MorphoSys AG's (ETR:MOR) 93% Share Price Surge Not Quite Adding Up

MorphoSys AG (ETR:MOR) shareholders would be excited to see that the share price has had a great month, posting a 93% gain and recovering from prior weakness. The last month tops off a massive increase of 169% in the last year.

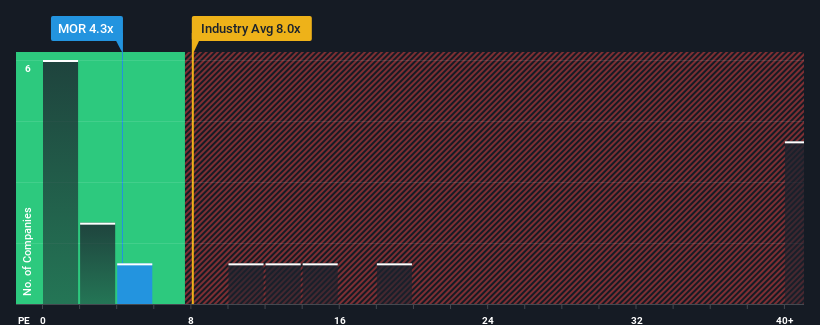

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about MorphoSys' P/S ratio of 4.3x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in Germany is also close to 3.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for MorphoSys

How Has MorphoSys Performed Recently?

With revenue growth that's inferior to most other companies of late, MorphoSys has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MorphoSys.Is There Some Revenue Growth Forecasted For MorphoSys?

The only time you'd be comfortable seeing a P/S like MorphoSys' is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 4.5% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 14% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the twelve analysts covering the company suggest revenue should grow by 29% per year over the next three years. With the industry predicted to deliver 50% growth each year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that MorphoSys' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does MorphoSys' P/S Mean For Investors?

MorphoSys appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that MorphoSys' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you settle on your opinion, we've discovered 3 warning signs for MorphoSys that you should be aware of.

If you're unsure about the strength of MorphoSys' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:MOR

MorphoSys

Engages in the development and commercialization of therapeutics for patients suffering from various cancers in Europe, Asia, and the United States.

Low with limited growth.

Similar Companies

Market Insights

Community Narratives