- Germany

- /

- Real Estate

- /

- DB:TR61

Introducing TMM Real Estate Development (FRA:TR61), The Stock That Zoomed 167% In The Last Year

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Unfortunately, investing is risky - companies can and do go bankrupt. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the TMM Real Estate Development Plc (FRA:TR61) share price has soared 167% in the last year. Most would be very happy with that, especially in just one year! It's also good to see the share price up 45% over the last quarter. Looking back further, the stock price is 129% higher than it was three years ago.

Check out our latest analysis for TMM Real Estate Development

TMM Real Estate Development isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

TMM Real Estate Development actually shrunk its revenue over the last year, with a reduction of 42%. We're a little surprised to see the share price pop 167% in the last year. It just goes to show the market doesn't always pay attention to the reported numbers. It's quite likely the revenue fall was already priced in, anyway.

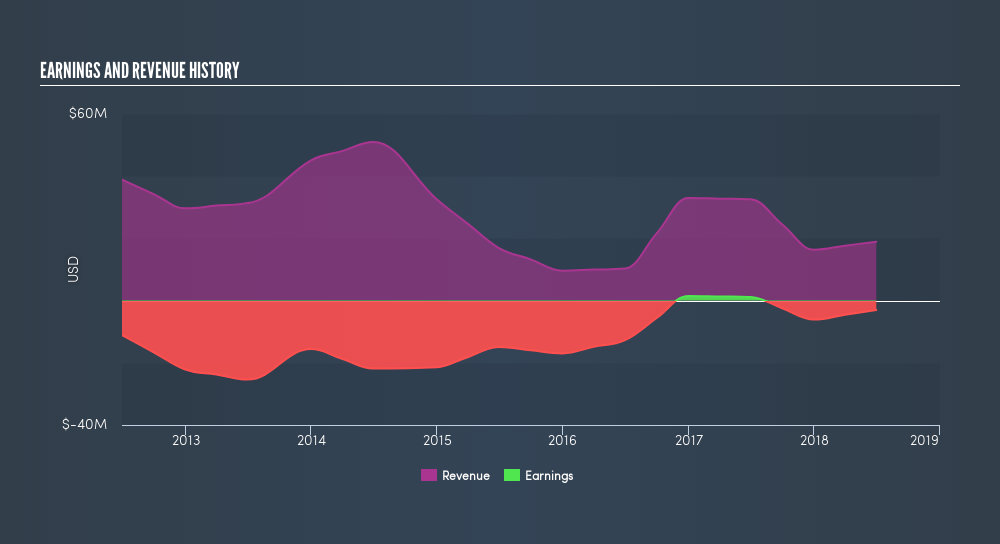

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that TMM Real Estate Development has rewarded shareholders with a total shareholder return of 167% in the last twelve months. That certainly beats the loss of about 28% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. You could get a better understanding of TMM Real Estate Development's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: TMM Real Estate Development may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:TR61

TMM Real Estate Development

Engages in the construction and development of residential and business properties primarily in Kyiv and Kharkiv regions in Ukraine.

Low with weak fundamentals.

Market Insights

Community Narratives