- Germany

- /

- Life Sciences

- /

- XTRA:EVT

A Piece Of The Puzzle Missing From Evotec SE's (ETR:EVT) 32% Share Price Climb

Those holding Evotec SE (ETR:EVT) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 51% share price drop in the last twelve months.

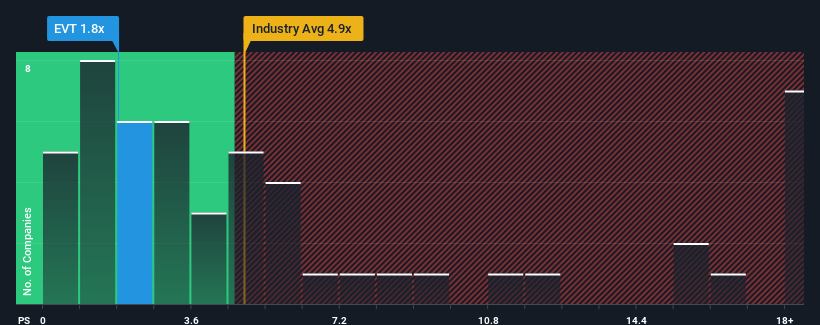

Although its price has surged higher, Evotec may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 1.8x, considering almost half of all companies in the Life Sciences industry in Germany have P/S ratios greater than 4.9x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Evotec

How Has Evotec Performed Recently?

Evotec hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Keen to find out how analysts think Evotec's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Evotec's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 46% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per year during the coming three years according to the ten analysts following the company. With the industry predicted to deliver 12% growth each year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Evotec's P/S is lagging behind its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Evotec's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've seen that Evotec currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 1 warning sign for Evotec you should be aware of.

If these risks are making you reconsider your opinion on Evotec, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Evotec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:EVT

Evotec

Operates as a drug discovery and development company in the United States, Germany, France, the United Kingdom, Switzerland, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives