- Germany

- /

- Entertainment

- /

- DB:8WP

The Price Is Right For Beyond Frames Entertainment AB (publ) (FRA:8WP) Even After Diving 27%

Unfortunately for some shareholders, the Beyond Frames Entertainment AB (publ) (FRA:8WP) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

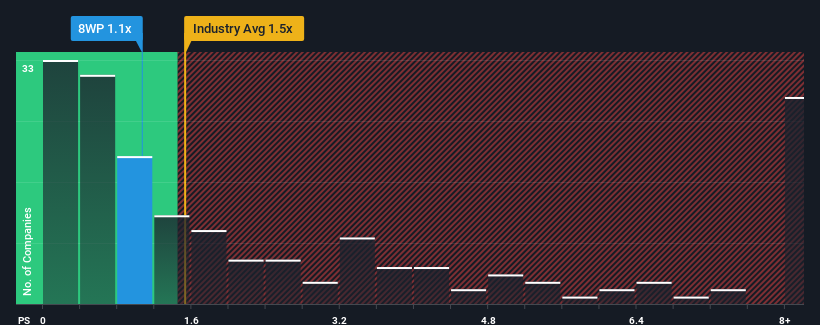

In spite of the heavy fall in price, it's still not a stretch to say that Beyond Frames Entertainment's price-to-sales (or "P/S") ratio of 1.1x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Germany, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Beyond Frames Entertainment

How Has Beyond Frames Entertainment Performed Recently?

Recent times have been advantageous for Beyond Frames Entertainment as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Beyond Frames Entertainment will help you uncover what's on the horizon.How Is Beyond Frames Entertainment's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Beyond Frames Entertainment's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. Spectacularly, three year revenue growth has also set the world alight, thanks to the last 12 months of incredible growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 9.4% as estimated by the two analysts watching the company. With the industry predicted to deliver 8.8% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Beyond Frames Entertainment is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Following Beyond Frames Entertainment's share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Beyond Frames Entertainment's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Entertainment industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

Before you take the next step, you should know about the 2 warning signs for Beyond Frames Entertainment (1 shouldn't be ignored!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026