- Germany

- /

- Entertainment

- /

- DB:8WP

Beyond Frames Entertainment AB (publ)'s (FRA:8WP) Stock Retreats 26% But Revenues Haven't Escaped The Attention Of Investors

Beyond Frames Entertainment AB (publ) (FRA:8WP) shares have had a horrible month, losing 26% after a relatively good period beforehand. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 16% in that time.

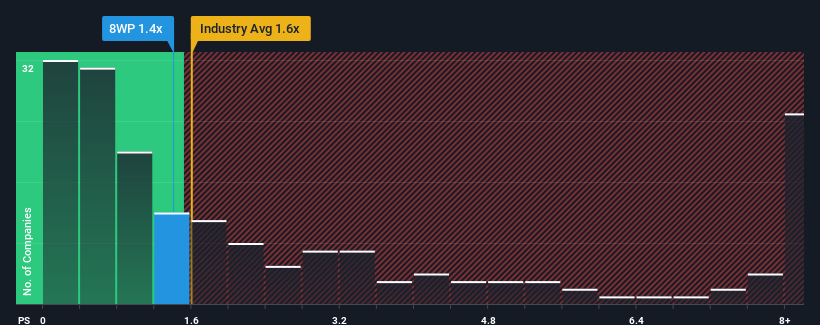

In spite of the heavy fall in price, when almost half of the companies in Germany's Entertainment industry have price-to-sales ratios (or "P/S") below 0.5x, you may still consider Beyond Frames Entertainment as a stock probably not worth researching with its 1.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

Check out our latest analysis for Beyond Frames Entertainment

How Has Beyond Frames Entertainment Performed Recently?

With revenue growth that's superior to most other companies of late, Beyond Frames Entertainment has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Beyond Frames Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Beyond Frames Entertainment?

In order to justify its P/S ratio, Beyond Frames Entertainment would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 9.4% as estimated by the two analysts watching the company. With the industry only predicted to deliver 6.7%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Beyond Frames Entertainment's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Beyond Frames Entertainment's P/S?

Beyond Frames Entertainment's P/S remain high even after its stock plunged. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look into Beyond Frames Entertainment shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Beyond Frames Entertainment you should know about.

If you're unsure about the strength of Beyond Frames Entertainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026