- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

AUTO1 Group SE (ETR:AG1) Stock Rockets 26% But Many Are Still Ignoring The Company

The AUTO1 Group SE (ETR:AG1) share price has done very well over the last month, posting an excellent gain of 26%. The annual gain comes to 109% following the latest surge, making investors sit up and take notice.

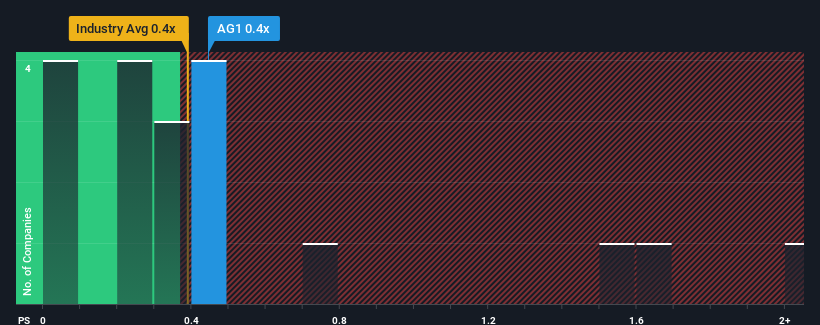

Even after such a large jump in price, there still wouldn't be many who think AUTO1 Group's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Germany's Specialty Retail industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for AUTO1 Group

How Has AUTO1 Group Performed Recently?

Recent revenue growth for AUTO1 Group has been in line with the industry. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. Those who are bullish on AUTO1 Group will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on AUTO1 Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For AUTO1 Group?

AUTO1 Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 5.5% last year. This was backed up an excellent period prior to see revenue up by 47% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 8.6% per annum as estimated by the eleven analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.3% each year, which is noticeably less attractive.

With this in consideration, we find it intriguing that AUTO1 Group's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does AUTO1 Group's P/S Mean For Investors?

Its shares have lifted substantially and now AUTO1 Group's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that AUTO1 Group currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you take the next step, you should know about the 1 warning sign for AUTO1 Group that we have uncovered.

If these risks are making you reconsider your opinion on AUTO1 Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:AG1

AUTO1 Group

A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success