- Germany

- /

- Entertainment

- /

- DB:8WP

What Beyond Frames Entertainment AB (publ)'s (FRA:8WP) 54% Share Price Gain Is Not Telling You

Beyond Frames Entertainment AB (publ) (FRA:8WP) shareholders have had their patience rewarded with a 54% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 30% over that time.

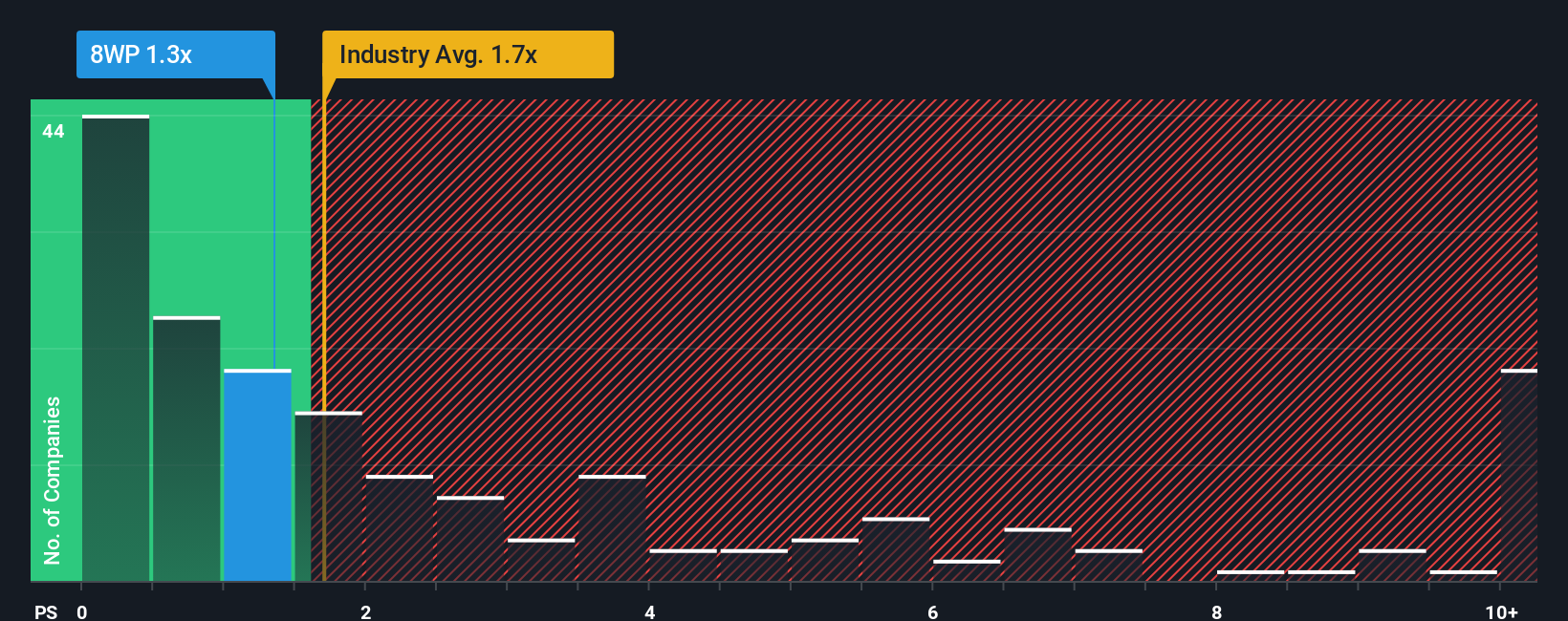

Even after such a large jump in price, it's still not a stretch to say that Beyond Frames Entertainment's price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Germany, where the median P/S ratio is around 0.9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Beyond Frames Entertainment

What Does Beyond Frames Entertainment's Recent Performance Look Like?

Beyond Frames Entertainment could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beyond Frames Entertainment.How Is Beyond Frames Entertainment's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beyond Frames Entertainment's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 9.2%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 0.9% over the next year. Meanwhile, the rest of the industry is forecast to expand by 6.0%, which is noticeably more attractive.

With this information, we find it interesting that Beyond Frames Entertainment is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Beyond Frames Entertainment's P/S Mean For Investors?

Beyond Frames Entertainment's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Beyond Frames Entertainment's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you take the next step, you should know about the 3 warning signs for Beyond Frames Entertainment (1 is concerning!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026