- Germany

- /

- Real Estate

- /

- XTRA:ADJ

Bullish: Analysts Just Made A Decent Upgrade To Their ADLER Group S.A. (ETR:ADJ) Forecasts

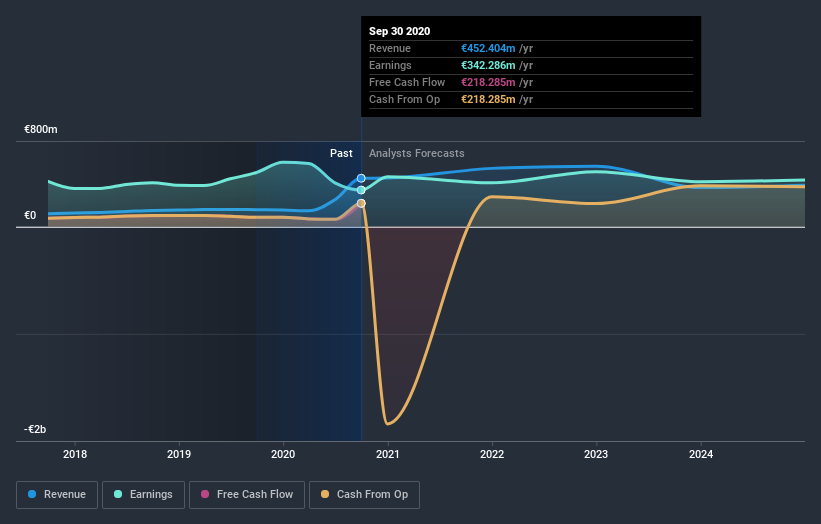

Shareholders in ADLER Group S.A. (ETR:ADJ) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. The consensus statutory numbers for both revenue and earnings per share (EPS) increased, with their view clearly much more bullish on the company's business prospects. Investors have been pretty optimistic on ADLER Group too, with the stock up 11% to €26.86 over the past week. It will be interesting to see if today's upgrade is enough to propel the stock even higher.

After this upgrade, ADLER Group's three analysts are now forecasting revenues of €544m in 2021. This would be a sizeable 20% improvement in sales compared to the last 12 months. Statutory earnings per share are anticipated to tumble 42% to €3.13 in the same period. Previously, the analysts had been modelling revenues of €403m and earnings per share (EPS) of €2.84 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

Check out our latest analysis for ADLER Group

Despite these upgrades, the analysts have not made any major changes to their price target of €29.00, suggesting that the higher estimates are not likely to have a long term impact on what the stock is worth. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic ADLER Group analyst has a price target of €35.00 per share, while the most pessimistic values it at €20.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the ADLER Group's past performance and to peers in the same industry. We would highlight that ADLER Group's revenue growth is expected to slow, with forecast 20% increase next year well below the historical 26% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 0.1% next year. So it's pretty clear that, while ADLER Group's revenue growth is expected to slow, it's still expected to grow faster than the industry itself.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for next year, expecting improving business conditions. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So ADLER Group could be a good candidate for more research.

Analysts are clearly in love with ADLER Group at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as its declining profit margins. You can learn more, and discover the 3 other concerns we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading ADLER Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:ADJ

Adler Group

Engages in the purchase, development, and management of multi-family residential real estate properties in Germany.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.