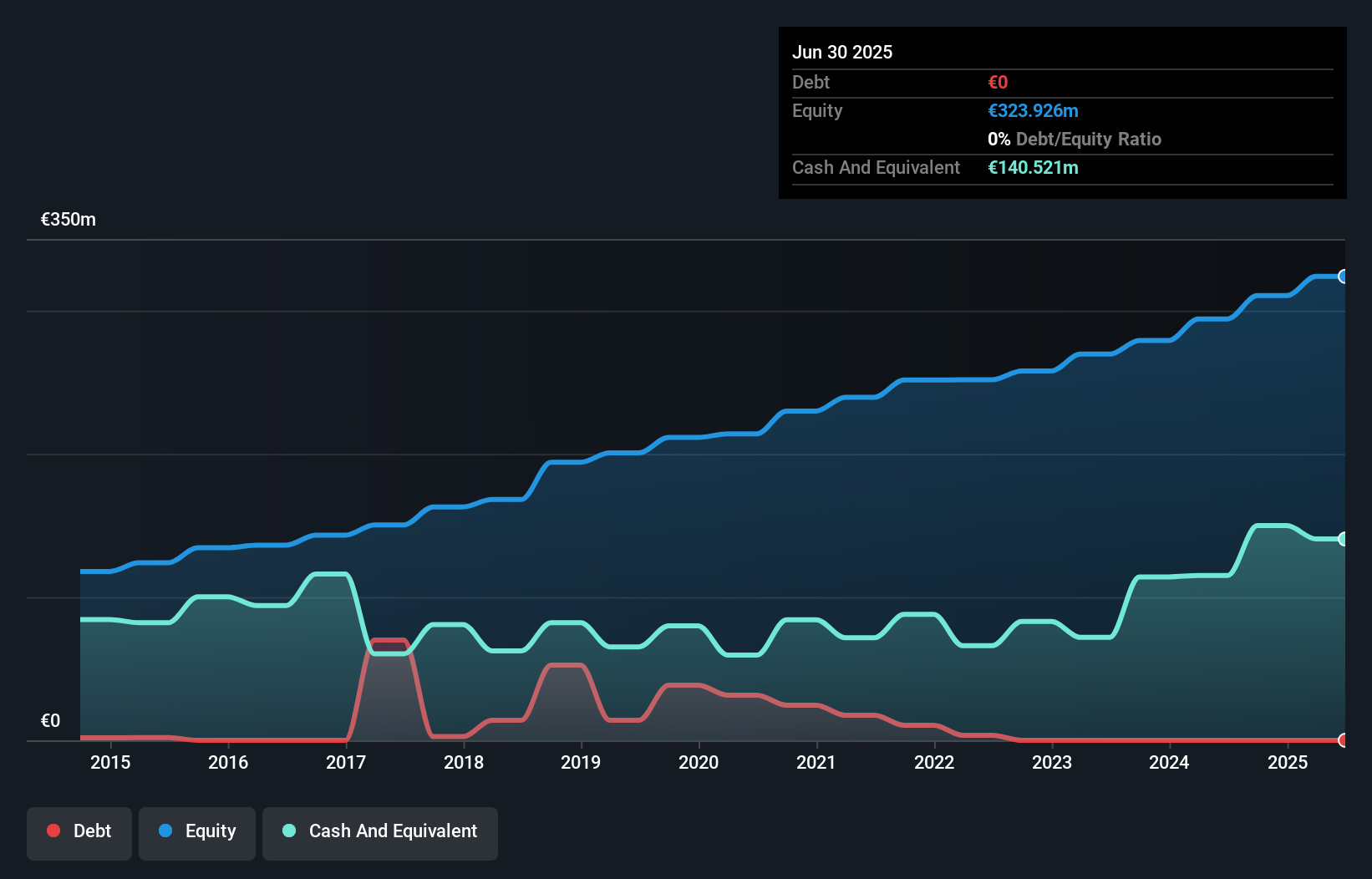

Spadel, a notable player in the European beverage sector, showcases impressive financial health with zero debt compared to a 14.7% debt-to-equity ratio five years ago. Its earnings surged by 26.6% over the past year, outpacing the industry average of -3.3%. The company reported half-year sales of €211.29 million and net income of €26.78 million, reflecting solid growth from last year's figures of €190.67 million and €24.19 million respectively. With basic earnings per share rising to €6.45 from €5.83, Spadel demonstrates robust performance and high-quality earnings potential in its market segment.

- Delve into the full analysis health report here for a deeper understanding of Spadel.

Understand Spadel's track record by examining our Past report.

Intellego Technologies (OM:INT)

Simply Wall St Value Rating: ★★★★★★

Overview: Intellego Technologies AB is a Swedish company specializing in the production and sale of colorimetric ultraviolet indicators, with a market capitalization of SEK 4.60 billion.

Operations: The company generates revenue primarily from its electronic components and parts segment, amounting to SEK 554.24 million.

Intellego Technologies has been making waves with its impressive financial performance, highlighted by a massive earnings growth of 172.6% over the past year, outpacing the Electronic industry’s -3.2%. The company recently reported second-quarter sales of SEK 217.15 million, a significant jump from SEK 54.69 million a year ago, and net income rose to SEK 111.96 million from SEK 13.22 million previously. With more cash than total debt and EBIT covering interest payments at an impressive 14.3 times, Intellego seems financially robust despite its volatile share price in recent months and is trading well below estimated fair value by about 91%.

All for One Group (XTRA:A1OS)

Simply Wall St Value Rating: ★★★★★☆

Overview: All for One Group SE, along with its subsidiaries, offers business software solutions for SAP, Microsoft, and IBM across Germany, Switzerland, Austria, Poland, Luxembourg, and internationally with a market cap of €218.69 million.

Operations: The company generates revenue primarily from its CORE segment, contributing €456.65 million, and its LOB segment, which adds €74.61 million.

All for One Group, a promising player in the IT sector, is undergoing a strategic shift toward cloud subscriptions and S/4HANA transformations to bolster revenue stability. Trading at €45.00, it offers potential upside with a price target of €78.85. The company reported Q3 sales of €122.79 million, slightly up from last year’s €122.28 million, while net income rose to €0.686 million from €0.525 million previously; however, nine-month earnings dipped to €8.01 million from last year's €10.29 million due to transition challenges and market uncertainties impacting short-term performance despite long-term growth prospects remaining intact.

Key Takeaways

- Click this link to deep-dive into the 328 companies within our European Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:SPA

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion