Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that TAG Immobilien AG (ETR:TEG) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for TAG Immobilien

What Is TAG Immobilien's Net Debt?

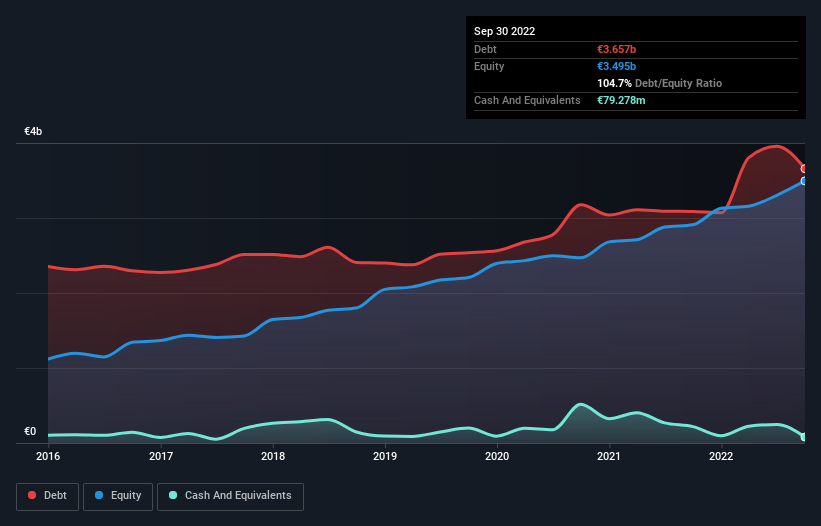

You can click the graphic below for the historical numbers, but it shows that as of September 2022 TAG Immobilien had €3.66b of debt, an increase on €3.09b, over one year. However, it also had €79.3m in cash, and so its net debt is €3.58b.

How Healthy Is TAG Immobilien's Balance Sheet?

According to the last reported balance sheet, TAG Immobilien had liabilities of €1.31b due within 12 months, and liabilities of €3.66b due beyond 12 months. Offsetting this, it had €79.3m in cash and €29.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by €4.86b.

The deficiency here weighs heavily on the €1.10b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, TAG Immobilien would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

TAG Immobilien's net debt to EBITDA ratio is 16.2 which suggests rather high debt levels, but its interest cover of 8.0 times suggests the debt is easily serviced. Our best guess is that the company does indeed have significant debt obligations. Importantly, TAG Immobilien's EBIT fell a jaw-dropping 21% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if TAG Immobilien can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the most recent three years, TAG Immobilien recorded free cash flow worth 75% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This cold hard cash means it can reduce its debt when it wants to.

Our View

On the face of it, TAG Immobilien's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. We're quite clear that we consider TAG Immobilien to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 6 warning signs with TAG Immobilien (at least 2 which are concerning) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if TAG Immobilien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:TEG

TAG Immobilien

A real estate company, engages in the acquisition, development, and management of residential real estate properties in Germany.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success