- Germany

- /

- Entertainment

- /

- DB:8WP

After Leaping 26% Beyond Frames Entertainment AB (publ) (FRA:8WP) Shares Are Not Flying Under The Radar

Beyond Frames Entertainment AB (publ) (FRA:8WP) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 97%.

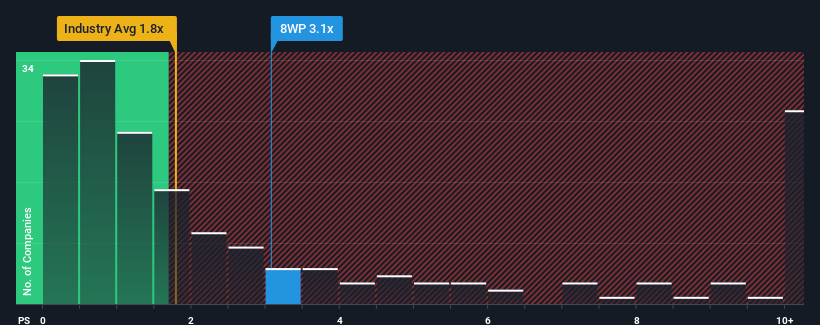

Following the firm bounce in price, when almost half of the companies in Germany's Entertainment industry have price-to-sales ratios (or "P/S") below 0.8x, you may consider Beyond Frames Entertainment as a stock not worth researching with its 3.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Beyond Frames Entertainment

What Does Beyond Frames Entertainment's P/S Mean For Shareholders?

Recent times have been advantageous for Beyond Frames Entertainment as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Beyond Frames Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Beyond Frames Entertainment's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 137% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the only analyst covering the company suggest revenue growth will be highly resilient over the next year growing by 18%. With the rest of the industry predicted to shrink by 0.8%, that would be a fantastic result.

In light of this, it's understandable that Beyond Frames Entertainment's P/S sits above the majority of other companies. At this time, shareholders aren't keen to offload something that is potentially eyeing a much more prosperous future.

The Final Word

The strong share price surge has lead to Beyond Frames Entertainment's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we anticipated, our review of Beyond Frames Entertainment's analyst forecasts shows that the company's better revenue forecast compared to a turbulent industry is a significant contributor to its high price-to-sales ratio. Outperforming the industry in this manner looks to have provided investors with a bit of confidence that the future will be bright, bolstering the P/S. Our only concern is whether its revenue trajectory can keep outperforming under these tough industry conditions. Although, if the company's prospects don't change they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Beyond Frames Entertainment (2 are a bit unpleasant!) that you need to be mindful of.

If these risks are making you reconsider your opinion on Beyond Frames Entertainment, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beyond Frames Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:8WP

Beyond Frames Entertainment

A video game company, engages in the game creation and publishing business in Sweden.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026