- Germany

- /

- Entertainment

- /

- XTRA:HLG

Is Highlight Communications AG's (ETR:HLG) Latest Stock Performance A Reflection Of Its Financial Health?

Highlight Communications' (ETR:HLG) stock is up by a considerable 8.0% over the past month. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. Particularly, we will be paying attention to Highlight Communications' ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

Check out our latest analysis for Highlight Communications

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Highlight Communications is:

16% = CHF31m ÷ CHF197m (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. So, this means that for every €1 of its shareholder's investments, the company generates a profit of €0.16.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

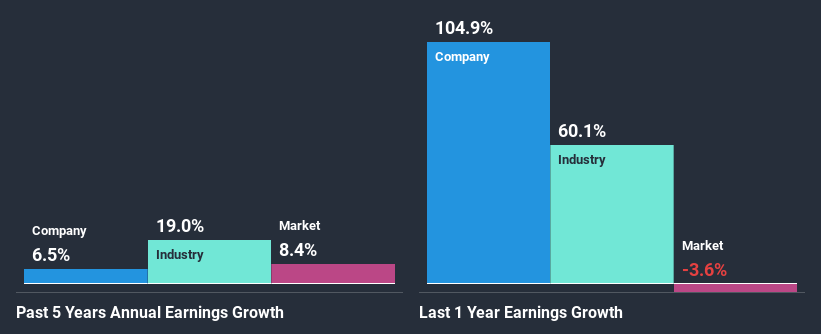

A Side By Side comparison of Highlight Communications' Earnings Growth And 16% ROE

To start with, Highlight Communications' ROE looks acceptable. Even when compared to the industry average of 17% the company's ROE looks quite decent. This certainly adds some context to Highlight Communications' moderate 6.5% net income growth seen over the past five years.

When you consider the fact that the industry earnings have shrunk at a rate of 5.4% in the same period, the company's net income growth is pretty remarkable.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Highlight Communications''s valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Highlight Communications Efficiently Re-investing Its Profits?

While Highlight Communications has a three-year median payout ratio of 61% (which means it retains 39% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Additionally, Highlight Communications has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

In total, we are pretty happy with Highlight Communications' performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. So far, we've only made a quick discussion around the company's earnings growth. You can do your own research on Highlight Communications and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you’re looking to trade Highlight Communications, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Highlight Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About XTRA:HLG

Highlight Communications

Operates as a strategic and financial holding company in Switzerland, Germany, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026