- Germany

- /

- Real Estate

- /

- XTRA:VNA

The Bull Case For Vonovia (XTRA:VNA) Could Change Following Major Heat Pump Collaboration Announcement

Reviewed by Simply Wall St

- On September 19, 2025, EnerCube GmbH, Vonovia SE, and DFA Demonstrationsfabrik Aachen GmbH announced a collaboration to accelerate series production of a compact, fossil fuel–free heat pump system, set to supply sustainable heating to over 20,000 Vonovia residential units in Germany by 2029.

- This initiative highlights modular, prefabricated technology that can be quickly installed in densely populated neighborhoods, supporting both climate-neutral housing and operational cost savings across Vonovia’s property portfolio.

- We’ll examine how scaling the Heat Pump Cube production could influence Vonovia’s efforts in sustainable modernization and non-rental earnings.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Vonovia Investment Narrative Recap

To be a shareholder of Vonovia today, you need to believe in the company's ability to modernize its vast property portfolio and expand non-rental income streams, particularly as Germany’s regulatory environment drives housing toward sustainability. The September 2025 Heat Pump Cube partnership is promising for green modernization, but its influence on the company’s most pressing short-term catalyst, non-rental EBITDA growth, remains limited in scale for now, with refinancing costs and revenue pressure continuing to be the key risks.

Of recent announcements, the August 2025 issuance of AUD 850,000,000 in unsecured bonds stands out, as it underscores Vonovia’s ongoing need to secure fresh capital for investments like heat pump rollouts and to alleviate near-term refinancing pressures. Continued active debt management and success in service business expansion remain vital for generating earnings growth.

But amid these green ambitions, investors should also be mindful that rising financing costs and price-to-earnings ratios...

Read the full narrative on Vonovia (it's free!)

Vonovia's outlook suggests revenues of €3.7 billion and earnings of €3.2 billion by 2028. This assumes a 19.0% annual revenue decline and a €4.1 billion increase in earnings from the current level of €-922.7 million.

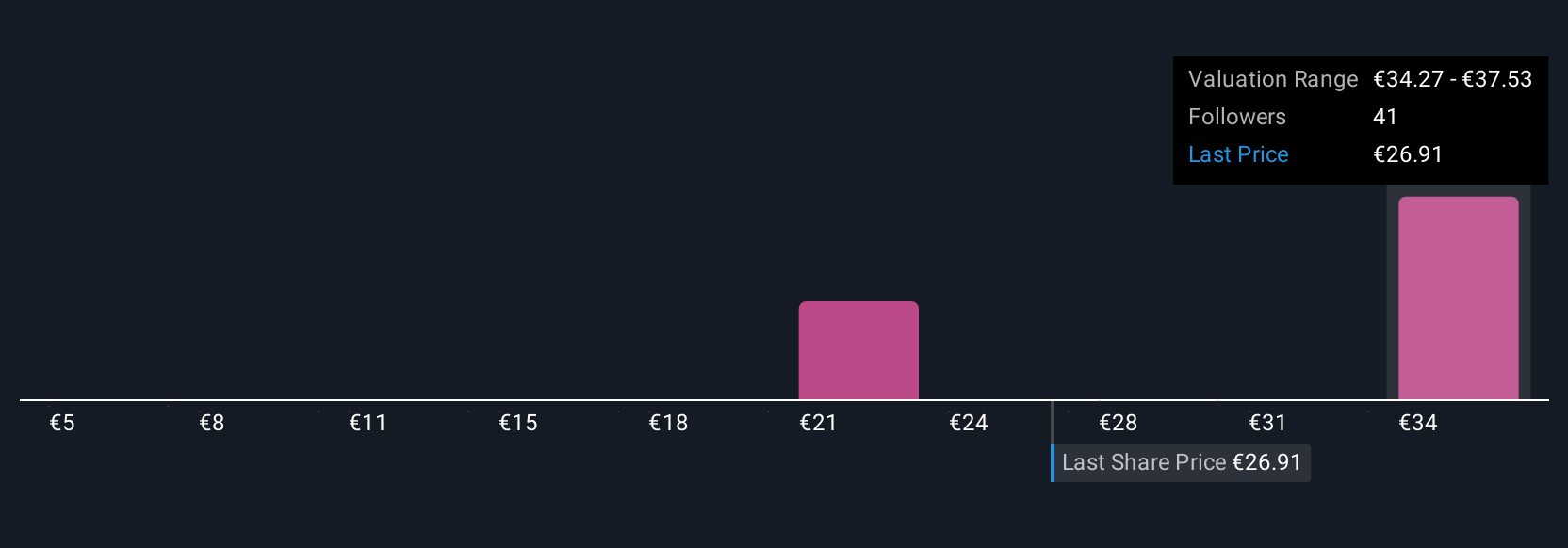

Uncover how Vonovia's forecasts yield a €37.53 fair value, a 45% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community have published fair value estimates on Vonovia ranging from €4.95 to €37.53 per share. With refinancing risks and profitability challenges ahead, your view could shift as you consider these different perspectives.

Explore 6 other fair value estimates on Vonovia - why the stock might be worth as much as 45% more than the current price!

Build Your Own Vonovia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vonovia research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vonovia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vonovia's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Established dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives