Is There Now an Opportunity in Bayer Shares After Recent Volatility?

Reviewed by Bailey Pemberton

- Ever wondered whether Bayer is a hidden value opportunity or just another name in pharma? You are in the right place if you are curious about what the current price really means for you as an investor.

- The stock has shown dramatic swings lately. It is up a healthy 38.0% so far this year and has gained 9.4% over twelve months, but has recently pulled back with a -7.3% drop in the past month and -2.5% over the past week.

- These moves come as Bayer continues to grab headlines, including ongoing developments in its life sciences divisions and investor discussions about the strategic future of the company. Issues like restructuring efforts and high-profile legal headlines have also played a part in shaping sentiment and fueling market volatility.

- Bayer earns a valuation score of 5 out of 6, meaning it passes almost every check for being undervalued based on our core metrics. We will dive into these traditional assessment methods, and explore an even smarter way to understand Bayer's true value by the end of this article.

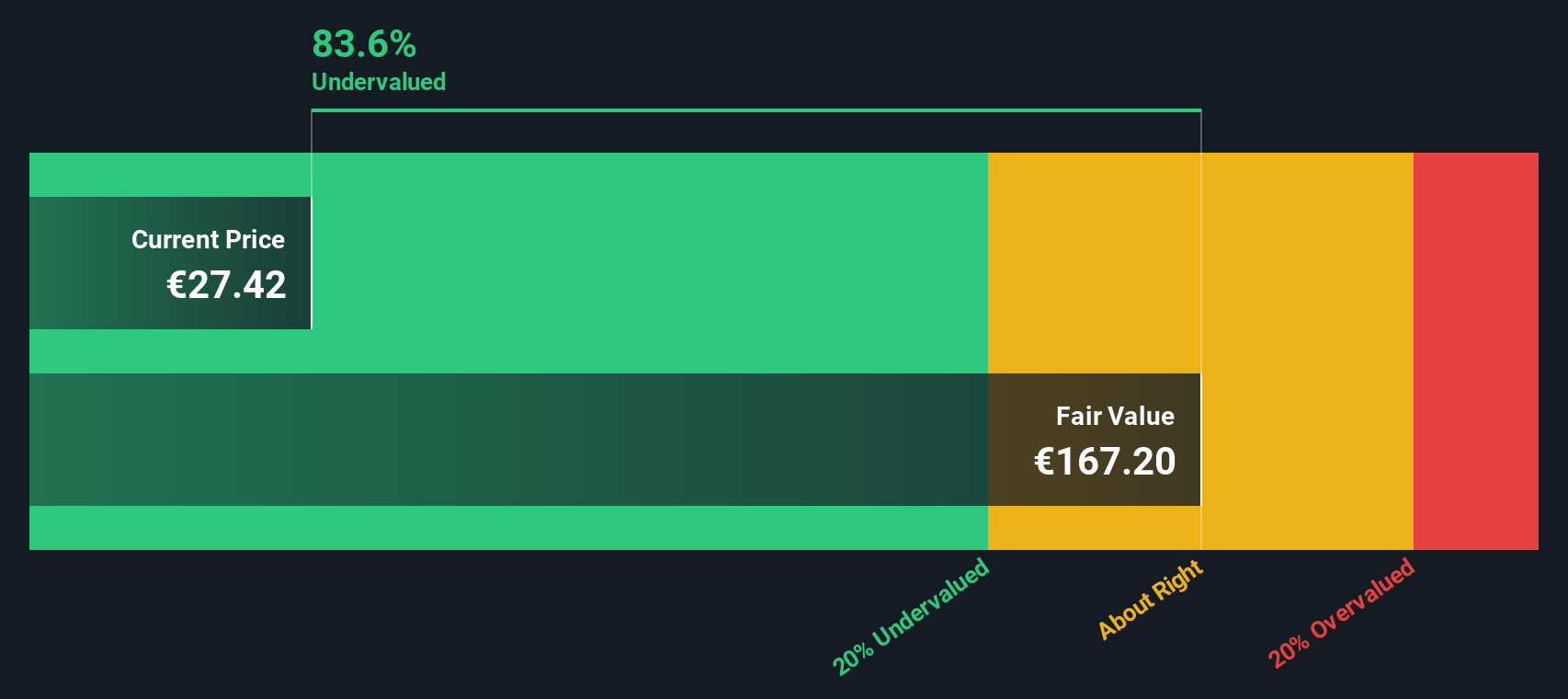

Approach 1: Bayer Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. This approach is particularly helpful for companies in established industries like pharmaceuticals, where future earnings can be projected with a reasonable degree of confidence.

Bayer’s latest reported Free Cash Flow (FCF) is €4.4 Billion. Analysts provide cash flow forecasts up to five years, and from 2029 onwards, Simply Wall St extrapolates further. The projections show Bayer’s FCF growing consistently, reaching €6.1 Billion by 2029. Over the next decade, annual cash flow is expected to gradually rise, with estimates extending beyond €7.4 Billion by 2035.

Based on these cash flows, the DCF model calculates Bayer’s intrinsic value at approximately €179.22 per share. Compared to the current share price, this valuation suggests the stock is trading with an 85.1% discount, indicating it is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayer is undervalued by 85.1%. Track this in your watchlist or portfolio, or discover 841 more undervalued stocks based on cash flows.

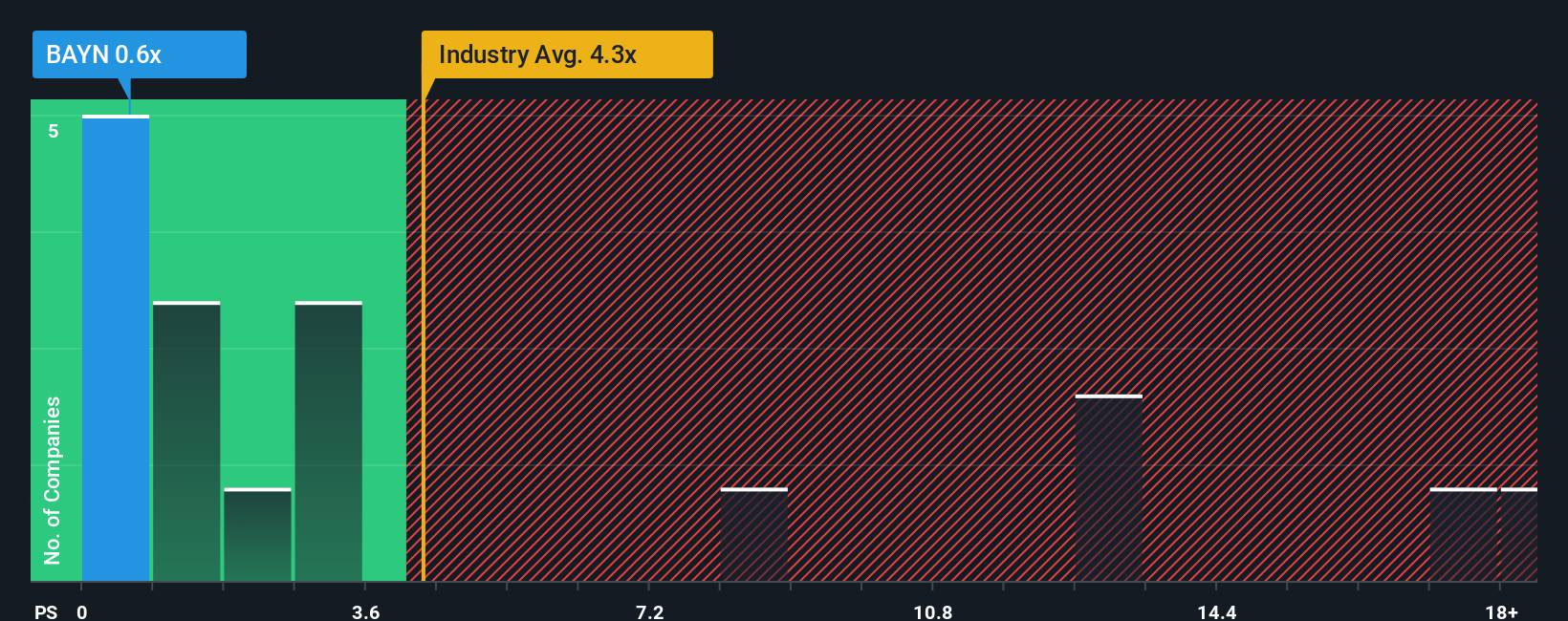

Approach 2: Bayer Price vs Sales

The Price-to-Sales (P/S) ratio is the preferred valuation metric for Bayer because it provides a clear view of how much investors are paying for each euro of the company’s revenue, regardless of current profitability. This approach is especially suitable for companies like Bayer, where factors such as legal settlements or restructuring can temporarily depress profits and make earnings-based multiples less reliable.

Growth prospects and perceived risk heavily shape what a “normal” or “fair” P/S ratio should be. A company with steady long-term growth and lower risks might command a higher multiple, while elevated risks or weaker growth trajectories justify a lower ratio.

Currently, Bayer trades at a P/S ratio of 0.57x. This is strikingly low compared to the Pharmaceuticals industry average of 2.78x and the peer group average of 1.96x, putting Bayer at a substantial discount. However, Simply Wall St’s proprietary “Fair Ratio” tool goes further by factoring in company-specific metrics such as Bayer’s growth outlook, profit margins, market cap, and risk profile. For Bayer, the Fair Ratio is calculated at 1.36x.

Unlike blunt comparisons to industry or peers, the Fair Ratio adjusts for Bayer’s unique situation and gives a more complete picture of what valuation is justified. Comparing Bayer’s actual 0.57x P/S ratio to its Fair Ratio of 1.36x shows the stock is meaningfully undervalued, even when you account for its specific risks and growth prospects.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

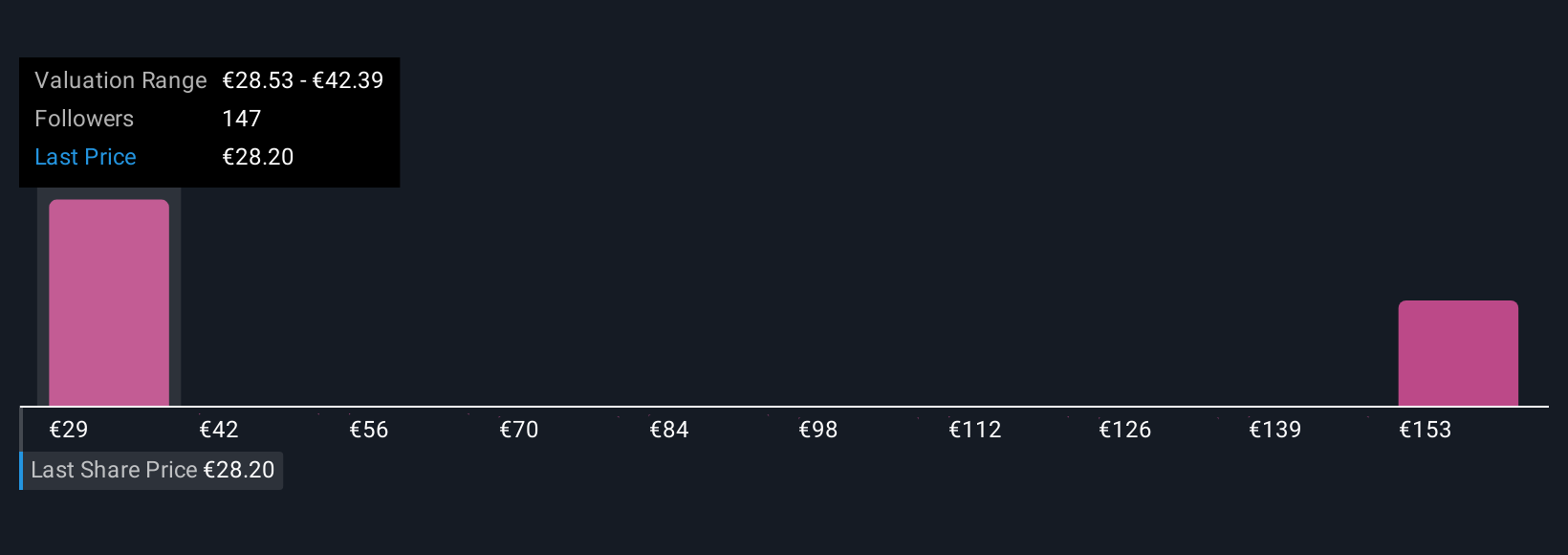

Upgrade Your Decision Making: Choose your Bayer Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is Simply Wall St’s easy and dynamic tool that lets you apply your own story, your unique view of the company’s prospects, risks, and potential, directly to financial forecasts, resulting in a tailored fair value estimate. Narratives seamlessly connect a company’s background and future expectations with logical forecasts for revenue, profit margins, and fair value, creating a living bridge between numbers and real-world events.

Millions of investors on the Simply Wall St Community page use Narratives to compare their personal fair value to the current share price and decide whether to buy or sell. Narratives are kept up-to-date as new earnings, news, or industry changes emerge, so your viewpoint evolves alongside the business. For example, with Bayer, some investors may build a bullish Narrative around strong pharma launches and improved margins, setting fair value close to €39.0, while others with more cautious views on Bayer’s legal risks may see fair value as low as €23.0. No matter your position, Narratives make it simple to turn your perspective into action.

Do you think there's more to the story for Bayer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives