Innoscripta (XTRA:1INN) Margin Surges to 40.4%, Reinforcing Bullish Profitability Narrative

Reviewed by Simply Wall St

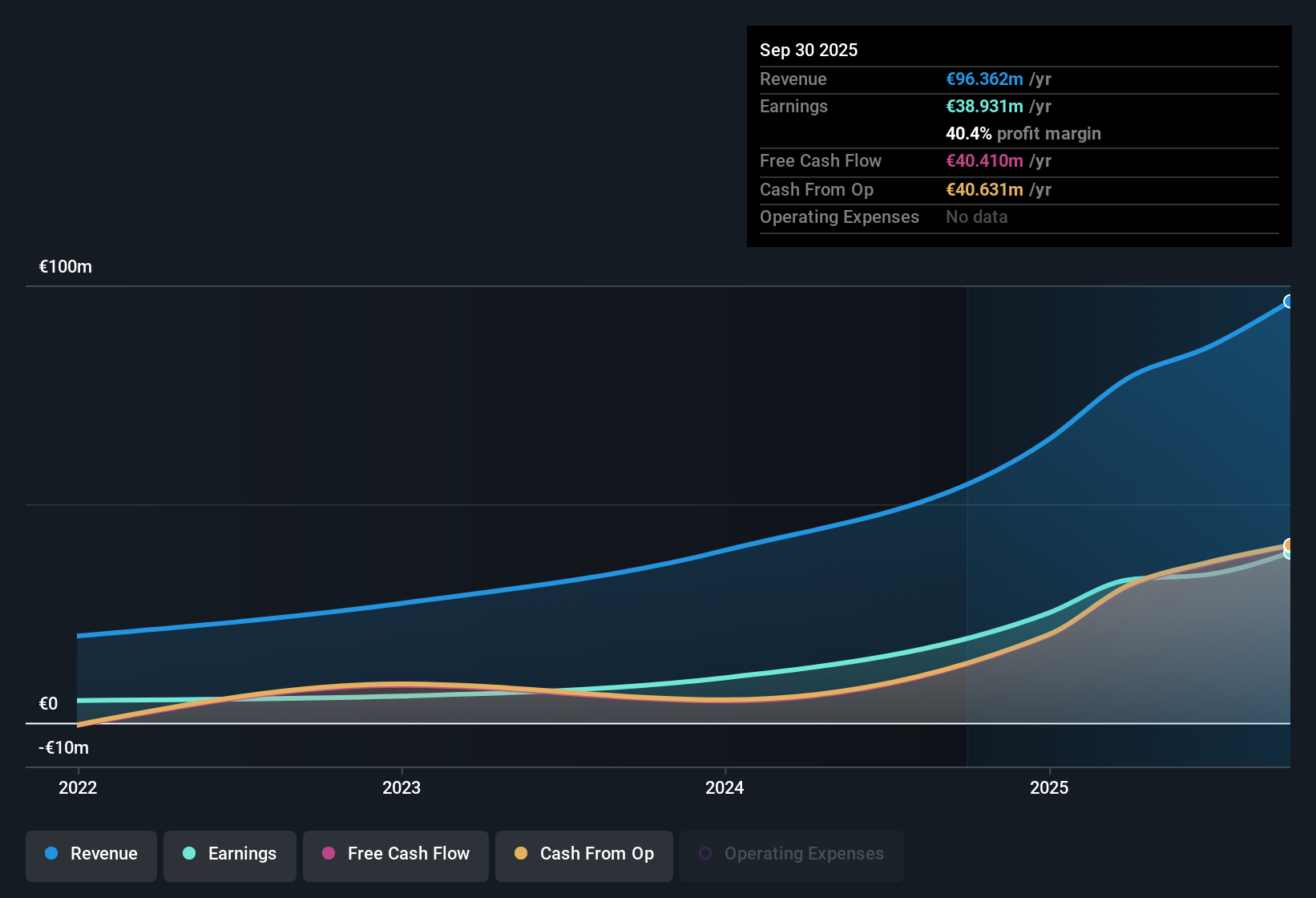

Innoscripta (XTRA:1INN) continues its strong run with net profit margins climbing to 40.4%, up from 36.6% last year, and a substantial 82.2% earnings growth over the past year. This performance is well ahead of its already impressive five-year average of 44% per year. Looking forward, analysts expect both revenue and earnings to rise at rapid clips of 24.7% and 27.2% per year, respectively, outpacing the broader German market. Investors will likely view this momentum, paired with a share price of €121 that hovers just below estimated fair value, as a positive signal for ongoing profitability and relative value.

See our full analysis for innoscripta.The next section puts these headline results side by side with the most widely discussed market narratives, revealing where the stories line up and where the numbers start to challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Push Higher, Now Above 40%

- Innoscripta posted net profit margins of 40.4%, noticeably above last year's 36.6% level. This indicates that recent revenue growth has translated efficiently into bottom-line profits.

- The prevailing narrative centers on how margin strength, combined with outperformance versus the German market, supports the case that Innoscripta's sector dynamics and execution create real pricing power.

- Bulls point to Innoscripta’s margin exceeding broader industry averages. Sustained earnings growth over five years at 44% per year further underscores operational leverage.

- What is surprising is that these gains are not being undercut by rising costs, a common concern in high-growth software businesses.

Growth Projections Outrun the Market

- Forward-looking expectations call for annual revenue growth of 24.7% and annual earnings growth of 27.2%, both comfortably ahead of the typical forecasts for the German market.

- The prevailing market view highlights that these forecasts justify current optimism. Investors should keep a close eye on execution risks if sector sentiment cools.

- Unlike more speculative growth stories, Innoscripta posts earnings growth of 82.2% over the last twelve months, far exceeding its already strong five-year track record.

- Although guidance impresses, the premium versus software peers could invite scrutiny if growth even slightly misses.

Valuation Sits Just Below Fair Value

- At a share price of €121, Innoscripta trades below its DCF fair value of €125.67 and below the sector peer price-to-earnings average (31.1x vs peers’ 59.4x), though at a premium to the broader European software industry (27x).

- The prevailing market view suggests that while pricing near fair value helps limit risk, peer-relative metrics and valuation multiples are likely to keep investors engaged as sector volatility and growth outlooks shift.

- Bulls might argue valuation is supported by compelling profit growth and margin resilience, but skepticism could rise if competitive intensity or broader market multiples contract.

- A share price just beneath modeled fair value may create a narrow margin of safety. This means upward momentum is tied more tightly than usual to the company’s next growth milestones.

See our latest analysis for innoscripta.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on innoscripta's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite exceptional growth, Innoscripta’s narrow margin of safety and looming valuation risks leave investors vulnerable if expectations slip or if sector sentiment cools.

If you’re concerned about holding stocks where valuation feels stretched, shift your focus to these 840 undervalued stocks based on cash flows, where you can spot companies priced more attractively and minimize downside risk in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if innoscripta might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1INN

innoscripta

Provides software-as-a-service for managing research and development (R&D) tax incentives and project management consulting in Germany.

Exceptional growth potential with outstanding track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion