Benign Growth For Going Public Media Aktiengesellschaft (ETR:G6P0) Underpins Stock's 32% Plummet

Going Public Media Aktiengesellschaft (ETR:G6P0) shares have had a horrible month, losing 32% after a relatively good period beforehand. The recent drop has obliterated the annual return, with the share price now down 7.1% over that longer period.

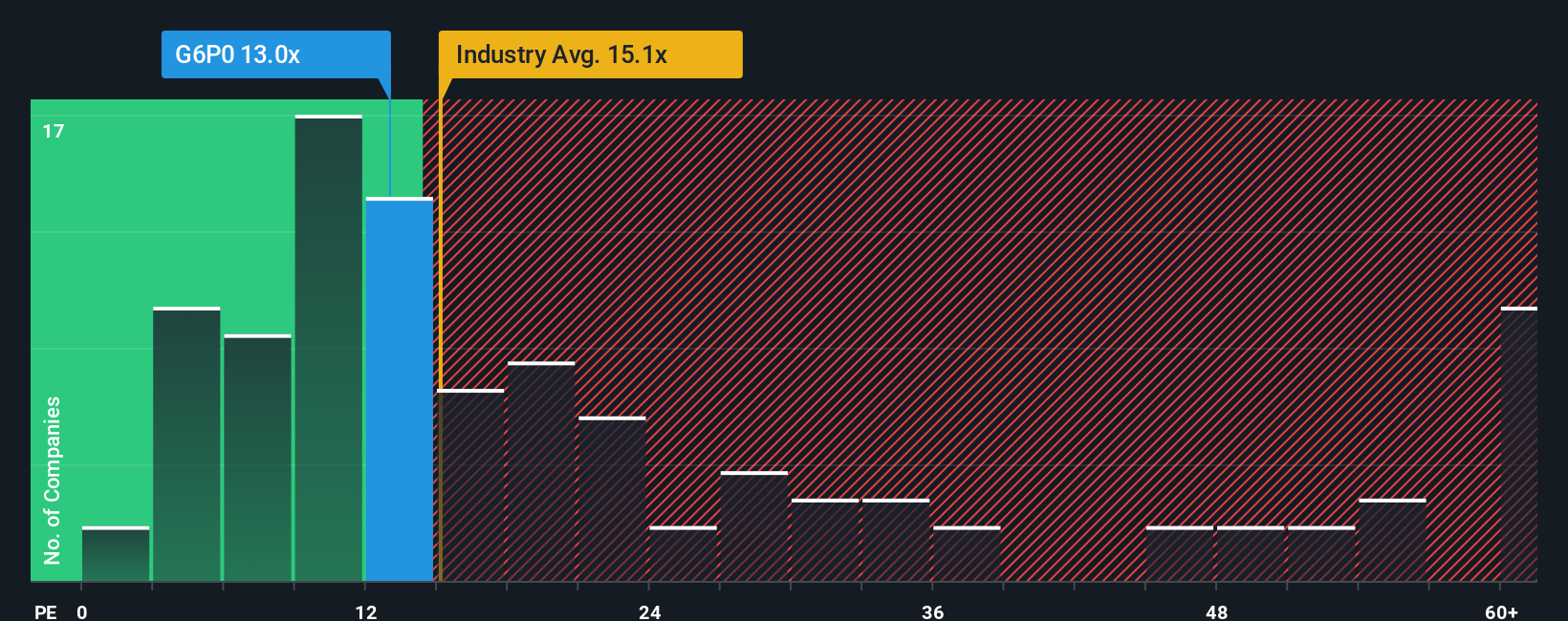

In spite of the heavy fall in price, Going Public Media's price-to-earnings (or "P/E") ratio of 13x might still make it look like a buy right now compared to the market in Germany, where around half of the companies have P/E ratios above 20x and even P/E's above 38x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been quite advantageous for Going Public Media as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Going Public Media

How Is Going Public Media's Growth Trending?

In order to justify its P/E ratio, Going Public Media would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 436% gain to the company's bottom line. However, this wasn't enough as the latest three year period has seen a very unpleasant 67% drop in EPS in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's an unpleasant look.

With this information, we are not surprised that Going Public Media is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Going Public Media's P/E?

The softening of Going Public Media's shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Going Public Media maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware Going Public Media is showing 5 warning signs in our investment analysis, and 2 of those can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:G6P0

Going Public Media

Operates as a media house for corporate finance and investment issues in Germany.

Flawless balance sheet and good value.

Market Insights

Community Narratives