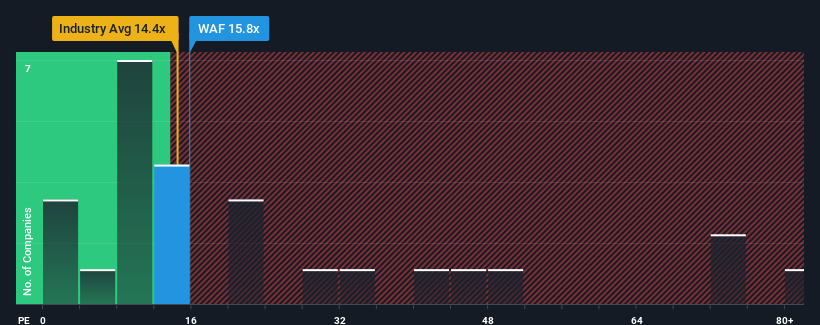

It's not a stretch to say that Siltronic AG's (ETR:WAF) price-to-earnings (or "P/E") ratio of 15.8x right now seems quite "middle-of-the-road" compared to the market in Germany, where the median P/E ratio is around 16x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

While the market has experienced earnings growth lately, Siltronic's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Siltronic

Is There Some Growth For Siltronic?

In order to justify its P/E ratio, Siltronic would need to produce growth that's similar to the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 63%. The last three years don't look nice either as the company has shrunk EPS by 53% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 8.7% per year as estimated by the eleven analysts watching the company. Meanwhile, the broader market is forecast to expand by 15% each year, which paints a poor picture.

With this information, we find it concerning that Siltronic is trading at a fairly similar P/E to the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Siltronic's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Siltronic's analyst forecasts revealed that its outlook for shrinking earnings isn't impacting its P/E as much as we would have predicted. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware Siltronic is showing 4 warning signs in our investment analysis, and 2 of those shouldn't be ignored.

If you're unsure about the strength of Siltronic's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:WAF

Siltronic

Develops, produces, markets, and sells hyperpure silicon wafers for the semiconductor industry in Germany, rest of Europe, the United States, Taiwan, Mainland China, South Korea, rest of Asia, and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives