- Germany

- /

- Specialty Stores

- /

- HMSE:HBM

Does Expanding into Serbia Redefine HORNBACH Baumarkt’s Geographic Strategy (HMSE:HBM)?

Reviewed by Sasha Jovanovic

- HORNBACH Baumarkt AG recently announced plans to enter the Serbian market with new DIY stores and garden centres, establishing subsidiaries and initiating site selection and supplier agreements as part of its overall expansion strategy.

- This move highlights the company’s intent to broaden its geographic footprint in Europe and focus on local supplier integration from the project’s outset.

- We’ll explore how HORNBACH Baumarkt’s focus on site quality and supplier networks in Serbia shapes its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is HORNBACH Baumarkt's Investment Narrative?

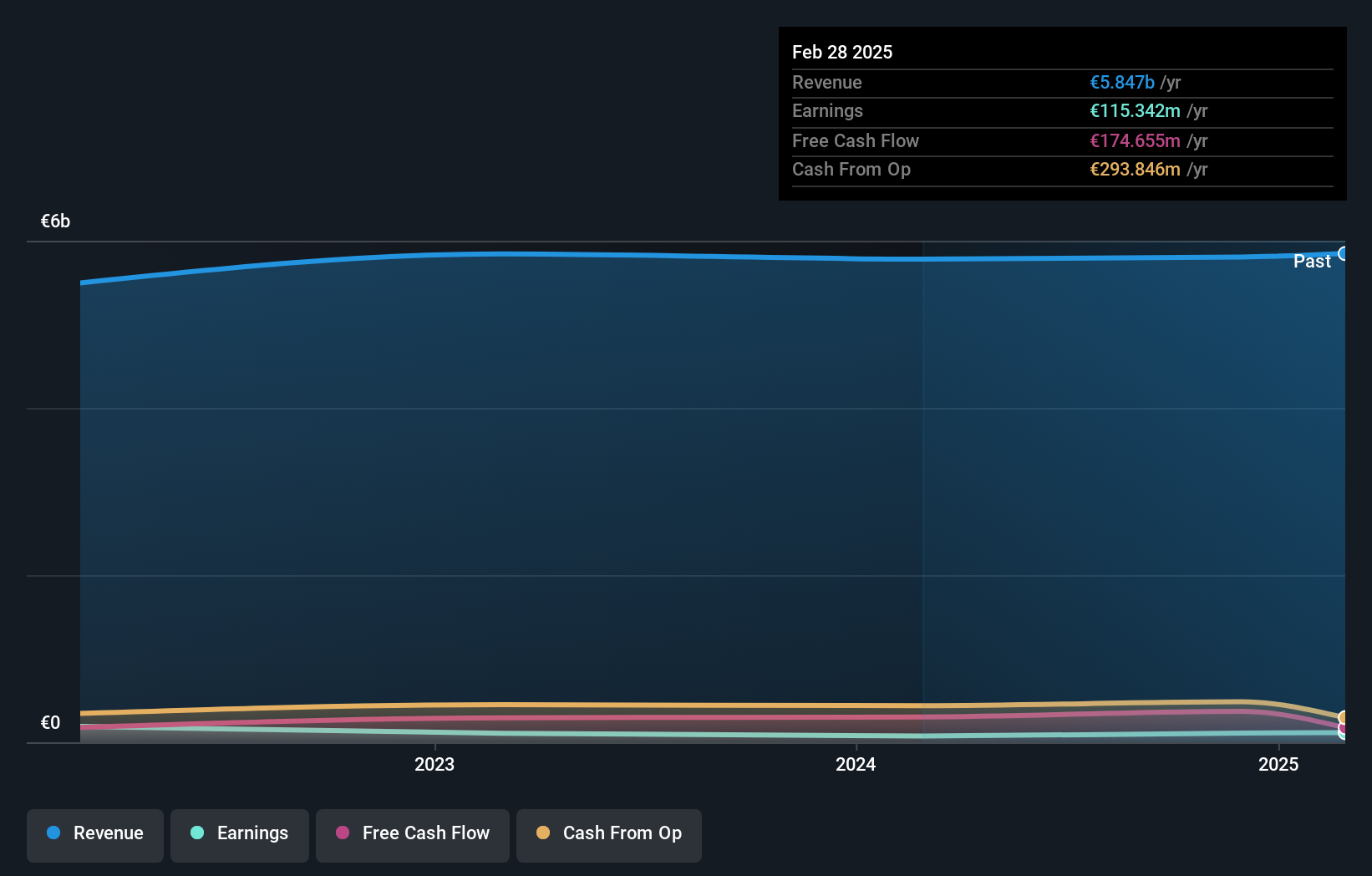

To invest in HORNBACH Baumarkt, you’d need to believe in its ability to maintain operational strength while adapting to evolving European retail trends. This latest announcement to enter Serbia adds a fresh layer to the company’s story, potentially adjusting near-term catalysts and risks. Previously, attention was centered on steady earnings growth, modest returns, and competitive valuation, with catalysts like expansion in electric vehicle charging and new leadership at the CFO level. Now, the Serbia project introduces some new uncertainties: timing and execution risks around site openings, the unknown cost of establishing regional supplier ties, and foreseeable delays or integration challenges. While the impact isn’t immediately material given the project is in its infancy, such cross-border ventures inevitably influence both short-term focus and long-term growth appetite, two factors that could alter risk profiles for existing shareholders.

But supply chain disruptions in a new market could create headwinds investors should not ignore. HORNBACH Baumarkt's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on HORNBACH Baumarkt - why the stock might be worth 40% less than the current price!

Build Your Own HORNBACH Baumarkt Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HORNBACH Baumarkt research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free HORNBACH Baumarkt research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HORNBACH Baumarkt's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HORNBACH Baumarkt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HMSE:HBM

HORNBACH Baumarkt

Operates as a do-it-yourself (DIY) retail company in Germany, Austria, the Czech Republic, Luxembourg, the Netherlands, Romania, Slovakia, Sweden, Switzerland, and Serbia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives