- Germany

- /

- Entertainment

- /

- DB:WBAH

Revenues Not Telling The Story For Wild Bunch AG (FRA:WBAH) After Shares Rise 35%

Wild Bunch AG (FRA:WBAH) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 76% in the last year.

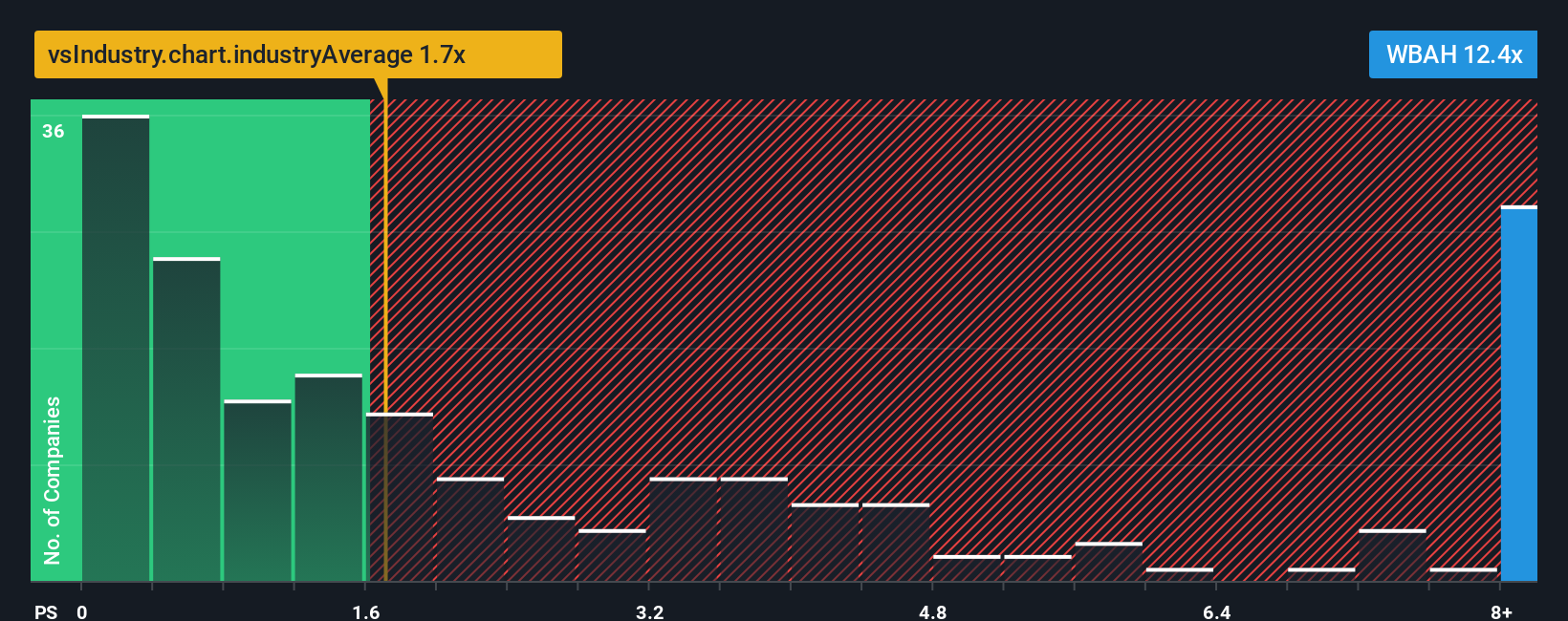

After such a large jump in price, when almost half of the companies in Germany's Entertainment industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Wild Bunch as a stock not worth researching with its 12.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Wild Bunch

What Does Wild Bunch's P/S Mean For Shareholders?

Wild Bunch has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Wild Bunch, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Wild Bunch?

In order to justify its P/S ratio, Wild Bunch would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. The latest three year period has also seen a 9.1% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 6.2% shows it's noticeably less attractive.

With this information, we find it concerning that Wild Bunch is trading at a P/S higher than the industry. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does Wild Bunch's P/S Mean For Investors?

The strong share price surge has lead to Wild Bunch's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Wild Bunch currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Wild Bunch that you should be aware of.

If you're unsure about the strength of Wild Bunch's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Wild Bunch might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:WBAH

Wild Bunch

Operates as an independent film distribution and TV production company in France, Germany, Italy, Spain, and Austria.

Very low risk with weak fundamentals.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success