- Germany

- /

- Real Estate

- /

- XTRA:AT1

Aroundtown (XTRA:AT1) Rallies to Net Profit on €615m One-Off Gain, Challenging Sustainability Narratives

Reviewed by Simply Wall St

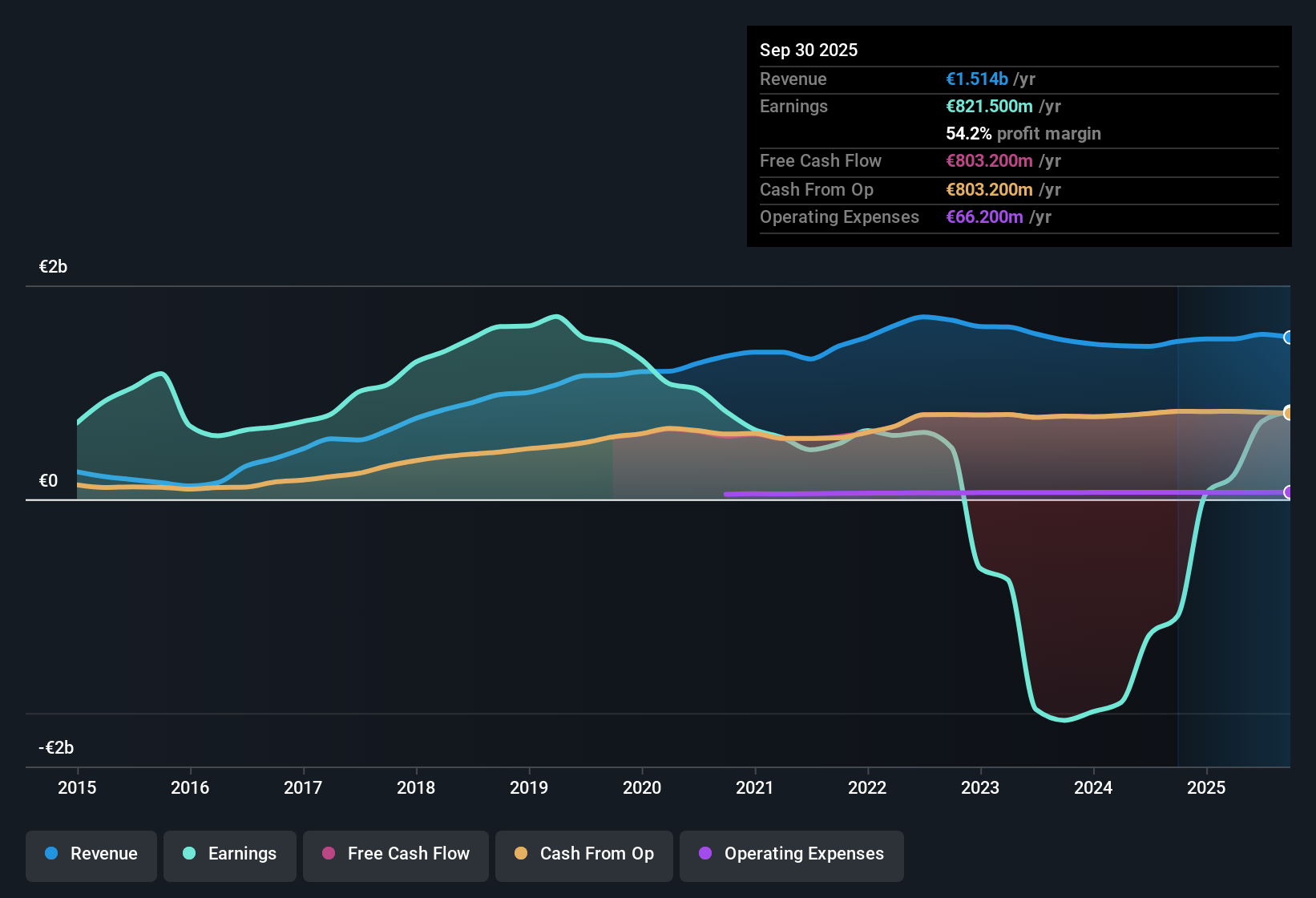

Aroundtown (XTRA:AT1) just reported its Q3 2025 results, posting revenue of €389.9 million and basic EPS of €0.17 for the quarter. The company has seen revenue range from €418.1 million in Q3 2024 to €389.9 million most recently, while EPS figures have fluctuated between €0.09 and €0.17 over the past year. Investors now have fresh margins data to digest as they size up the overall performance and what it signals for the business's current trajectory.

See our full analysis for Aroundtown.Next, we compare these fresh numbers with the prevailing narratives to see where the consensus holds up and which beliefs might be re-examined.

See what the community is saying about Aroundtown

Net Income Leaps with €615 Million One-Off Gain

- Over the last twelve months, net income reached €821.5 million, sharply higher than previous periods due to a non-recurring gain of €615.0 million.

- The analysts’ consensus narrative notes that even though Aroundtown benefitted from this one-off boost which drove net profit margins positive, future profit growth is challenged by expectations of declining earnings:

- Margins only improved temporarily, and consensus sees average earnings falling by 27.3% annually over the next three years.

- The exceptional gain was not tied to core operations, so investors are being cautious about the sustainability of this profit trend.

- The outlook signals investors may want to sense check the jump in net income against more typical periods to judge long-term potential. 📊 Read the full Aroundtown Consensus Narrative.

Share Price Far Below DCF Fair Value

- At a current price of €2.97, Aroundtown trades 52.6% below its DCF fair value estimate of €6.26, and at a PE ratio of just 3.9x versus industry peers at 10.8x.

- According to the analysts' consensus view, this deep discount could attract investors looking for value:

- The relatively low PE and discount to fair value look favorable, but this is tempered by risk factors like high leverage and the potential for ongoing earnings declines.

- Consensus suggests the current share price already reflects both the upside from cost efficiencies and the downside from lower future profits.

Revenue Growth Lags Market Average

- Aroundtown’s revenue increased just 1.8% annually over the last year, significantly lagging behind the broader German market’s 6.2% pace.

- The consensus narrative highlights the challenge that, while operational improvements such as asset diversification and efficiency initiatives are supportive, investors remain watchful as slower revenue growth raises questions about the company’s ability to regain momentum:

- Major bullish catalysts like sector-leading initiatives and asset upgrades may take time to materially lift revenue growth.

- The muted top-line expansion stands in contrast to the market’s expectations for stronger industry-wide performance.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aroundtown on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique perspective on the numbers? In just a few minutes, you can turn your viewpoint into a personalized narrative: Do it your way.

A great starting point for your Aroundtown research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Aroundtown’s muted revenue growth and concerns over the sustainability of its recent profit jump create uncertainty about its ability to maintain steady performance.

If you want to focus on companies with a track record of consistent growth and reliability across cycles, check out stable growth stocks screener (2074 results) for opportunities built on stable expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AT1

Aroundtown

Operates as a real estate company in Germany, the Netherlands, the United Kingdom, Belgium, and internationally.

Undervalued with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success