- Germany

- /

- Real Estate

- /

- XTRA:VIH1

The three-year underlying earnings growth at VIB Vermögen (ETR:VIH1) is promising, but the shareholders are still in the red over that time

Investing in stocks inevitably means buying into some companies that perform poorly. But long term VIB Vermögen AG (ETR:VIH1) shareholders have had a particularly rough ride in the last three year. Unfortunately, they have held through a 62% decline in the share price in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 41% lower in that time. Even worse, it's down 26% in about a month, which isn't fun at all.

If the past week is anything to go by, investor sentiment for VIB Vermögen isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for VIB Vermögen

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, VIB Vermögen actually saw its earnings per share (EPS) improve by 1.7% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. But it's possible a look at other metrics will be enlightening.

We note that, in three years, revenue has actually grown at a 12% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching VIB Vermögen more closely, as sometimes stocks fall unfairly. This could present an opportunity.

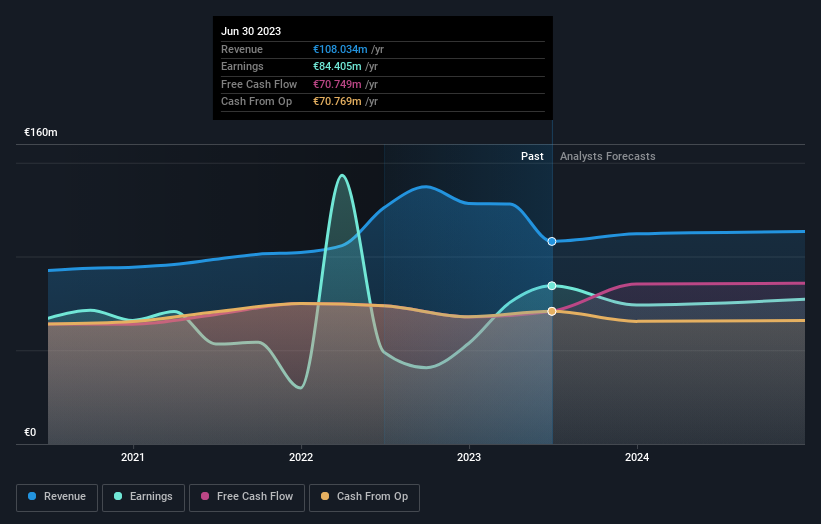

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that VIB Vermögen has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on VIB Vermögen

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between VIB Vermögen's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for VIB Vermögen shareholders, and that cash payout explains why its total shareholder loss of 60%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Investors in VIB Vermögen had a tough year, with a total loss of 41%, against a market gain of about 8.7%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 8% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand VIB Vermögen better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for VIB Vermögen (of which 2 are significant!) you should know about.

But note: VIB Vermögen may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:VIH1

VIB Vermögen

Engages in the development, acquisition, and management of commercial real estate properties in Germany.

Good value with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion