- Germany

- /

- Real Estate

- /

- XTRA:NUVA

Further Upside For Noratis AG (ETR:NUVA) Shares Could Introduce Price Risks After 33% Bounce

Those holding Noratis AG (ETR:NUVA) shares would be relieved that the share price has rebounded 33% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 79% share price decline over the last year.

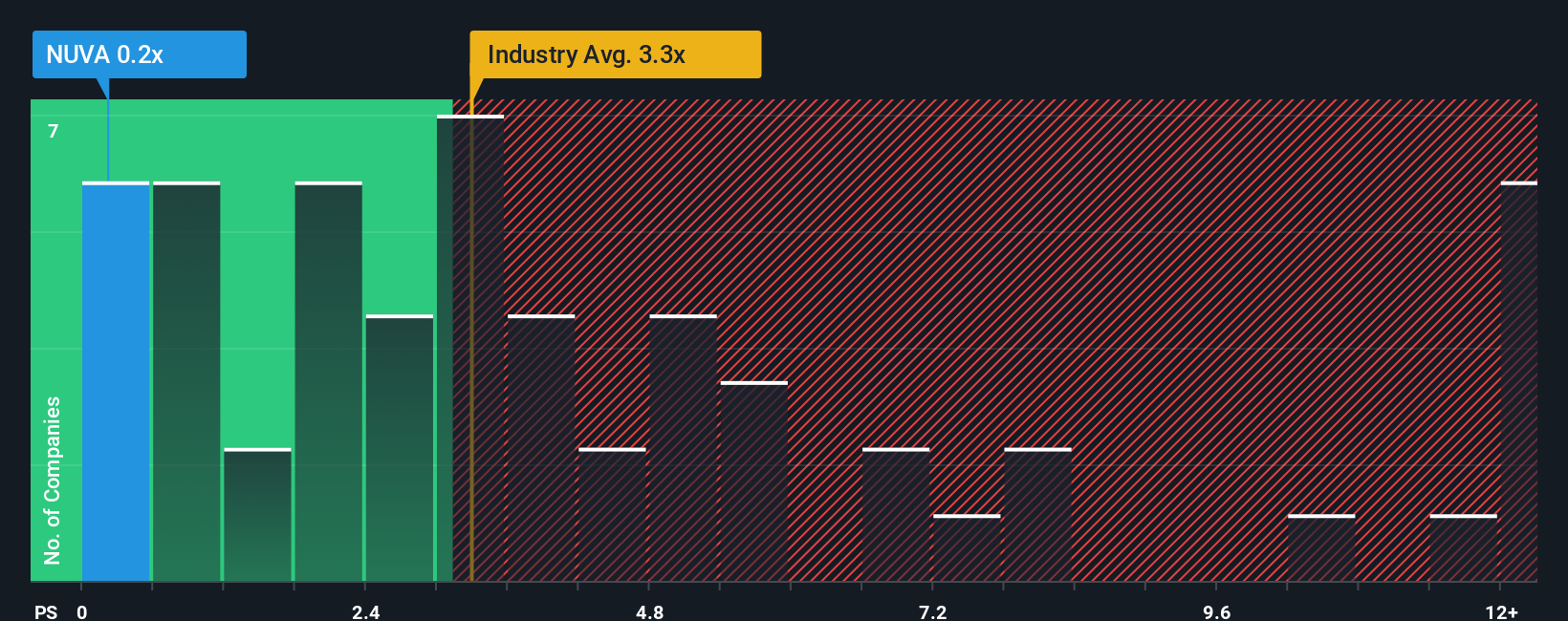

Although its price has surged higher, Noratis may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Real Estate industry in Germany have P/S ratios greater than 3.3x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Noratis

How Noratis Has Been Performing

Revenue has risen firmly for Noratis recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Noratis will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Noratis?

Noratis' P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. Still, lamentably revenue has fallen 9.6% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

This is in contrast to the rest of the industry, which is expected to decline by 40% over the next year, even worse than the company's recent medium-term annualised revenue decline.

In light of this, the fact Noratis' P/S sits below the majority of other companies is peculiar but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is still potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Bottom Line On Noratis' P/S

Shares in Noratis have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we've mentioned, Noratis' lower than industry P/S comes as a bit of a surprise due to its recent three-year revenue not being as bad as the forecasts for a struggling industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. We'd hazard a guess that some investors are concerned about the company's revenue performance tailing off amidst these tough industry conditions. While recent medium-term revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

You should always think about risks. Case in point, we've spotted 5 warning signs for Noratis you should be aware of, and 4 of them are a bit unpleasant.

If you're unsure about the strength of Noratis' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Noratis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NUVA

Noratis

A real estate company, invests in, develops, manages, and sells residential property portfolios in Germany.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026