- Germany

- /

- Entertainment

- /

- DB:8WP

Beyond Frames Entertainment AB (publ)'s (FRA:8WP) Popularity With Investors Is Under Threat From Overpricing

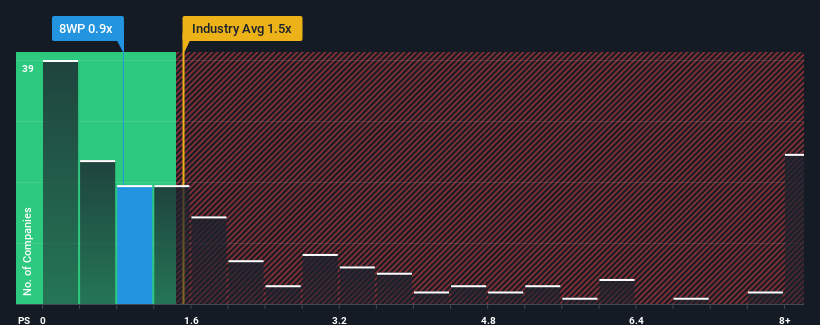

With a median price-to-sales (or "P/S") ratio of close to 0.6x in the Entertainment industry in Germany, you could be forgiven for feeling indifferent about Beyond Frames Entertainment AB (publ)'s (FRA:8WP) P/S ratio of 0.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Beyond Frames Entertainment

What Does Beyond Frames Entertainment's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Beyond Frames Entertainment has been doing relatively well. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Beyond Frames Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Beyond Frames Entertainment?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beyond Frames Entertainment's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 71% gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.4% as estimated by the two analysts watching the company. That's shaping up to be materially lower than the 7.7% growth forecast for the broader industry.

In light of this, it's curious that Beyond Frames Entertainment's P/S sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

When you consider that Beyond Frames Entertainment's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

Before you take the next step, you should know about the 4 warning signs for Beyond Frames Entertainment that we have uncovered.

If you're unsure about the strength of Beyond Frames Entertainment's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026