- Germany

- /

- Real Estate

- /

- XTRA:CRZK

Top German Dividend Stocks To Watch

Reviewed by Simply Wall St

The German market has shown resilience, with the DAX gaining 1.35% recently, buoyed by a positive earnings season and strong investor sentiment. As investors seek stability amid fluctuating global markets, dividend stocks in Germany present an attractive option for those looking to balance income and growth. In the current economic climate, a good dividend stock typically combines consistent payout history with robust financial health and potential for long-term appreciation. Here are three top German dividend stocks to watch that exemplify these qualities.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.44% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.79% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.74% | ★★★★★☆ |

| INDUS Holding (XTRA:INH) | 5.57% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.92% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.53% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.14% | ★★★★★☆ |

| Deutsche Telekom (XTRA:DTE) | 3.21% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.40% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.20% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

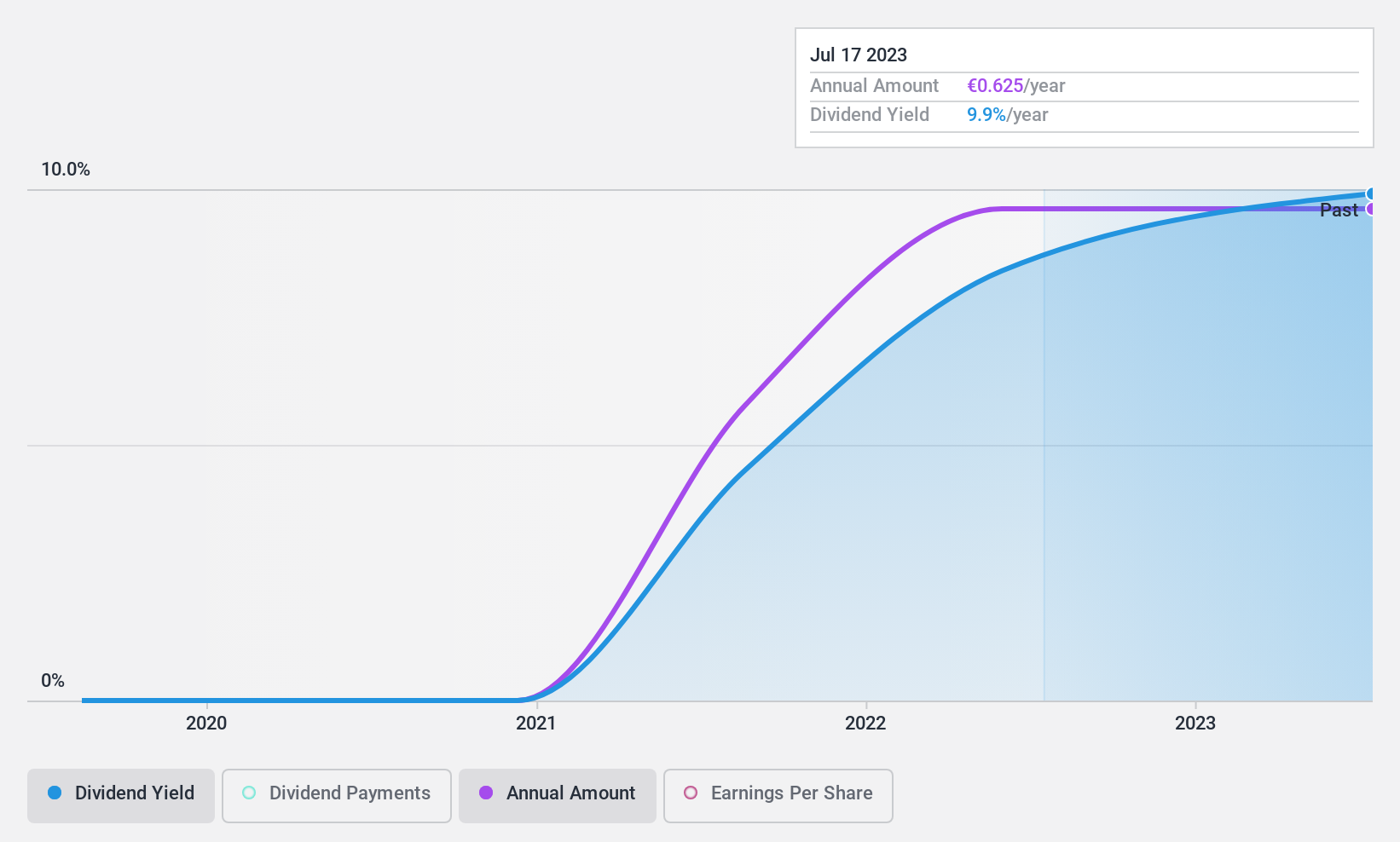

CR Energy (XTRA:CRZK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CR Energy AG, an investment company with a market cap of €155.70 million, focuses on investing in technology companies in Germany.

Operations: CR Energy AG generates its revenue primarily from Real Estate - Rental, amounting to €68.57 million.

Dividend Yield: 9.4%

CR Energy AG's dividends are well covered by both earnings (22.4% payout ratio) and cash flows (62.6% cash payout ratio), ensuring sustainability. Despite a recent decline in revenue to €68.64 million and net income to €65.78 million, the company trades at 48.9% below its estimated fair value, indicating good relative value. However, dividends have only been paid for six years, suggesting limited historical reliability despite their stability and growth so far.

- Click here to discover the nuances of CR Energy with our detailed analytical dividend report.

- Our valuation report here indicates CR Energy may be undervalued.

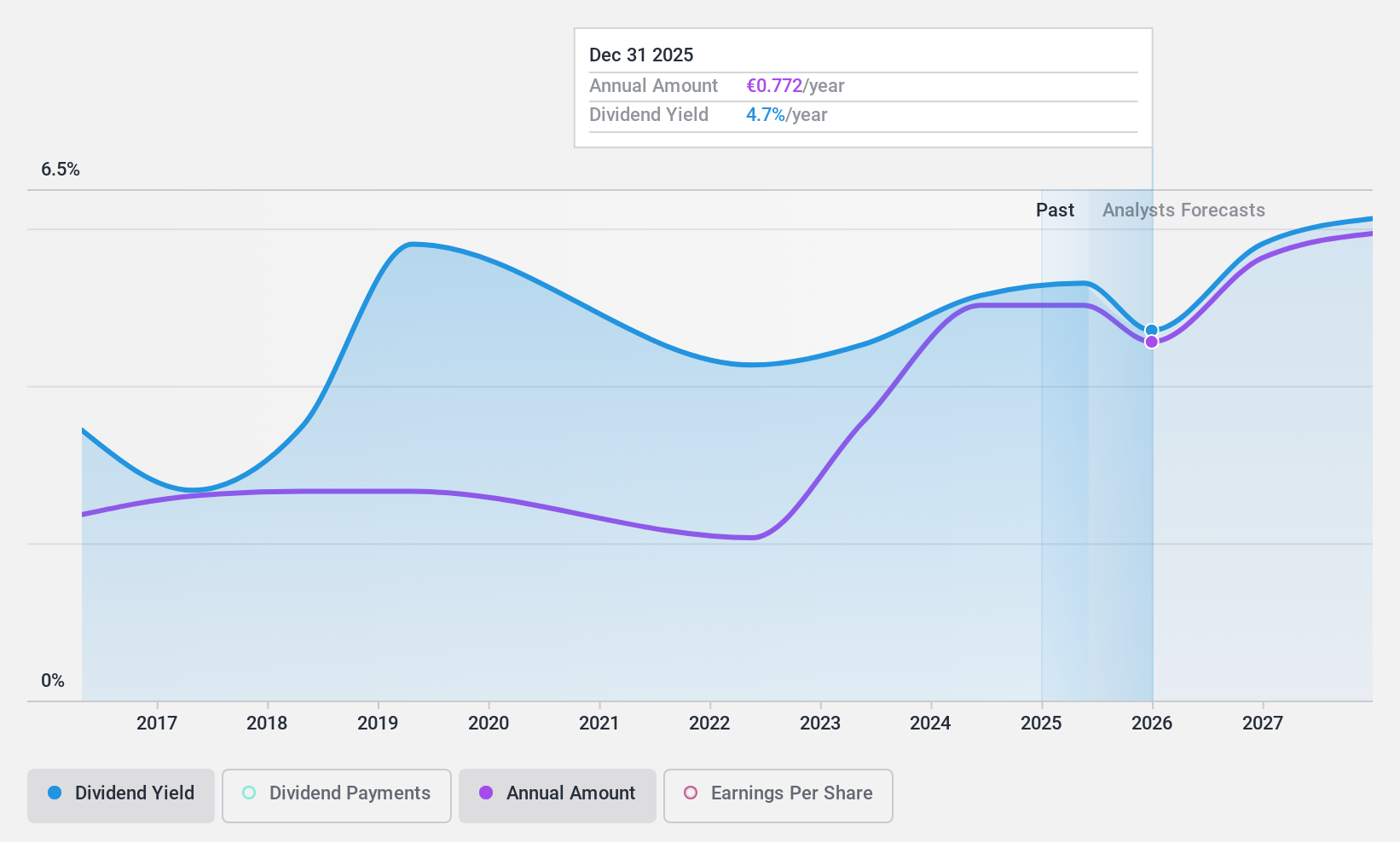

SAF-Holland (XTRA:SFQ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAF-Holland SE manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses with a market cap of €842.52 million.

Operations: SAF-Holland SE generates revenue from three primary regions: €898.79 million from the Americas, €280.64 million from Asia/Pacific (APAC)/China/India, and €951.75 million from Europe, the Middle East, and Africa (EMEA).

Dividend Yield: 4.6%

SAF-Holland SE reported Q1 2024 sales of €505.43 million and net income of €26.23 million, reflecting solid growth from the previous year. The company has a reasonably low payout ratio (44.6%) and cash payout ratio (31.6%), ensuring dividend coverage by earnings and cash flows. Despite an increasing dividend over the past decade, its track record is unstable with volatility in payments, making it less reliable for consistent income-focused investors.

- Dive into the specifics of SAF-Holland here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that SAF-Holland is priced lower than what may be justified by its financials.

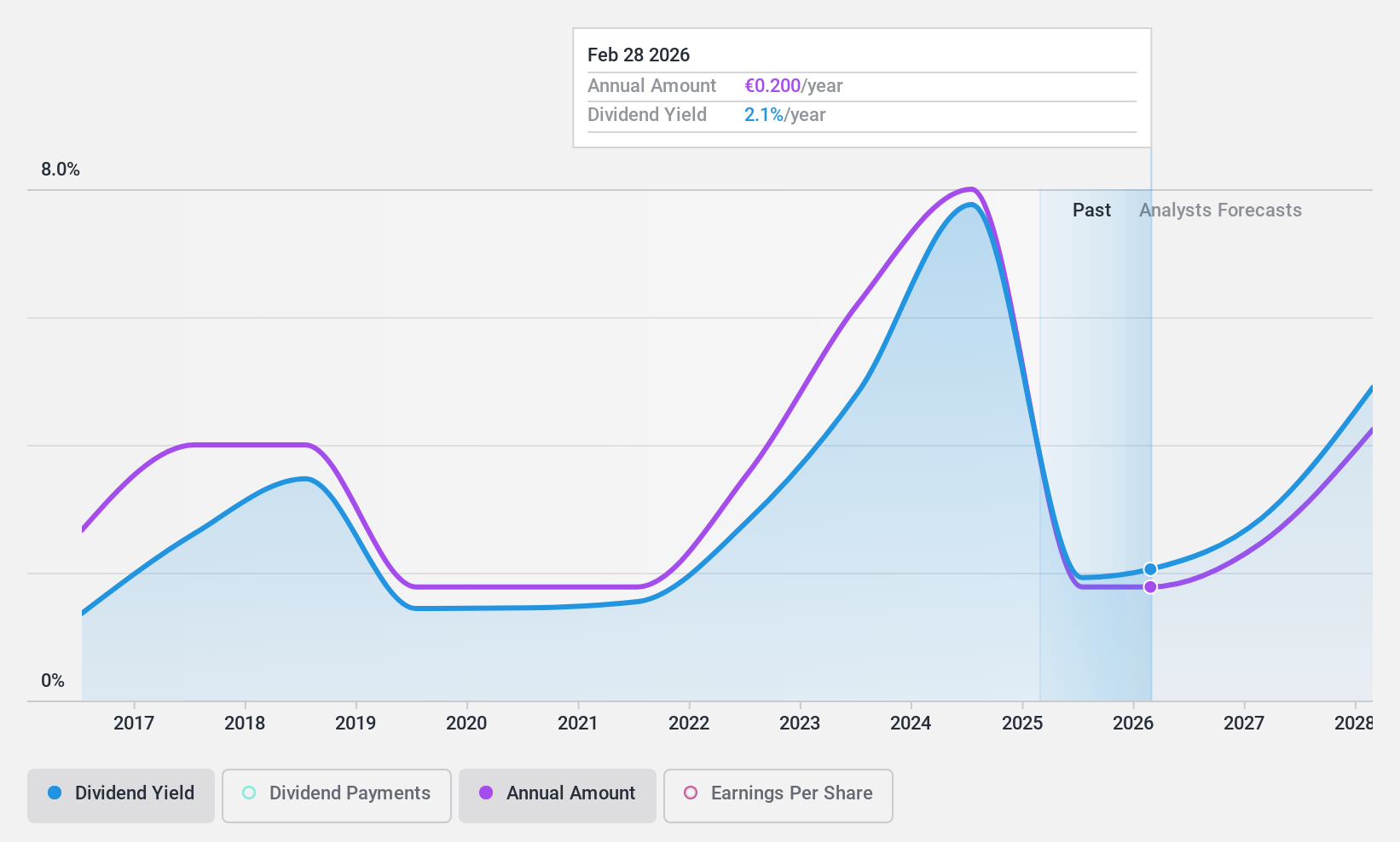

Südzucker (XTRA:SZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Südzucker AG produces and sells sugar products in Germany, the rest of the European Union, the United Kingdom, the United States, and internationally, with a market cap of approximately €2.44 billion.

Operations: Südzucker AG's revenue segments include €1.58 billion from Fruit, €4.59 billion from Sugar, €1.12 billion from Starch, €1.16 billion from CropEnergies, and €2.40 billion from Special Products (excluding Starch).

Dividend Yield: 7.5%

Südzucker AG's Q1 2024 earnings showed a slight increase in sales to €2.55 billion, but net income dropped significantly to €83 million. Despite this, the company proposed a dividend increase to €0.90 per share for fiscal 2023/24, supported by low payout (39.4%) and cash payout ratios (23.4%). However, its dividend history is volatile and unreliable over the past decade, despite recent growth in payments and being among the top tier of German dividend payers at 7.53%.

- Navigate through the intricacies of Südzucker with our comprehensive dividend report here.

- The analysis detailed in our Südzucker valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Unlock our comprehensive list of 29 Top German Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:CRZK

CR Energy

An investment company, invests in technology companies in Germany.

Flawless balance sheet, undervalued and pays a dividend.