Does Bayer’s Recent Strategic Update Signal a Real Turnaround Opportunity for 2025?

Reviewed by Bailey Pemberton

- Wondering if Bayer's recent move in the markets makes it a true bargain, or just another value trap? You're not alone. Here is what really matters for investors looking for an edge.

- The stock has climbed 42.3% year-to-date and is up 40.0% over the last 12 months. However, it has taken a small dip of 2.9% this week, hinting at shifting moods around its growth potential and risk.

- Recent headlines have spotlighted Bayer's progress with new therapies and changes in its leadership team. Both factors have fueled debate about the company's future direction. A major strategic update last month added to the buzz and fueled speculation that the company may be on the verge of a turnaround.

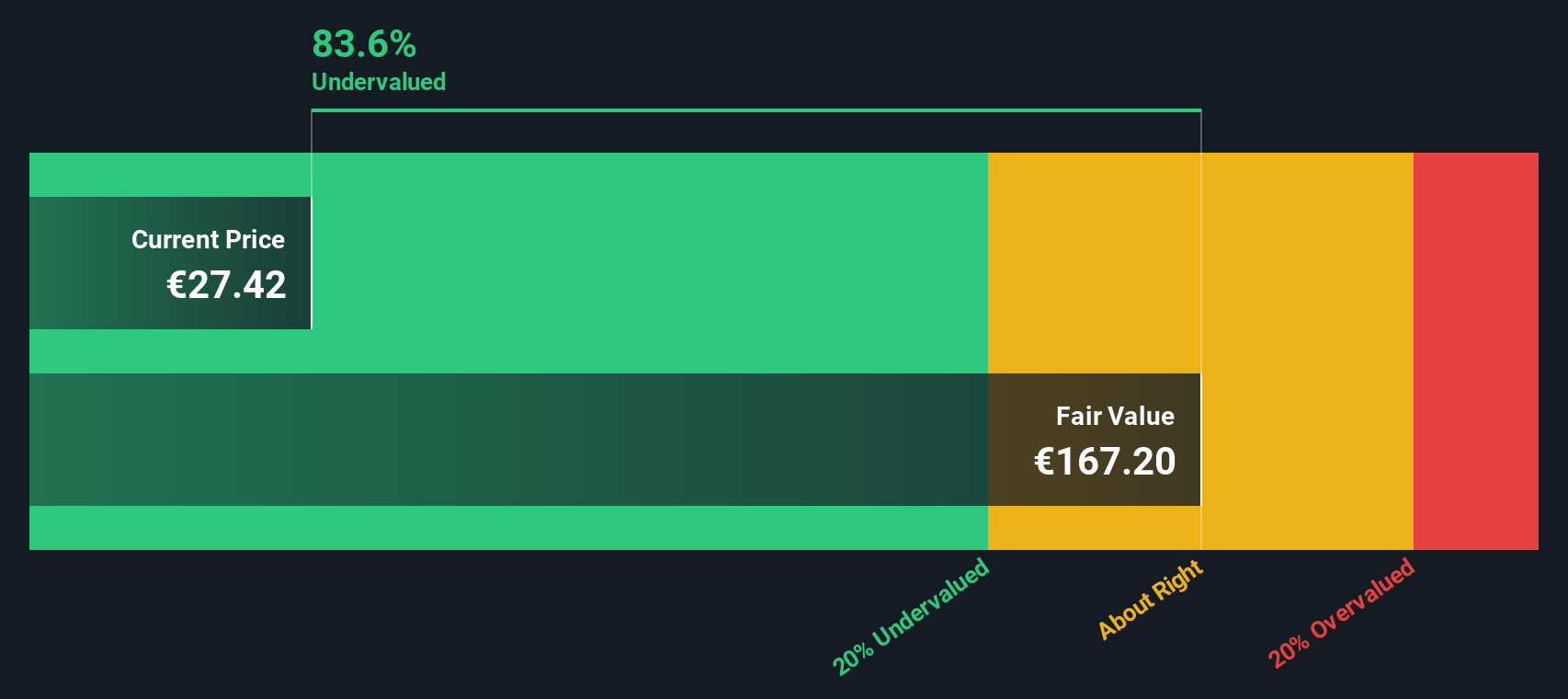

- Bayer currently holds a valuation score of 5 out of 6, suggesting it is undervalued in most areas assessed. This article will break down how analysts and models arrive at that number and introduce an alternative way to think about valuation by the end of the discussion.

Approach 1: Bayer Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. This approach relies on the idea that the worth of a business is based on how much cash it can generate in the years ahead.

Bayer reported Free Cash Flow (FCF) of €3.93 billion over the last twelve months. According to analyst estimates, FCF is projected to grow, reaching €5.77 billion by 2029. After analysts' five-year projections, further growth expectations are extrapolated, showing estimated FCF of roughly €6.13 billion by 2035. These projections are then discounted to reflect their value in today's terms.

Based on the 2 Stage Free Cash Flow to Equity model, the calculated intrinsic value for Bayer shares comes to approximately €149.85 per share. Compared to the current market price, this valuation signals that Bayer stock is about 81.6% undervalued according to the DCF model.

In summary, the market appears to be overlooking the business’s potential to generate cash in the next decade.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bayer is undervalued by 81.6%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

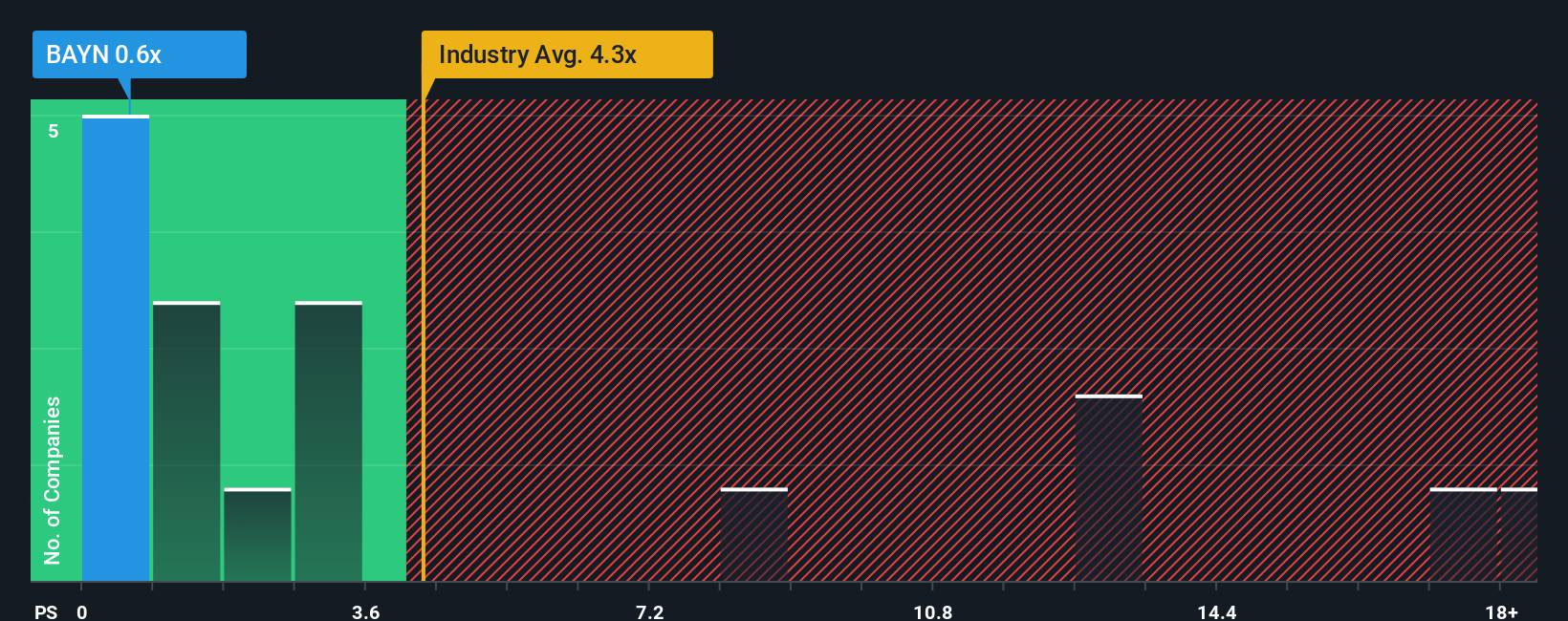

Approach 2: Bayer Price vs Sales

The Price-to-Sales (P/S) ratio is a useful valuation tool for companies like Bayer, particularly when earnings are volatile or negative. By focusing on a company’s revenues rather than profits, the P/S ratio helps investors gauge whether the market is undervaluing or overvaluing the company’s sales compared to its peers and the wider industry.

Growth prospects and risk are major factors that influence what is considered a "normal" or "fair" P/S ratio. Typically, companies with stronger growth expectations and lower risk profiles command higher multiples, while riskier or slower-growing companies trade at lower ratios.

Bayer currently trades at a P/S ratio of 0.59x. This is well below both the Pharmaceuticals industry average of 2.66x and the peer group average of 2.03x. While such comparisons are helpful, they do not account for Bayer's unique characteristics, such as its specific growth outlook, profit margins, market cap, and risk profile.

This is where Simply Wall St’s proprietary Fair Ratio comes in. The Fair Ratio estimates what Bayer’s P/S ratio should be after factoring in its earnings growth, profitability, size, industry, and risks, resulting in a fair value multiple of 1.41x. This approach gives a more customized and forward-looking perspective than simply matching industry averages or peer groups.

Given that Bayer is trading at 0.59x, well below its Fair Ratio of 1.41x, the stock appears undervalued through this lens.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1422 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bayer Narrative

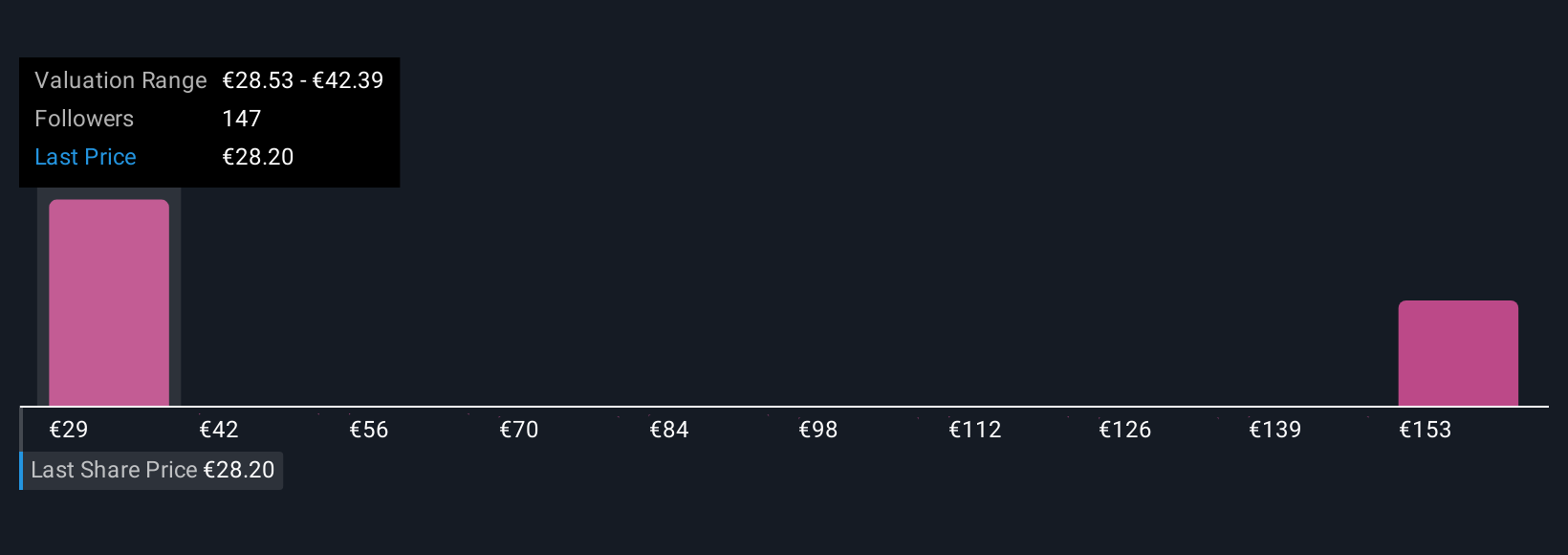

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives, a simple framework that lets you attach your own story and reasoning to Bayer’s numbers, going beyond just models or analyst targets.

A Narrative is essentially your own perspective on a company. You consider Bayer’s recent legal issues, innovation pipeline, and management shifts, then express what you believe will happen next, such as your forecasts for revenue, margins, and what you think the shares should be worth.

This approach connects the company’s story directly to a concrete financial projection and ultimately to a fair value estimate. It helps you clarify your view, challenge your assumptions, or compare with other investors.

Narratives are easy to create and review on Simply Wall St’s Community page, where millions of investors share and debate their reasoning.

Once you have built or found a Narrative, you can see if Bayer’s fair value matches, exceeds, or lags behind the current share price and make your buy, hold, or sell decision more confidently.

What is even smarter, Narratives keep adapting as market news or new results arrive, so your analysis always stays relevant and timely.

For Bayer, the most optimistic Narrative expects a €39.0 fair value based on strong pharmaceutical launches and margin recovery. The most cautious projects just €23.0, focusing on litigation risks and uncertain growth, so your view truly drives your actions.

Do you think there's more to the story for Bayer? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives