- Germany

- /

- Life Sciences

- /

- XTRA:EVT

Is Evotec's (XTRA:EVT) Share Buyback a Signal of Strategic Focus or Ongoing Challenges?

Reviewed by Sasha Jovanovic

- Evotec SE recently announced the launch of a share buyback program, aiming to repurchase up to 290,000 shares for €3 million, with the repurchased shares to be used exclusively for fulfilling employee share obligations through conversion to American Depositary Shares by December 17, 2025.

- The timing of this buyback, closely following the release of third-quarter earnings showing lower sales and a confirmed full-year revenue guidance, highlights management's focus on employee incentives and capital management in the face of ongoing net losses.

- We'll examine how Evotec's move to repurchase shares for employee equity plans affects its outlook amid persistent earnings challenges.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Evotec Investment Narrative Recap

To be an Evotec shareholder, you need to believe in the company's ability to convert its drug discovery partnerships and proprietary platforms into sustained revenue despite recent financial pressures. The share buyback for employee obligations is unlikely to materially affect the key near-term catalyst, stabilization and growth in core revenues, or address the main risk of continued revenue contraction and increased losses from a weak biotech funding market.

The most relevant recent announcement is Evotec's confirmation of full-year 2025 revenue guidance (€760 million to €800 million), despite posting lower third-quarter sales and wider losses. This guidance anchors expectations as investors closely watch for signs of a recovery in the Discovery & Preclinical Development segment, which is most exposed to ongoing external funding headwinds and R&D spending cuts.

But even as management demonstrates confidence with stable guidance, investors should be aware of the persistent risk of ongoing revenue softness from cautious biotech clients…

Read the full narrative on Evotec (it's free!)

Evotec's outlook anticipates €988.4 million in revenue and €53.9 million in earnings by 2028. This scenario requires annual revenue growth of 8.3% and an earnings increase of €209.4 million from the current earnings of €-155.5 million.

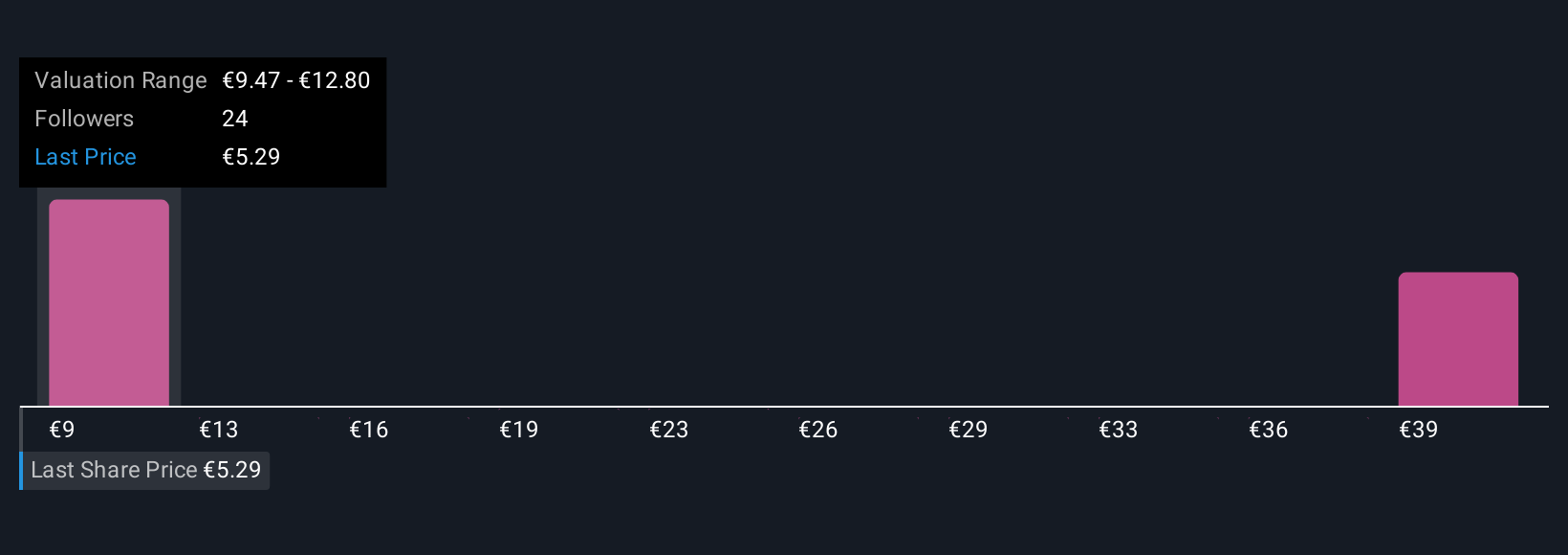

Uncover how Evotec's forecasts yield a €9.47 fair value, a 76% upside to its current price.

Exploring Other Perspectives

Five retail investors from the Simply Wall St Community set fair values for Evotec between €9.47 and €52.16 per share, reflecting a broad spectrum of optimism. While many expect recovery, the company’s dependence on external biotech R&D spending remains a critical point you should factor in when comparing perspectives.

Explore 5 other fair value estimates on Evotec - why the stock might be worth just €9.47!

Build Your Own Evotec Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Evotec research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Evotec research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Evotec's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Evotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:EVT

Evotec

Operates as a drug discovery and development company in the United States, Germany, France, the United Kingdom, Switzerland, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives