- Germany

- /

- Life Sciences

- /

- XTRA:GXI

Shareholders May Be Wary Of Increasing Gerresheimer AG's (ETR:GXI) CEO Compensation Package

Key Insights

- Gerresheimer's Annual General Meeting to take place on 5th of June

- Salary of €1.15m is part of CEO Dietmar Siemssen's total remuneration

- The overall pay is 33% above the industry average

- Gerresheimer's EPS declined by 5.7% over the past three years while total shareholder loss over the past three years was 6.6%

The results at Gerresheimer AG (ETR:GXI) have been quite disappointing recently and CEO Dietmar Siemssen bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 5th of June. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Gerresheimer

How Does Total Compensation For Dietmar Siemssen Compare With Other Companies In The Industry?

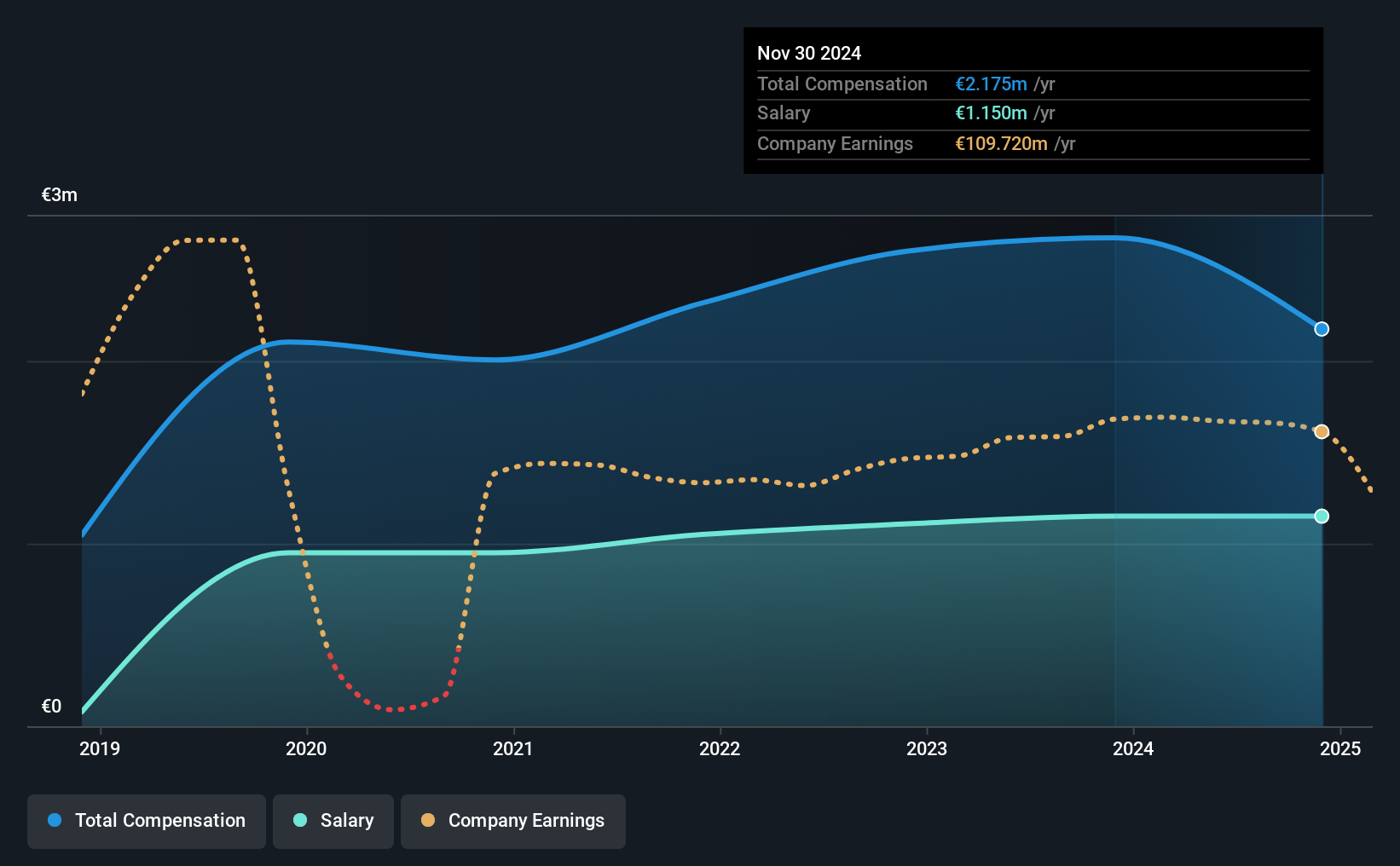

Our data indicates that Gerresheimer AG has a market capitalization of €2.2b, and total annual CEO compensation was reported as €2.2m for the year to November 2024. We note that's a decrease of 19% compared to last year. Notably, the salary which is €1.15m, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the Germany Life Sciences industry with market capitalizations ranging between €1.8b and €5.6b had a median total CEO compensation of €1.6m. This suggests that Dietmar Siemssen is paid more than the median for the industry.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €1.2m | €1.2m | 53% |

| Other | €1.0m | €1.5m | 47% |

| Total Compensation | €2.2m | €2.7m | 100% |

Talking in terms of the industry, salary represented approximately 49% of total compensation out of all the companies we analyzed, while other remuneration made up 51% of the pie. Gerresheimer is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Gerresheimer AG's Growth

Over the last three years, Gerresheimer AG has shrunk its earnings per share by 5.7% per year. Its revenue is up 4.6% over the last year.

Few shareholders would be pleased to read that EPS have declined. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Gerresheimer AG Been A Good Investment?

With a three year total loss of 6.6% for the shareholders, Gerresheimer AG would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 4 warning signs for Gerresheimer (2 don't sit too well with us!) that you should be aware of before investing here.

Switching gears from Gerresheimer, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:GXI

Gerresheimer

Provides medicine packaging, drug delivery devices, and solutions in Germany and internationally.

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives