European Stocks That May Be Trading Below Estimated Value In July 2025

Reviewed by Simply Wall St

As the European markets experience mixed returns, with the STOXX Europe 600 Index remaining roughly flat and major indices showing varied performance, investors are keeping a close eye on economic indicators such as inflation and labor market stability. In this context, identifying stocks that may be trading below their estimated value becomes crucial for those looking to capitalize on potential opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trøndelag Sparebank (OB:TRSB) | NOK113.70 | NOK222.46 | 48.9% |

| Sulzer (SWX:SUN) | CHF142.80 | CHF278.49 | 48.7% |

| Sonova Holding (SWX:SOON) | CHF231.20 | CHF451.88 | 48.8% |

| Lectra (ENXTPA:LSS) | €25.25 | €49.34 | 48.8% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €55.30 | €110.26 | 49.8% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.84 | €23.17 | 48.9% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.50 | €6.94 | 49.6% |

| Ependion (OM:EPEN) | SEK115.40 | SEK225.30 | 48.8% |

| Camurus (OM:CAMX) | SEK669.00 | SEK1317.33 | 49.2% |

| ATEME (ENXTPA:ATEME) | €5.20 | €10.34 | 49.7% |

Let's uncover some gems from our specialized screener.

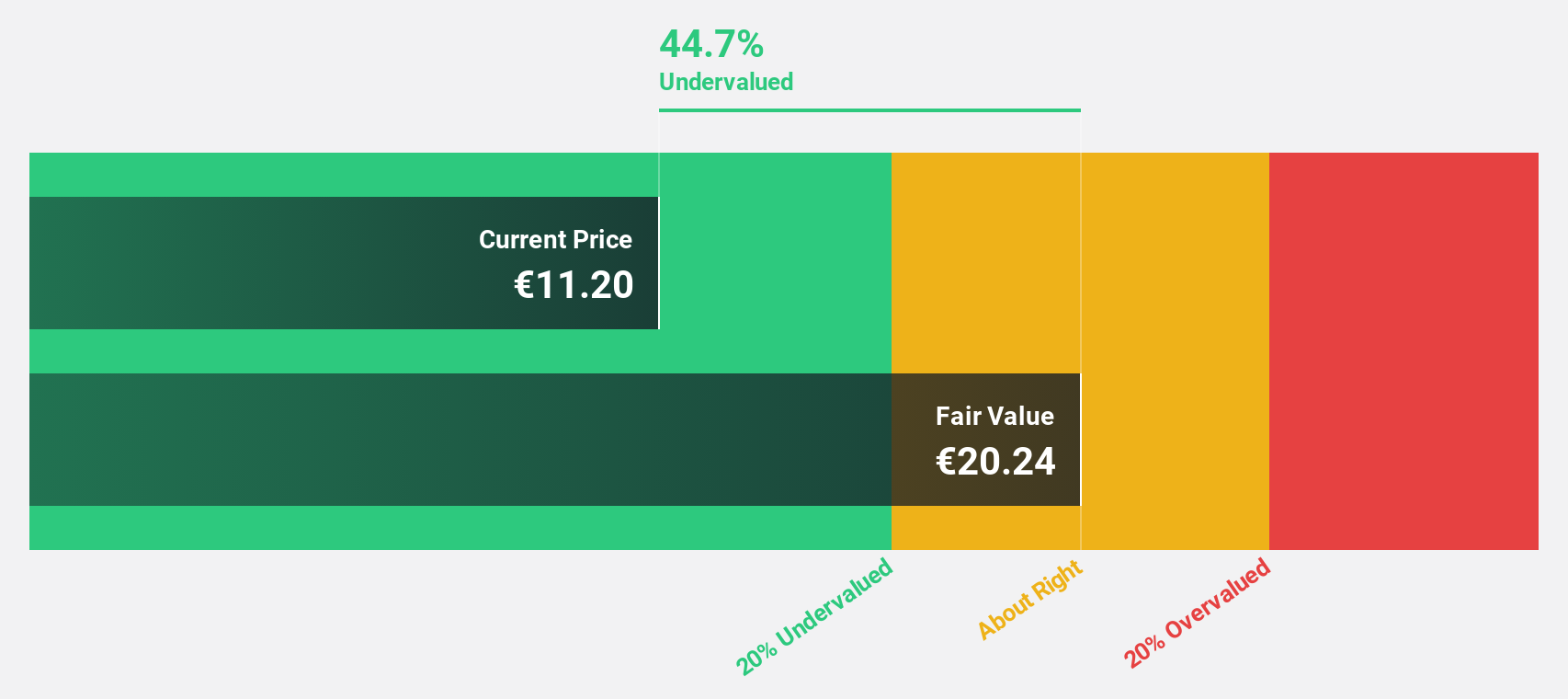

Almirall (BME:ALM)

Overview: Almirall, S.A. is a biopharmaceutical company specializing in skin health, operating across multiple regions including Spain, Europe, the Middle East, the United States, Asia, and Africa with a market cap of €2.34 billion.

Operations: Almirall generates its revenue through its focus on skin health across various regions, including Spain, Europe, the Middle East, the United States, Asia, and Africa.

Estimated Discount To Fair Value: 48.7%

Almirall is trading at €10.88, significantly below its estimated fair value of €21.21, suggesting it may be undervalued based on cash flows. The company's earnings and revenue are expected to grow substantially faster than the Spanish market, with earnings forecasted to increase by 33.3% annually. Recent results show a strong performance with Q1 2025 net income rising to €21.6 million from €7.4 million year-on-year, alongside confirmed double-digit sales growth guidance for 2025.

- The growth report we've compiled suggests that Almirall's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Almirall stock in this financial health report.

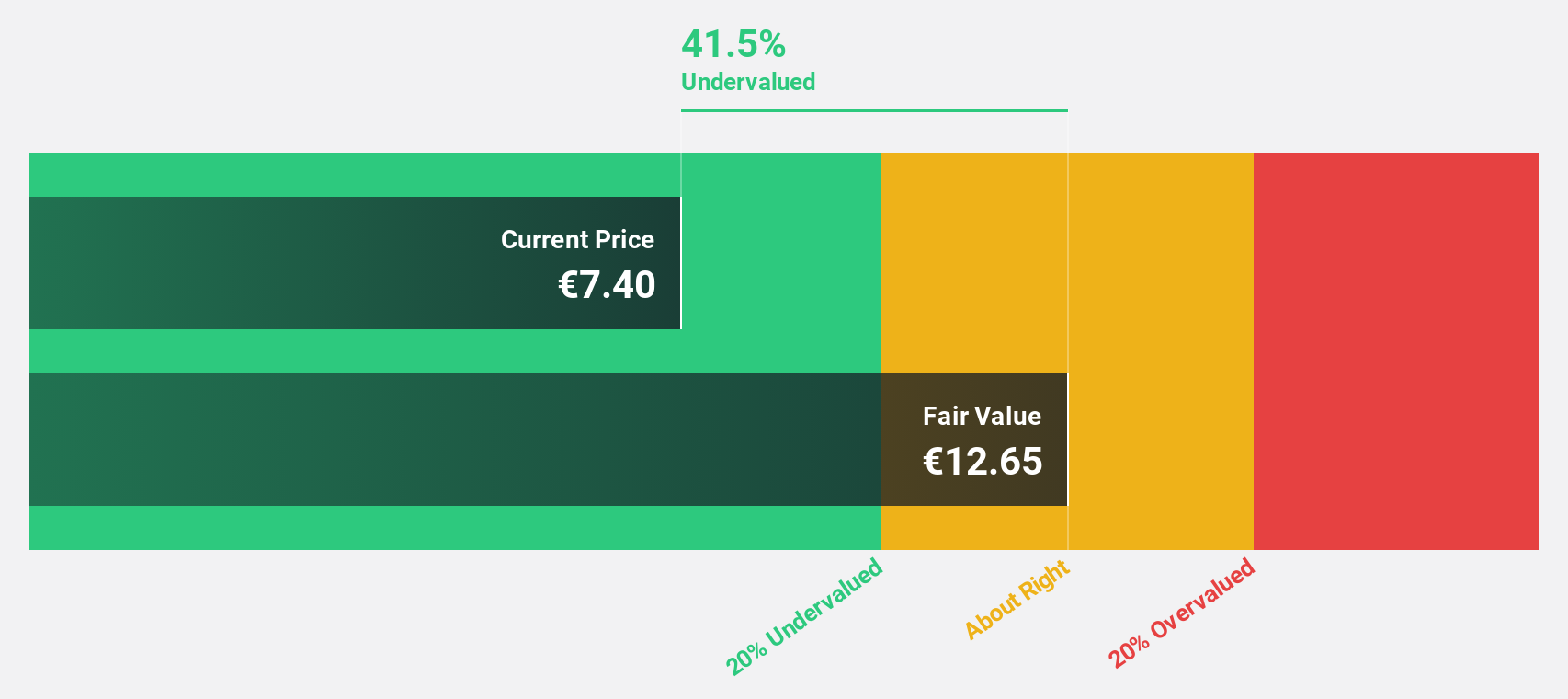

CTT - Correios De Portugal (ENXTLS:CTT)

Overview: CTT - Correios De Portugal, S.A., along with its subsidiaries, offers postal and financial services globally and has a market capitalization of approximately €1.04 billion.

Operations: The company generates revenue through various segments, including €463.10 million from Logistics - Mail Service, €502.29 million from Logistics - Express Mail and Orders, €132.33 million from Banking and Financial Services - Bank, and €34.64 million from Banking and Financial Services - Financial Service & Retail.

Estimated Discount To Fair Value: 42.8%

CTT - Correios De Portugal is trading at €8.11, well below its estimated fair value of €14.17, highlighting potential undervaluation based on cash flows. Revenue and earnings are projected to grow faster than the Portuguese market at 7.5% and 17.3% annually, respectively. Despite a drop in Q1 net income to €5.51 million from €7.43 million year-on-year, CTT completed a share buyback program worth €24.95 million, repurchasing 3.4% of its shares by April 2025.

- Insights from our recent growth report point to a promising forecast for CTT - Correios De Portugal's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of CTT - Correios De Portugal.

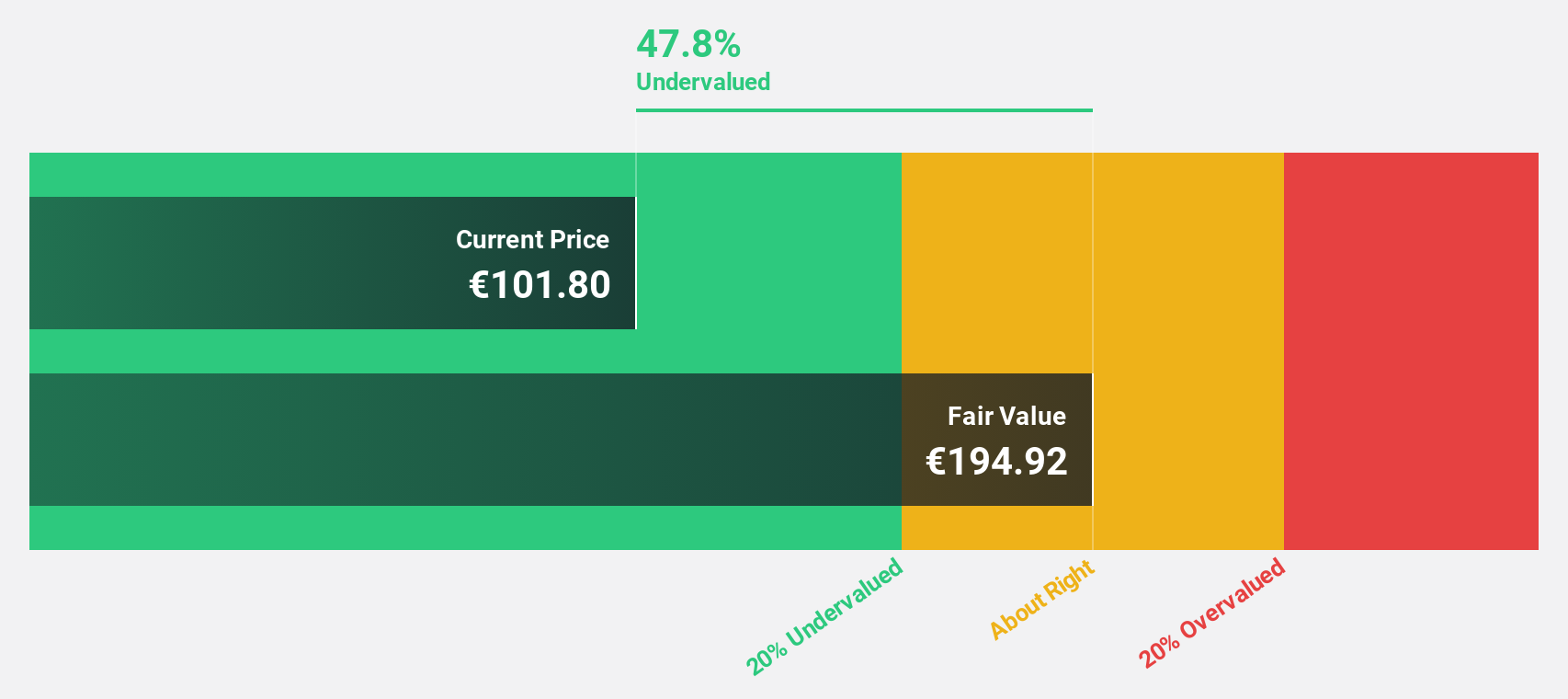

innoscripta (XTRA:1INN)

Overview: Innoscripta SE offers software-as-a-service solutions for managing R&D tax incentives and project management consulting in Germany, with a market cap of €1.06 billion.

Operations: The company's revenue primarily comes from its Internet Software & Services segment, totaling €78.81 million.

Estimated Discount To Fair Value: 45.6%

innoscripta SE, following its recent €223.60 million IPO, is trading at €106.4, significantly below its estimated fair value of €195.53, indicating a substantial undervaluation based on cash flows. With projected annual revenue growth of 24.8% and earnings growth of 26.3%, both surpassing the German market averages, innoscripta presents strong future potential despite recent share price volatility. Its return on equity is forecasted to be exceptionally high at 68.3% in three years' time.

- Our comprehensive growth report raises the possibility that innoscripta is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of innoscripta.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 176 Undervalued European Stocks Based On Cash Flows now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ALM

Almirall

Operates as a skin health-focused biopharmaceutical company in Spain, Europe, the Middle East, the United States, Asia, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives