- Germany

- /

- Real Estate

- /

- XTRA:VNA

Vonovia (XTRA:VNA) Valuation Check as New Development and HR Leaders Are Lined Up

Reviewed by Simply Wall St

Vonovia (XTRA:VNA) is back in focus after the company reshaped its top leadership, bringing in renewables veteran Katja Wünschel as future Chief Development Officer while extending CHRO Ruth Werhahn’s mandate.

See our latest analysis for Vonovia.

The leadership reshuffle comes as Vonovia’s share price has drifted lower, with a year to date share price return of minus 18.48 percent but a more resilient three year total shareholder return of 25.95 percent. This suggests sentiment is cautious rather than broken.

If this kind of leadership reset has you rethinking your watchlist, it could be a good moment to scan for opportunities among fast growing stocks with high insider ownership.

With profits holding up despite falling revenues and the stock still trading at a steep discount to analyst targets, is Vonovia quietly undervalued, or are investors already factoring in its next leg of growth?

Price-to-Earnings of 7.7x: Is it justified?

Vonovia trades on a price to earnings ratio of 7.7 times, which leaves the stock looking inexpensive versus both the wider German market and its own fair ratio.

The price to earnings multiple compares what investors pay today for each unit of current earnings, a key lens for established, income generating real estate businesses like Vonovia.

On one hand, the shares screen cheap against the German market average multiple of 18.2 times and an estimated fair price to earnings ratio of 15 times, levels the market could drift back toward if confidence in the earnings profile improves.

On the other hand, Vonovia screens more expensive than its closest peer group on this same metric, trading above the peer average multiple of 4.3 times. This underlines how cautiously investors appear to be pricing specialised real estate earnings right now.

Explore the SWS fair ratio for Vonovia

Result: Price-to-Earnings of 7.7x (UNDERVALUED)

However, persistent revenue declines and a steep five year total return loss could signal structural headwinds that prevent any meaningful re rating from this point.

Find out about the key risks to this Vonovia narrative.

Another Take from Our DCF Model

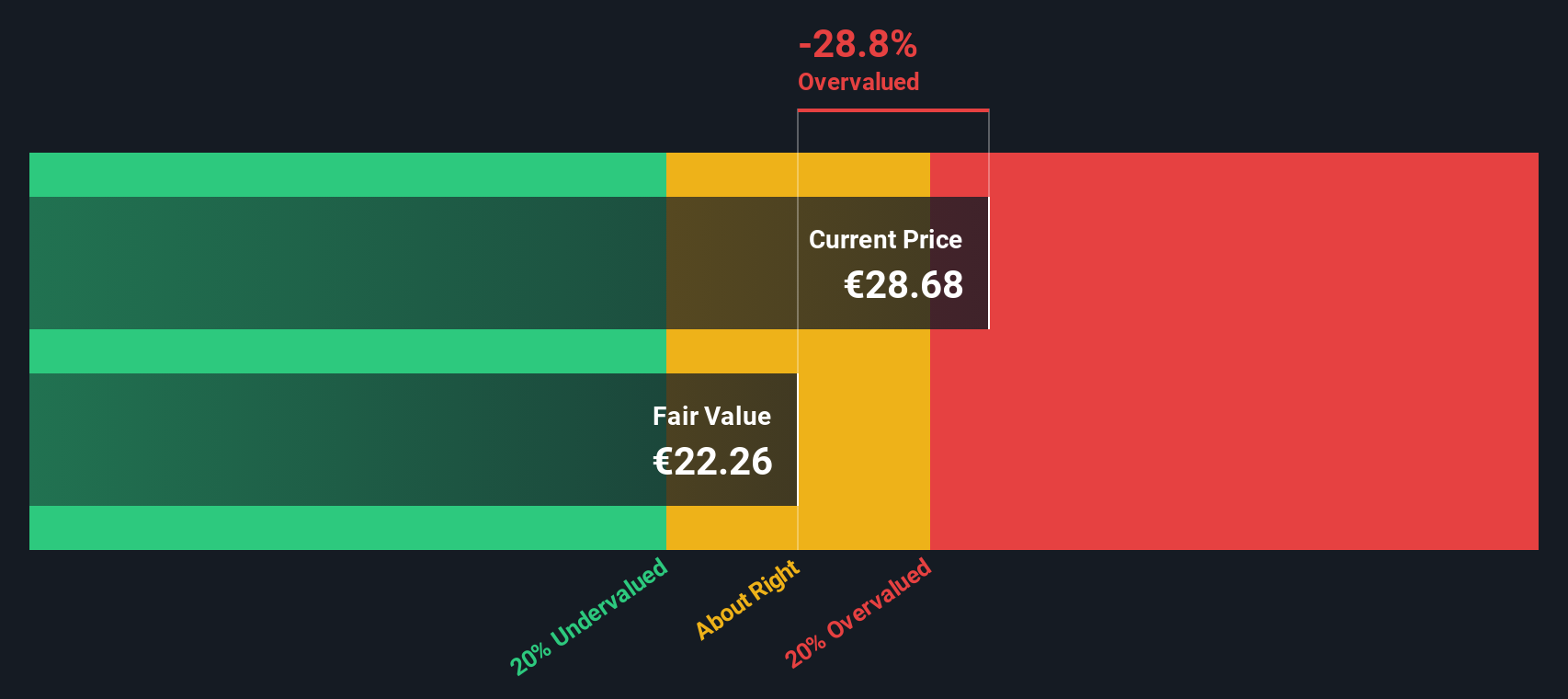

While earnings multiples make Vonovia look inexpensive, our DCF model paints a cooler picture, with the shares trading above an estimated fair value of €20.7. If cash flows are the real anchor, is today’s price already baking in more recovery than the balance sheet can support?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vonovia for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vonovia Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a complete view in just a few minutes using Do it your way.

A great starting point for your Vonovia research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for your next investing angle?

Do not stop with a single company. Right now is the time to broaden your opportunity set with focused stock ideas tailored to the way you like to invest.

- Target potential mispricings by scanning these 916 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations.

- Explore the next wave of innovation by zeroing in on these 24 AI penny stocks positioned to benefit from real world adoption of artificial intelligence.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that offer current yields and a history of consistent payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Established dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion